Coinbase-backed motion makes four key arguments to lift Tornado Cash sanctions

Six individuals seeking to overturn the United States Treasury’s decision to sanction crypto mixer Tornado Cash have just relayed four key arguments in support of their motion.

In a May 24 filing in support of a prior motion for partial summary judgment, the individuals argue that the “case is not about carving out special rules for new technology” but rather was a case of government overreach and a breach of First Amendment rights.

Coinbase’s chief legal officer, Paul Grewal, summarized the arguments in a Twitter thread soon after, arguing that the government is seeking to use a property sanctions statute to ban open-source software — which is contrary to the intentions of the law.

Coinbase has backed the lawsuit against the U.S. Department of Treasury, which was first filed on Sept. 8, 2022. The six plaintiffs behind the filing are Joseph Van Loon, Tyler Almeida, Alexander Fisher, Preston Van Loon, Kevin Vitale and Nate Welch. The filing detailed that most of the group had previously interacted with Tornado Cash.

Four key arguments

The first of these arguments relate to the Treasury’s attempt to classify Tornado Cash as a foreign “national” — which it must do to justify its action — by calling it an unincorporated association.

But the plaintiffs noted that the Treasury had defined Tornado Cash to include all holders of the TORN token, whether or not they have combined for any common purpose. The plaintiffs argue that as a result of this definition, Tornado Cash can’t be classified as an unincorporated association based on the Treasury’s own tests.

The second argument refers to how the open-source smart contracts which provide Tornado Cash with functionality cannot be considered property as property refers only to something which can be owned.

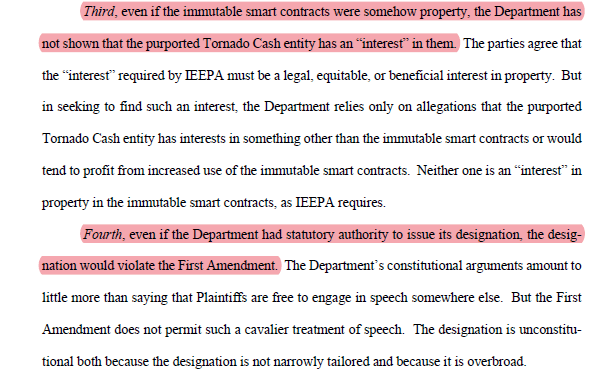

Even if these smart contracts could be considered property, the plaintiff's third argument is that no Tornado Cash entity has any “interest” in them, and therefore the Treasury does not have the authority to sanction it.

Screenshot highlighting the third and fourth key arguments by the plaintiffs. Source: Court filing

The final argument is that even if the Treasury does have the authority to do so, sanctioning Tornado Cash violates the First Amendment, and the Treasury is unable to defend this imposition by claiming that Tornado Cash users should engage in free speech elsewhere.

The Treasury initially sanctioned a number of addresses linked with Tornado Cash on August 8, 2022, just a month after the user interface code was open-sourced.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.