Chainlink needs to recover above $10.5 to avoid a massive collapse

- Chainlink (LINK) dropped below the daily EMA200 for the first time since April 2020.

- A failure to recover above $10.5 will increase the selling pressure on the coin.

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK) hit bottom at $8 on December 23 amid a massive sell-off across the cryptocurrency market. While the coin managed to recover to $10 by the time of writing, it is still over 17% down on a day-to-day basis. The sharp sell-off pushed LINK to 10th place in the global cryptocurrency market rating with the current market capitalization of $4 billion and an average daily trading volume of $2.2 billion.

LINK may be vulnerable to massive losses

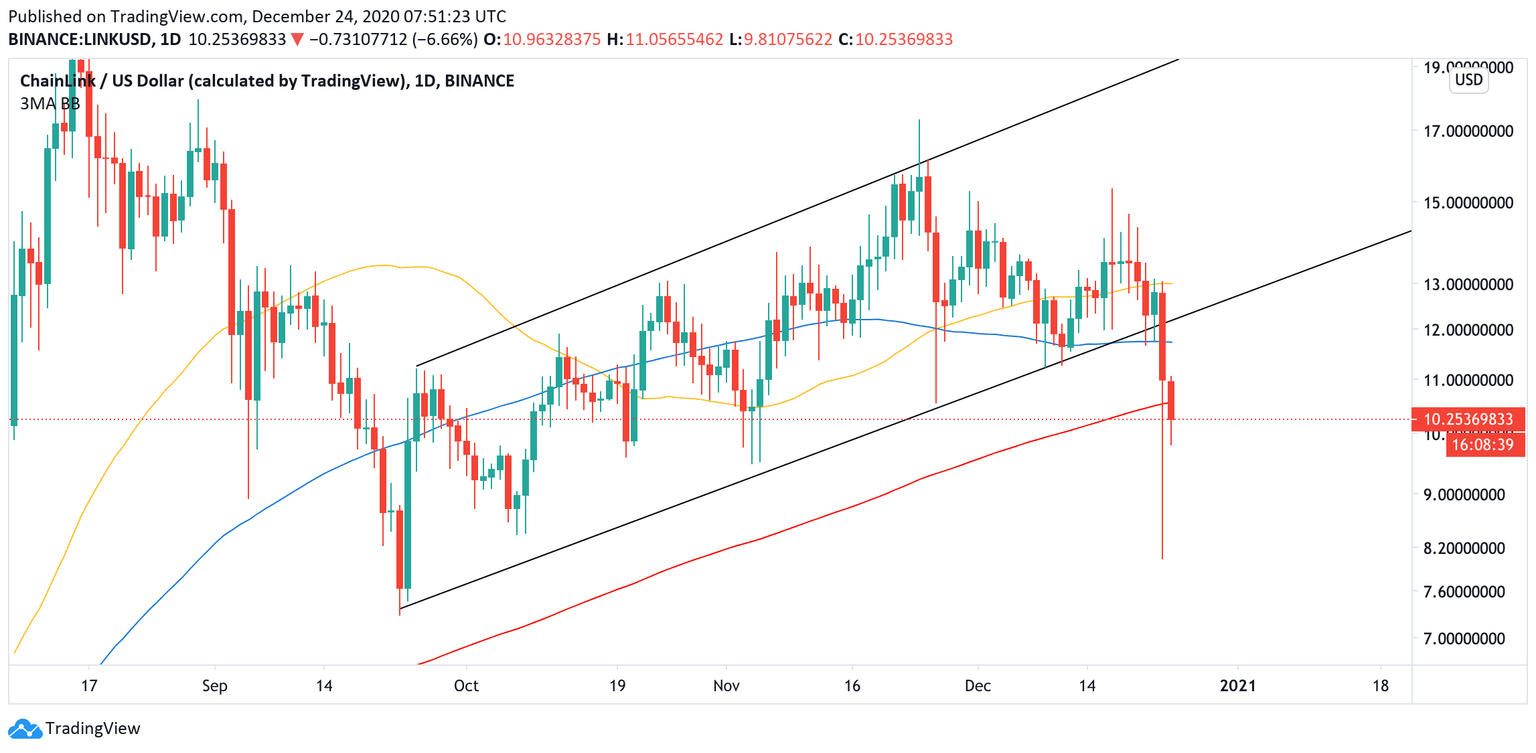

From the technical point of view, LINK broke below the vital support area of $12-$11.7 created by the daily EMA100 and a lower line of an upside-looking channel. The development worsened the short-term picture and pushed the price below the daily EMA200 at $10.5. This barrier now serves as the first critical resistance that must be cleared to improve the technical situation and allow for the recovery towards $12.

LINK, daily chart

Meanwhile, the rejection from $10.5 will trigger another bearish wave with the first target at $8 (the recent low). If it gives way, the September 23 low of $7.2 will come into focus.

Meanwhile, according to In/Out of the Money Around Price (IOMAP) data, the price sits on top of a minor support area below the current price. About 9,500 addresses purchased 5 million LINK tokens from $10.7 to $10.4. If this area is cleared, the sell-off will gain traction with the next backstop below $9.5.

LINK, In/Out of the Money Around Price (IOMAP)

On the other hand, the way to the North is cluttered with substantial barriers all the way up to $12, meaning LINK bulls may have a hard time pushing the price above critical resistance levels.

Author

Tanya Abrosimova

Independent Analyst

%2520Analytics%2520and%2520Charts-637443940416562994.png&w=1536&q=95)