Cardano price’s liquidity fractal strikes again, forecasts 20% upside

- Cardano price continues the tradition of liquidity run after it sweeps the August 30 swing low at $0.438.

- Investors can expect ADA to trigger a 14% run-up to $0.505, which could extend to $0.530 depending on market conditions.

- A daily candlestick close below $0.435 without a quick recovery will invalidate the bullish thesis.

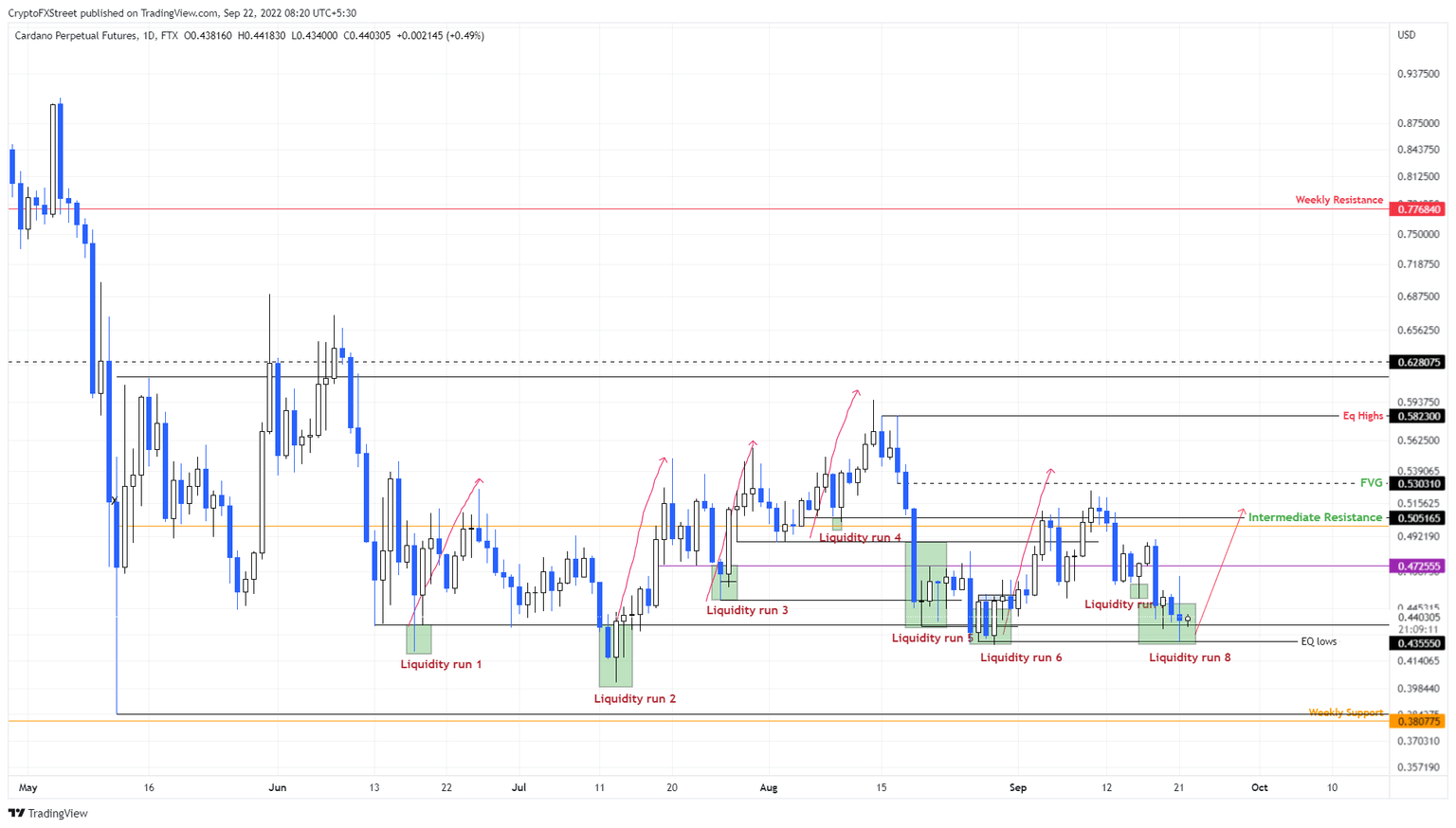

Cardano price shows a repeating pattern before it triggers an explosive run-up. This has been mentioned as a liquidity fractal in previous articles. The fractal is simple and involves collecting the sell-stop liquidity below previously formed lows. After the liquidity is swept, ADA recovers above the said swing low and kick-starts a rally.

So far, there have been seven distinctive liquidity runs, with the latest happening on September 21.

Cardano price ready to ride the wave

Cardano price dug below the $0.435 support level on September 21 as it dropped 13%. This move was followed by a quick recovery above the said barrier, indicating a willingness to move higher and the presence of sidelined buyers.

As mentioned above, this is a liquidity fractal in formation that signals the start of a rally. Going forward, investors can expect Cardano price to rally to $0.472 and retest the $0.505 hurdle. This move would constitute a 14% upswing, but it is not where the upside will be capped.

Depending on the market conditions, participants can look for a flip of the $0.505 resistance level, which will propel Cardano price to fill the imbalance, aka Fair Value Gap (FVG).

In total, this run-up would constitute a 20% gain and is likely where the upside is capped for ADA.

ADA/USDT 1-day chart

On the other hand, if Cardano price fails to stay above $0.435, it will denote a weakness in buyers and will lead to a takeover by bears. If ADA produces a daily candlestick close below $0.435 without a quick recovery, the bullish thesis will be invalidated.

In such a case, investors should be ready for a 12% crash in Cardano price to a weekly support level at $0.380.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.