Cardano price upsets investors as bulls go missing

- ADA price has broken through a critical Fibonacci level.

- Cardano price volume still looks bearishly strong.

- Invalidation of the bearish case is a close above $1.00.

Cardano price continues the downslide path as the bears have printed a bearish engulfing through a significant Fibonacci level. Bulls still involved are at high risk for a "sweep the lows" capitulation event.

Cardano price correction looks too deep for a new bull run

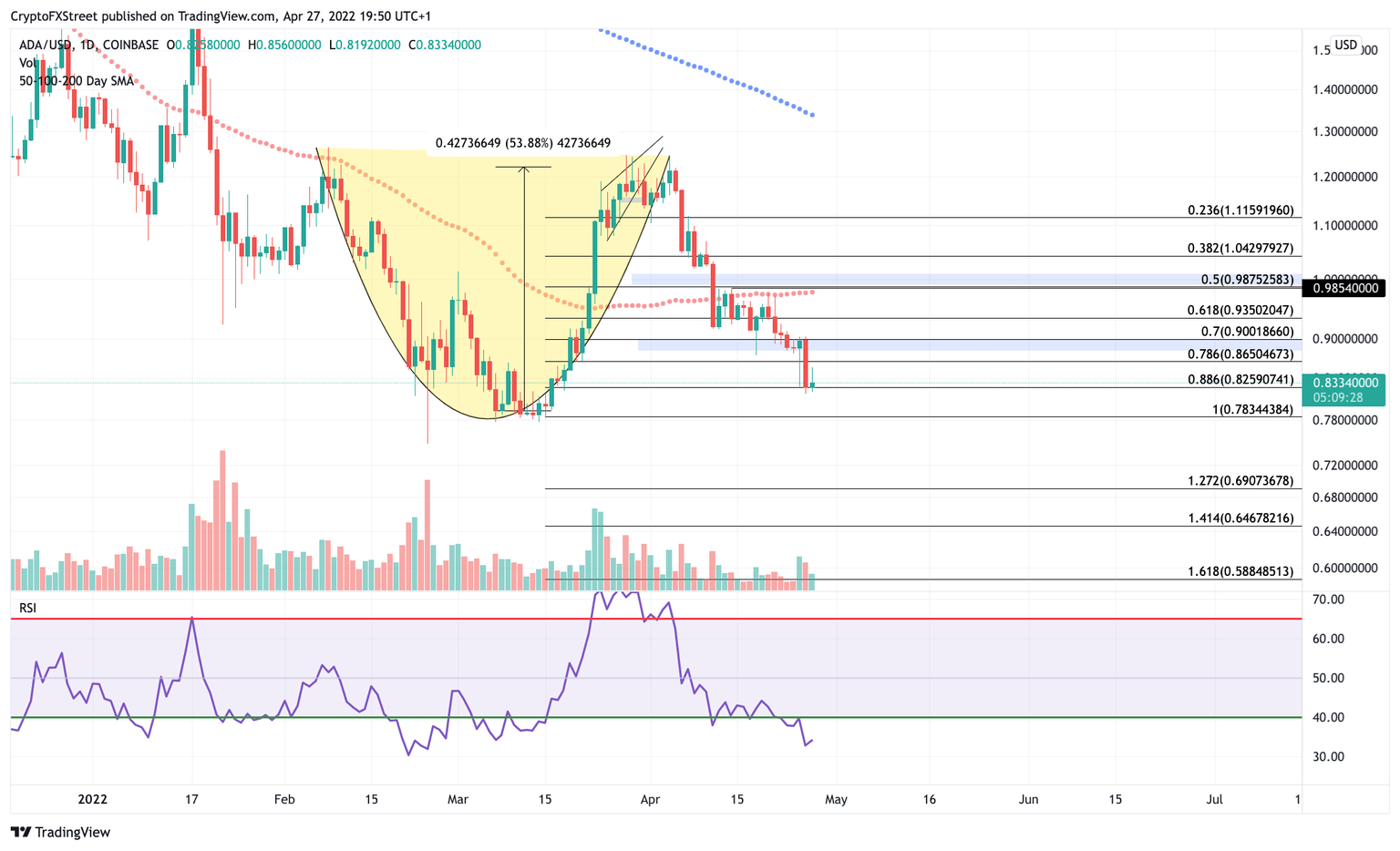

Cardano price is disappointing traders this week as the price action continues to see bearish force. Yesterday the ADA price saw a significant sell-off into the $0.82 level, now the lowest price point for April. Traders may have been optimistic as the ADA price displayed a classic bullish cup-and-handle pattern. A Fibonacci retracement level now surrounding the move suggests the bears have gone too far as Tuesday's bearish engulfing candle smashed straight through the critical 78.6% level.

Cardano price could likely sweep the lows at $0.77 and $0.75. Before the sell-off occurs, traders should expect some countertrend movements, potentially back into the low $0.90 level. Nonetheless, this ADA price thesis is being documented as bearish until proven otherwise. It is worth noting that the volume seen on Tuesday is relatively substantial regarding the entire downtrend. Therefore there is still no reason to consider a strong bullish reversal.

ADA/USDT 4-Hour Chart

Invalidation of the current downtrend is a close above $1.00. If traders can successfully conquer the $1.00 price level, then the $1.25 price level could be the next probable target, resulting in a 50% increase from the current ADA price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.