Cardano price has ADA bulls on edge as an upside breakout trade is set to materialize

- Cardano price sees bulls relentlessly buying at $0.39 near support.

- ADA will see a jump higher as tail risks are peel off.

- Expect to see a jump higher once geopolitical tension deflates further.

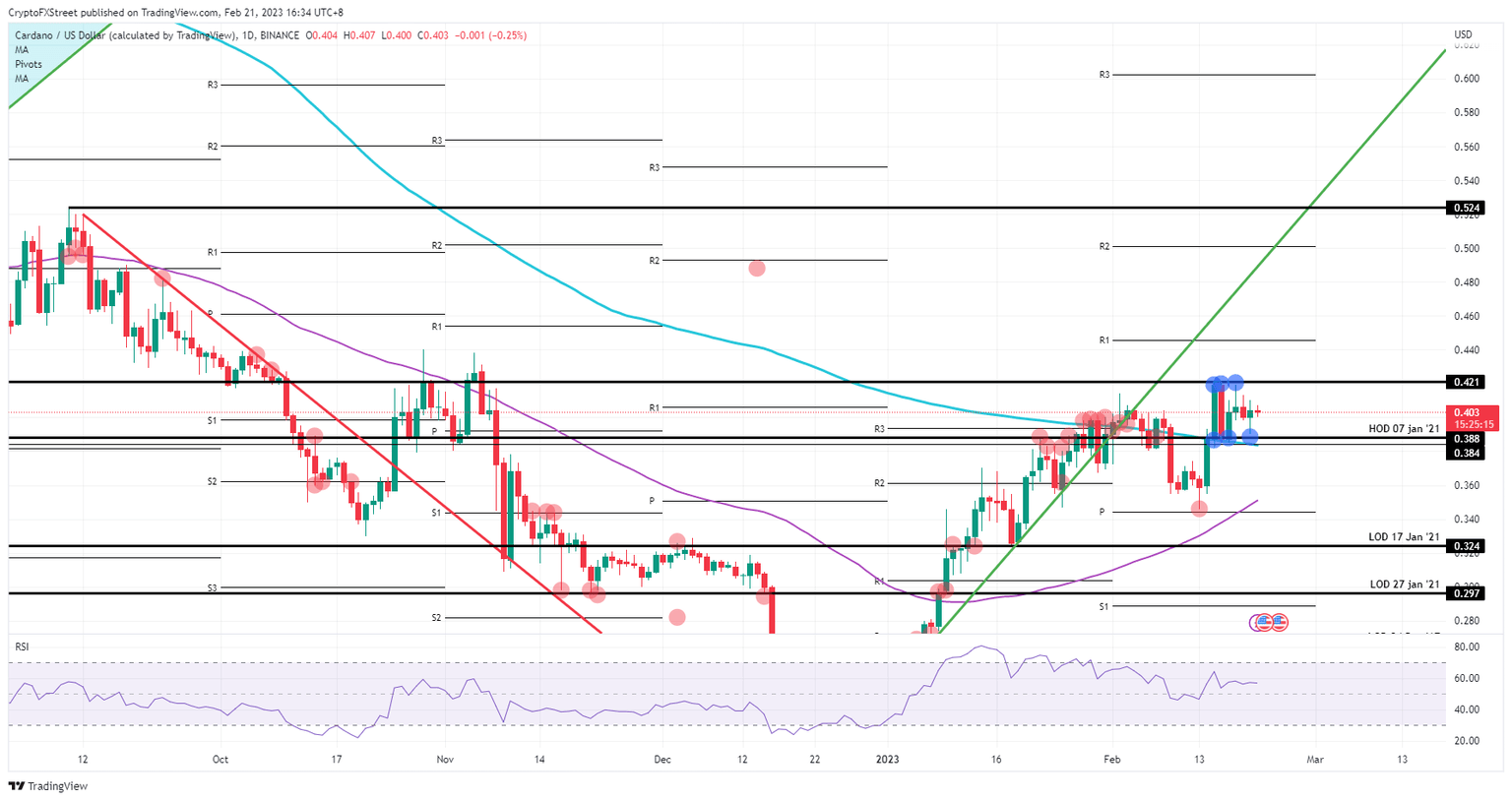

Cardano (ADA) price has seen bulls actively buying into the price action. With the Relative Strength Index flatlining, an equilibrium between bears and bulls has been found, as ADA resides in the middle of the current range. Expect, with economic tail risks to peel away with every data point that comes out in favour of the bulls. Once geopolitical risk is removed, so will the last big antagonist stopping bulls from breaking above $0.42.

Cardano price is a pressure cooker set to breakout towards $0.52

Cardano price is set to jump higher as bulls have chosen to load up on the price action in the alt-currency. With relentless buying each time ADA starts to near $0.38, it is becoming clearer that bulls are in it for a breakout. As inflation is coming down worldwide and markets are strong enough to shake off an outlier number left and right, the last man standing is geopolitics which could be seen abating as the build-up of pressure in Ukraine, though this too is soon set to deflate.

ADA will advance higher once all the cats are out of the bag, as Biden has visited Ukraine, and now headlines will start to fade into the background as the peak in geopolitics will have been passed for now. Expect Cardano price to move higher in the coming days and go for a breakout above $0.42. Should bulls close above $0.42 in the coming days, the take-profit level will increase to $0.52..

ADA/USD daily chart

Risk to the downside comes with the current geopolitical pressures should they spiral out of control. The tit-for-tat between Europe and Russia could intensify . If so, expect the 200-day Simple Moving Average to snap and see price action tank towards $0.32 in search of substantial support. Even $0.29 might come into play depending on the severity of the news and events that are taking place.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.