Cardano Price Prediction: ADA is well positioned for a countermove on the back of hyped inflation numbers

- Cardano price trading with thin liquidity as traders brace for the US inflation numbers.

- ADA traders are taking the price action 1% higher in the European trading session.

- Expect to see a possible jump in ADA toward $0.388.

Cardano (ADA) price is advancing near 1% in European trading, just hours away from the US inflation number for January. Several banks have hyped up the Consumer Price Index (CPI), and Bloomberg concluded that the basket reshuffle could trigger inflation. With Cardano price already substantially lower, Cardano price might print a knee-jerk boom to the upside.

Cardano price in for a surprise, good or bad

Cardano price could be seen jumping higher later in the day as traders have already positioned themselves for a negative number. Negative in the sense that inflation might remain stable or print higher against the last number from December. Expect on the back of that only marginal declines as traders have already priced that tail-risk into the price action.

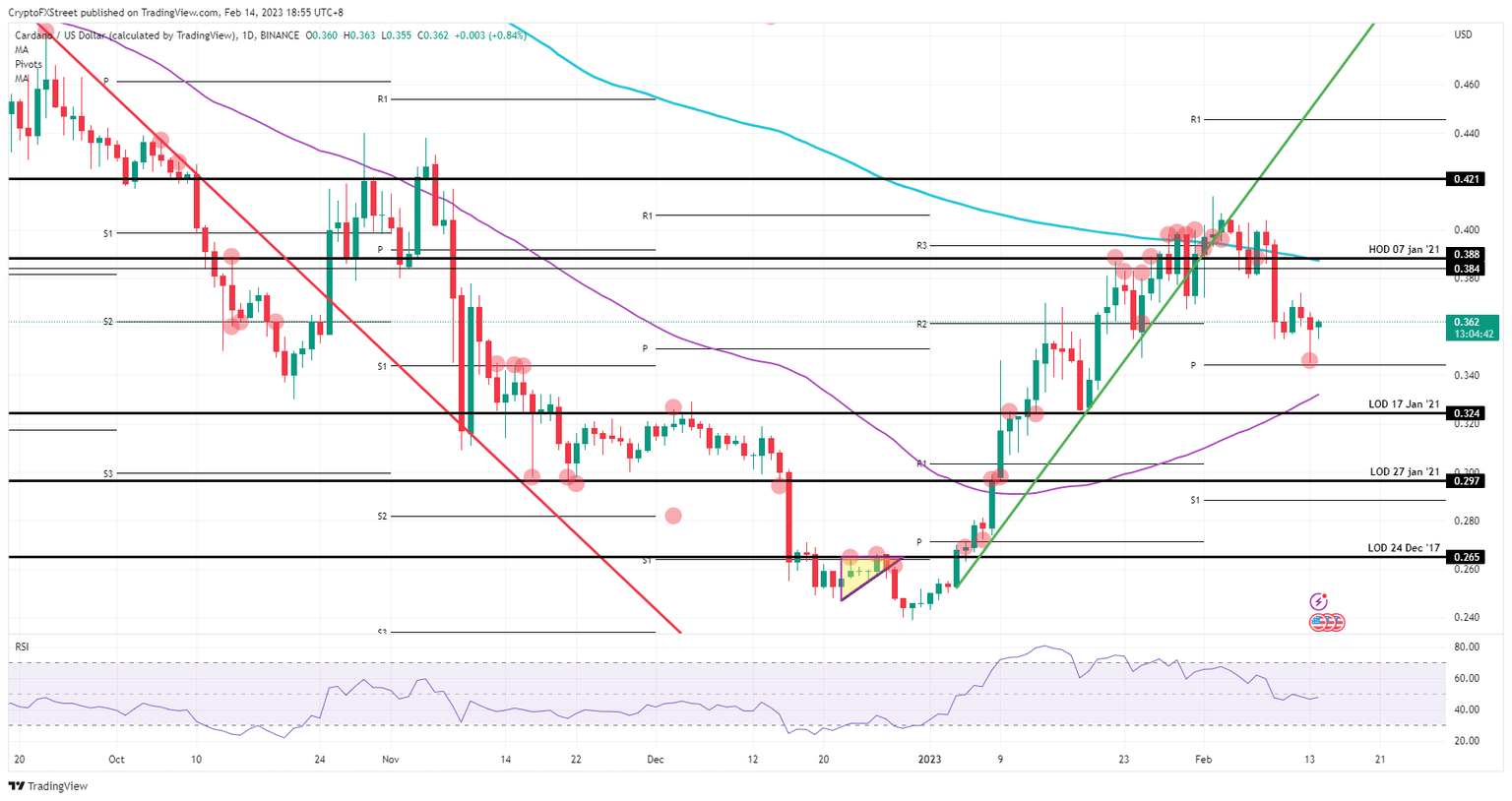

ADA thus holds better cards for an upside move than a downside one. Keep an eye on $0.388, which will be crucial to be broken as bears will defend it with knives between their teeth. A daily close above the 200-day Simple Moving Average (SMA) will be substantial and could set $0.421 as a target to the upside for later this week. If inflation drops, fireworks look granted, with ADA sprinting higher toward $0.45 quite rapidly.

ADA/USD daily chart

The substantial risk could come with the seasonal readjustment of inflation, meaning that the underlying metrics could have moved higher in the meantime. A very high inflation number would be required to see traders hit the breaks, flee out of their positions and move into safe havens and cash. Expect a blood-red trading session with ADA at risk of dropping toward $0.324 if that is the case.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.