Cardano Price Forecast: ADA encounters only one critical barrier before potential 36% upswing

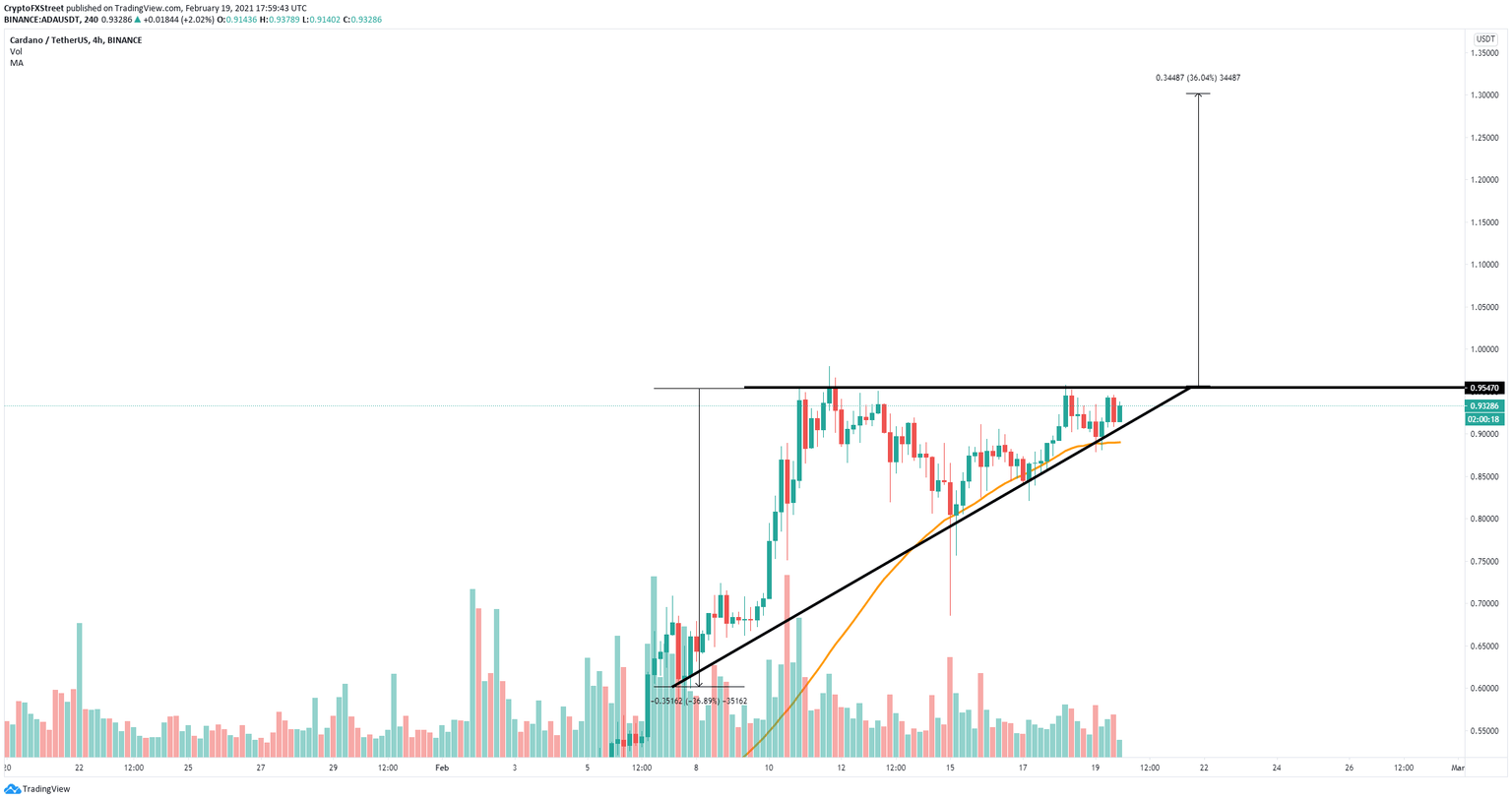

- Cardano price is currently contained inside an ascending triangle pattern on the 4-hour chart.

- The digital asset is on the verge of a massive price move.

- If one critical resistance level cracks, ADA could quickly climb towards $1.3.

Cardano has been on a massive run, almost hitting a new all-time high of $0.98 on February 11. The digital asset is prepared for yet another leg up that will push it towards new all-time highs but faces one key resistance level first.

Cardano price is inches away from massive 36% explosion

On the 4-hour chart, Cardano price has established an ascending triangle pattern that is on the verge of a breakout. So far, ADA bulls have defended the lower support trendline, which coincides with the 50-SMA.

ADA/USD 4-hour chart

A breakout above the critical resistance level formed at $0.95 should easily push Cardano price up to $1.3, a 36% move determined using the height of the pattern.

ADA IOMAP chart

Furthermore, the In/Out of the Money Around Price (IOMAP) shows basically no barriers. The volume of purchases above $0.93 until $1.08 is extremely low, which means there is no selling pressure.

ADA/USD 4-hour chart

However, there is a chance for the bears to take the lead and push Cardano price below the lower trendline support of the pattern on the 4-hour chart and the 50-SMA. This significant breakdown has the potential to drive Cardano price down to $0.6.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.