Cardano Price Forecast: ADA sits in a no-trade zone while momentum builds up

- Cardano price is currently bounded inside a parallel channel on the hourly chart.

- Bollinger Bands squeezing indicates a significant breakout could happen soon.

Cardano had an early recovery on November 28 ahead of Bitcoin’s last move toward $20,000. The digital asset is now consolidating and trading sideways as indicators show it is ready for another breakout in the short-term.

Cardano price awaits a clear breakout

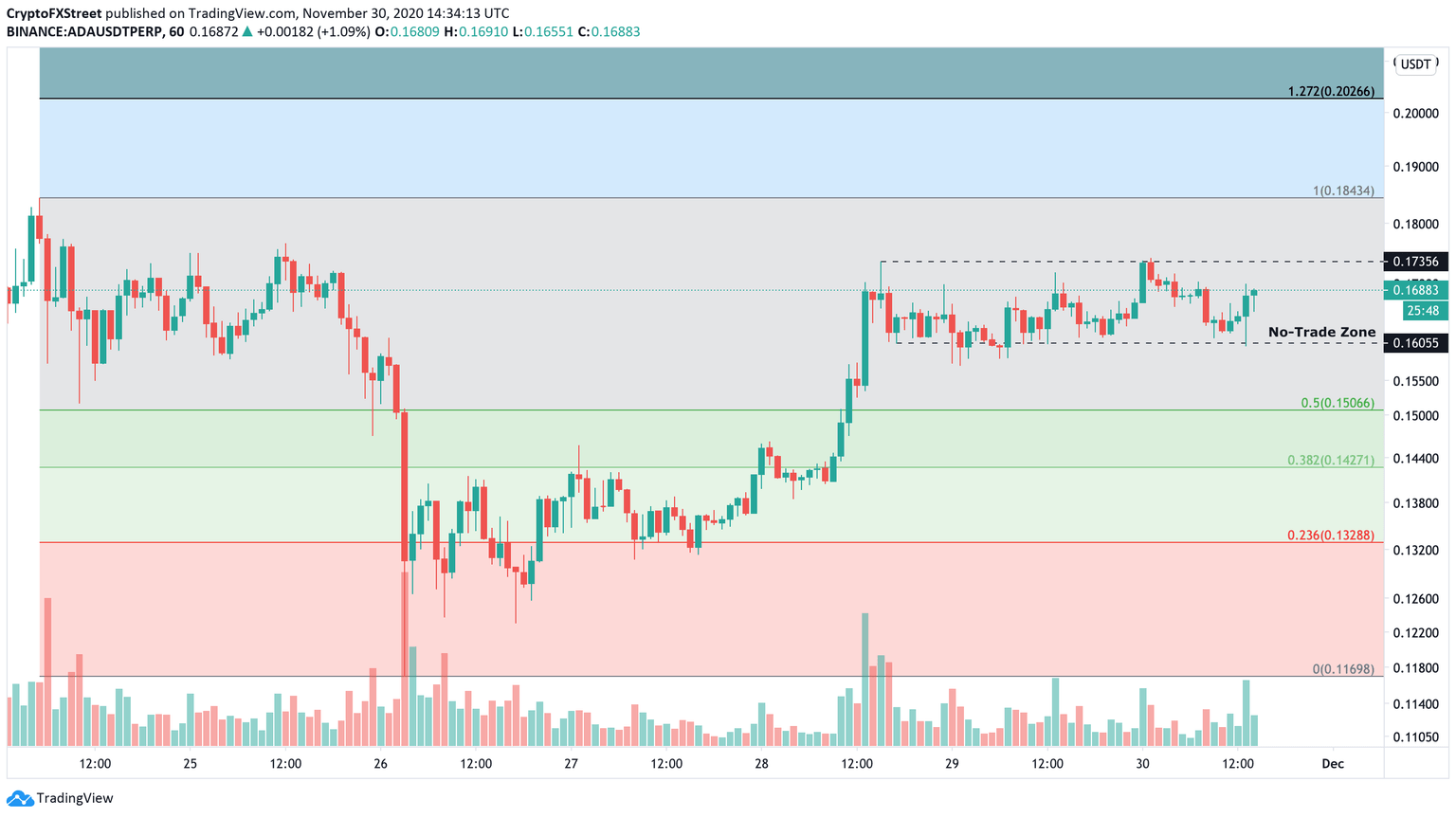

Cardano is currently trading at $0.168 after a notable breakout on November 28. The price seems to be contained inside a parallel channel formed on the hourly chart with the upper trendline at $0.173 and the lower boundary at $0.159.

ADA/USD 1-hour chart

Additionally, the Bollinger Bands have squeezed significantly over the past two days in the hourly chart, and both boundaries coincide with the trendlines of the parallel channel. A breakout above $0.173 could quickly push ADA to $0.18 and $0.20 at the 1.27 Fib level.

ADA/USD 1-hour chart

On the other hand, a breakdown below the channel's lower line and the Bollinger Band can push ADA to slice through the $0.15 support level at the 0.5 Fib level down to $0.142, the 0.382 Fib level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.