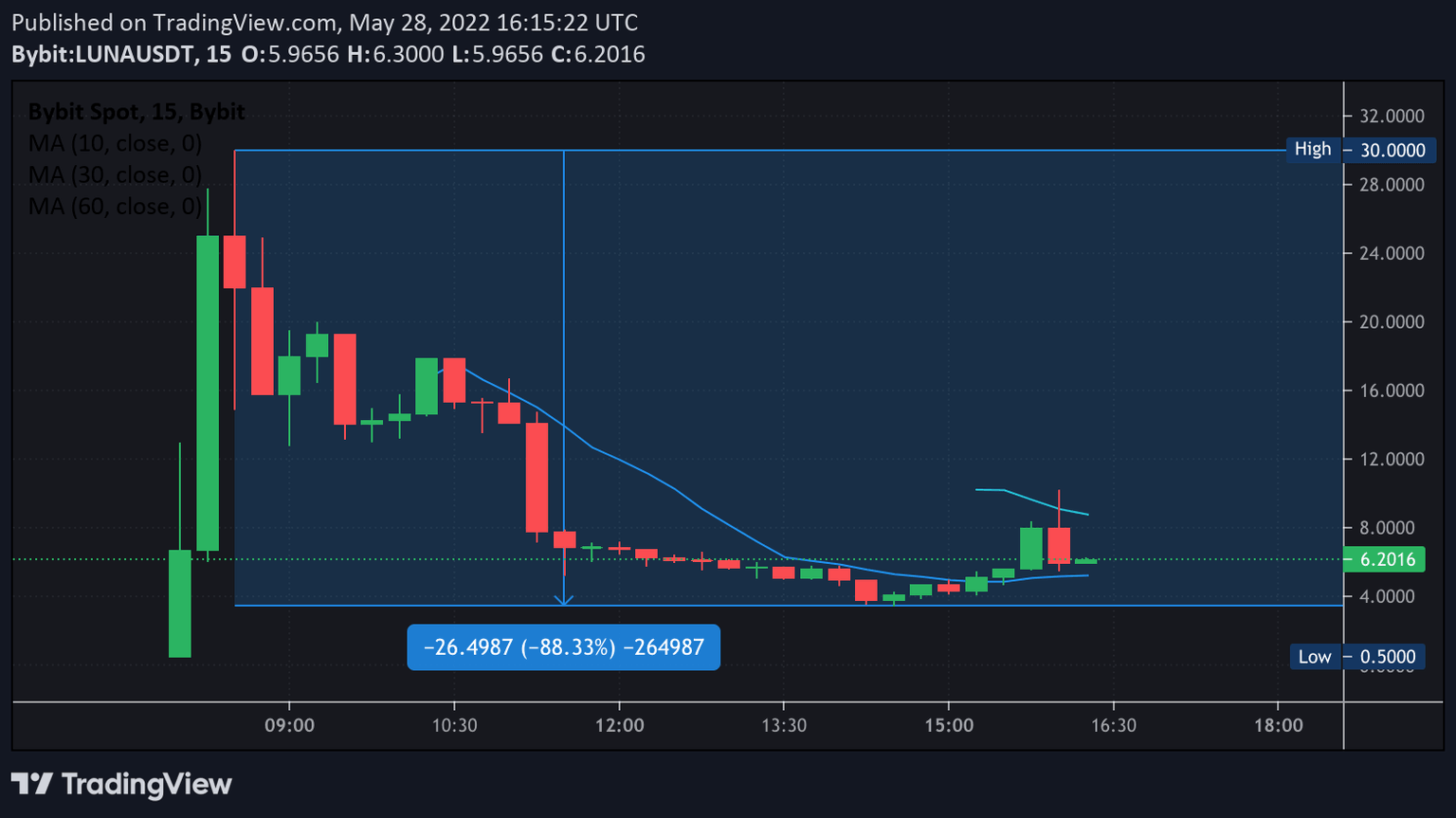

Terra's LUNA 2.0 crashes 88% after the airdrop

Terra has successfully distributed the new LUNA tokens to market participants who held LUNA Classic (LUNAC) and TerraUSD (UST). Data from cryptocurrency exchange Bybt shows that LUNA opened at $0.5 and, within a few minutes, surged to a high of $30 before plummeting by more than 88% to $3.5.

LUNA 2.0 has partially recovered from the crash and trades at $6.2 at the time of writing.

LUNA 15-min chart

LUNA 2.0 was rumored to cost between $30 and $50 upon launch by some members of the Terra community. The recent price action has caused a furor among investors who continue suffering from the losses incurred following Terra's LUNA and UST death spiral.

Rug me once; shame on you. Rug me twice; shame on me. Rug me twice and convince me to burn my money; now I’m just completely fukn redacted.

— Galois Capital (@Galois_Capital) May 25, 2022

Where is Bitcoin price heading next?

In the following video, FXStreet analysts evaluate Bitcoin price action to determine where it will go next and whether altcoins will move in the same direction:

Author

FXStreet Team

FXStreet