Ethereum surges to new all-time high following Powell's dovish hints, eyes $6,000

- Ethereum crossed the $4,800 mark for the first time in nearly four years after Fed Chair Powell's dovish remarks at Jackson Hole.

- ETH has risen over 100% since June, spurred by $9 billion ETF inflows and 3 million ETH acquisition from DATs.

- ETH is on the verge of validating another bullish pennant after hitting new all-time high.

Ethereum (ETH) surged to a new all-time high on Friday, crossing $4,868 for the first time since November 2021, according to data from crypto exchange Binance.

The top altcoin's surge follows Federal Reserve (Fed) Chair Jerome Powell's dovish hints at the Jackson Hole Economic Symposium on Friday. "Shifting balance of risks may warrant adjusting policy stance," said Powell, hinting at a potential rate cut in the Fed's next policy makers meeting in September.

Ethereum has now surged more than 100% since July, and more than 200% since early April after it tagged $1,500.

Institutional and corporate treasury accumulation boosts Ethereum's narrative

The top altcoin's explosive growth has also been heavily influenced by sustained accumulation from digital asset treasuries (DATs) and institutional investors.

Since early June, corporate ETH treasuries have acquired nearly 3 million ETH, led by Thomas Lee-backed BitMine Immersion (BMNR) and Joseph Lubin's SharpLink Gaming (SBET), according to data from the StrategicETHReserve.xyz.

On the institutional side, US spot Ethereum exchange-traded funds (ETFs) have pulled in over $9 billion since June, nearly three times their lifetime cumulative net inflows before the month, per SoSoValue data.

The trend shift in Ethereum comes on the back of regulatory progress, with the US Securities and Exchange Commission (SEC) providing clarity on liquid staking and the passage of the stablecoin-focused GENIUS Act

Thomas Lee predicts the "financialization of everything," describing Ethereum as "the rails for that future."

Last week, Standard Chartered analysts revised their year-end target for ETH to $7,500, citing institutional demand and regulatory progress.

Ethereum Price Forecast: ETH eyes $6,000 after hitting new all-time high

Ethereum saw $345.16 million in futures liquidations over the past 24 hours, comprising $80.27 million and $264.89 million in liquidated long and short positions.

ETH has reached a new all-time high for the first time since November 2021. The move comes after the top altcoin bounced off the support near $4,100 earlier in the week.

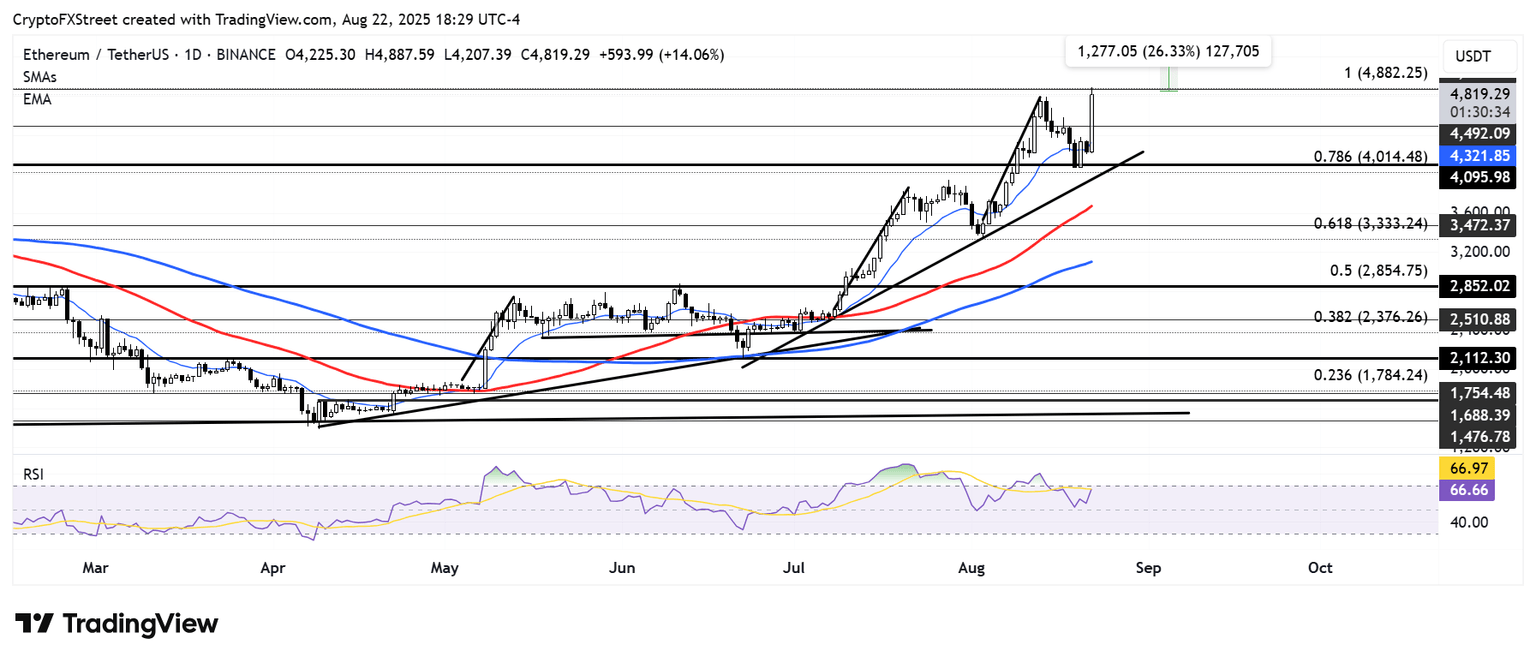

ETH/USDT daily chart

A firm close above its all-time high at $4,868 could see ETH validate another bullish pennant, priming it for a potential move toward $6,000. The target is obtained by measuring the height of the pennant and projecting it upward from a potential breakout point.

On the downside, ETH needs to hold the $4,100 support to maintain a bullish bias.

The Relative Strength Index (RSI) is approaching its overbought region while the Moving Average Convergence Divergence (MACD) is on the verge of crossing above its signal line. This indicates a dominant bullish momentum.

A daily candlestick close below $4,100 will invalidate the thesis and potentially send ETH toward the support at $3,472.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi