Ethereum Price Forecast: ETH risks selloff as supply in profit tops 90% ahead of Powell's speech

Ethereum price today: $4,210

- Ethereum's supply in profit has crossed the 90% mark, a level that historically triggers heavy selling activity.

- Profit-taking lingers as Cleveland Fed President Hammack says she would not support a rate cut if the Fed were to meet tomorrow.

- ETH could find support near the $4,000 level and a key rising trendline.

Ethereum's (ETH) large percentage of supply in profit could stir selling activity as hawkish signs continue to grow on Thursday, ahead of Federal Reserve (Fed) Chair Jerome Powell's speech at Jackson Hole.

Ethereum faces pressure from high supply in profit

Following an over 90% rise between July and August, Ethereum's percentage of total supply in profit reached 99% last week and is currently hovering around 93% after a slight correction.

While such a large amount of supply in profit shows a strong performance, it has historically triggered a large correction in ETH. The top altcoin plunged nearly 50% in May 2021 after supply in profit crossed the 90% mark. Another 70% crash followed as ETH reached an all-time high in November 2021.

After nearly two years of consolidation, ETH's supply in profit rose again above the 90% mark last year, sparking a correction on two separate occasions. The last event triggered more than a 60% crash that spanned December 2024 through March 2025.

%20%5B21-1755808484916-1755808484917.20.10%2C%2021%20Aug%2C%202025%5D.png&w=1536&q=95)

ETH Percent of Total Supply in Profit. Source: Santiment

Ethereum has begun to exhibit similar correction signs following a higher-than-expected Producer Price Index (PPI) inflation data last week.

The high inflation data calmed excitement over a potential rate cut in the next Fed meeting, causing a de-risking across risk assets — ETH has seen over a 10% decline so far.

The Federal Open Market Committee (FOMC) July meeting minutes, released on Wednesday, have also exacerbated cautious sentiment, pushing expectations of a rate cut lower. The probability of a rate cut in September, which was well above 90% last week, has declined to 73.6% on Thursday, according to the CME FedWatch tool. Odds of the Fed not cutting interest rates rose to 34% on prediction market Kalshi, its highest level since August 1st.

Cleveland Fed President Beth Hammack fueled the rising risk-off sentiment in an interview with Yahoo Finance on Thursday, where she raised concerns about inflation and played down talks of a rate cut.

"We have inflation that's too high and has been trending upwards over the past year," said Hammack. "With the information I have, if the meeting was tomorrow, I would not see a case for reducing interest rates."

All eyes are now set on the Fed's annual retreat at Jackson Hole, Wyoming, where Chair Jerome Powell is set to deliver a widely anticipated speech on Friday.

Ethereum Price Forecast: ETH bullish momentum wanes, key support levels to watch

Ethereum saw $79 million in futures liquidations over the past 24 hours, comprising $51 million and $28 million in liquidated long and short positions, according to Coinglass data.

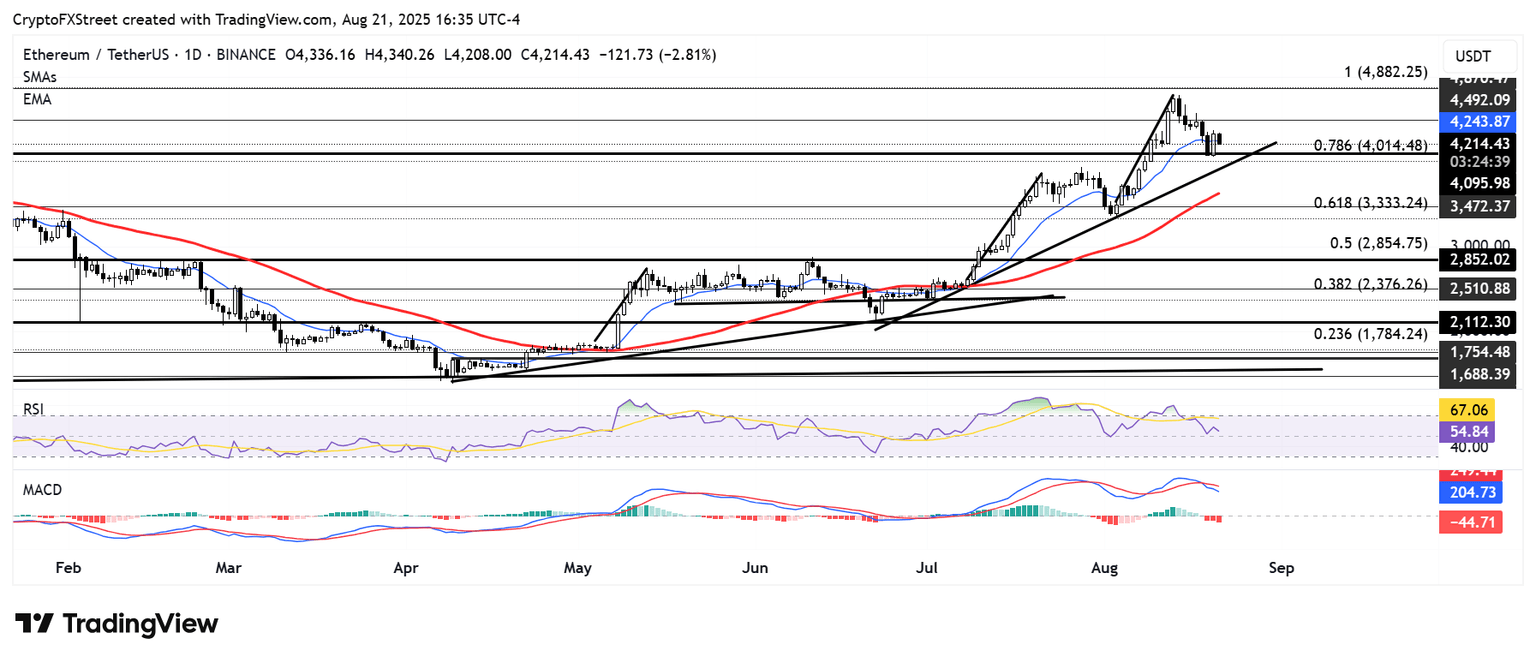

After bouncing near the $4,100 level, ETH faced a rejection around $4,370 on Thursday, just above the 14-day Exponential Moving Average (EMA).

ETH/USDT daily chart

On the downside, the top altcoin has to stay above the $4,000 psychological level and a key ascending trendline to maintain a bullish outlook. A decline below these levels could see ETH find support at $3,470.

On the upside, ETH could validate another bullish pennant if it recovers the $4,500 level and smashes its all-time resistance at $4,868.

The Relative Strength Index (RSI) is above its neutral level but trending downwards, while the Moving Average Convergence Divergence (MACD) is below its signal line, indicating weakening bullish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi