Breaking: Bitcoin price crashes 8%, wiping out $1 billion in open interest

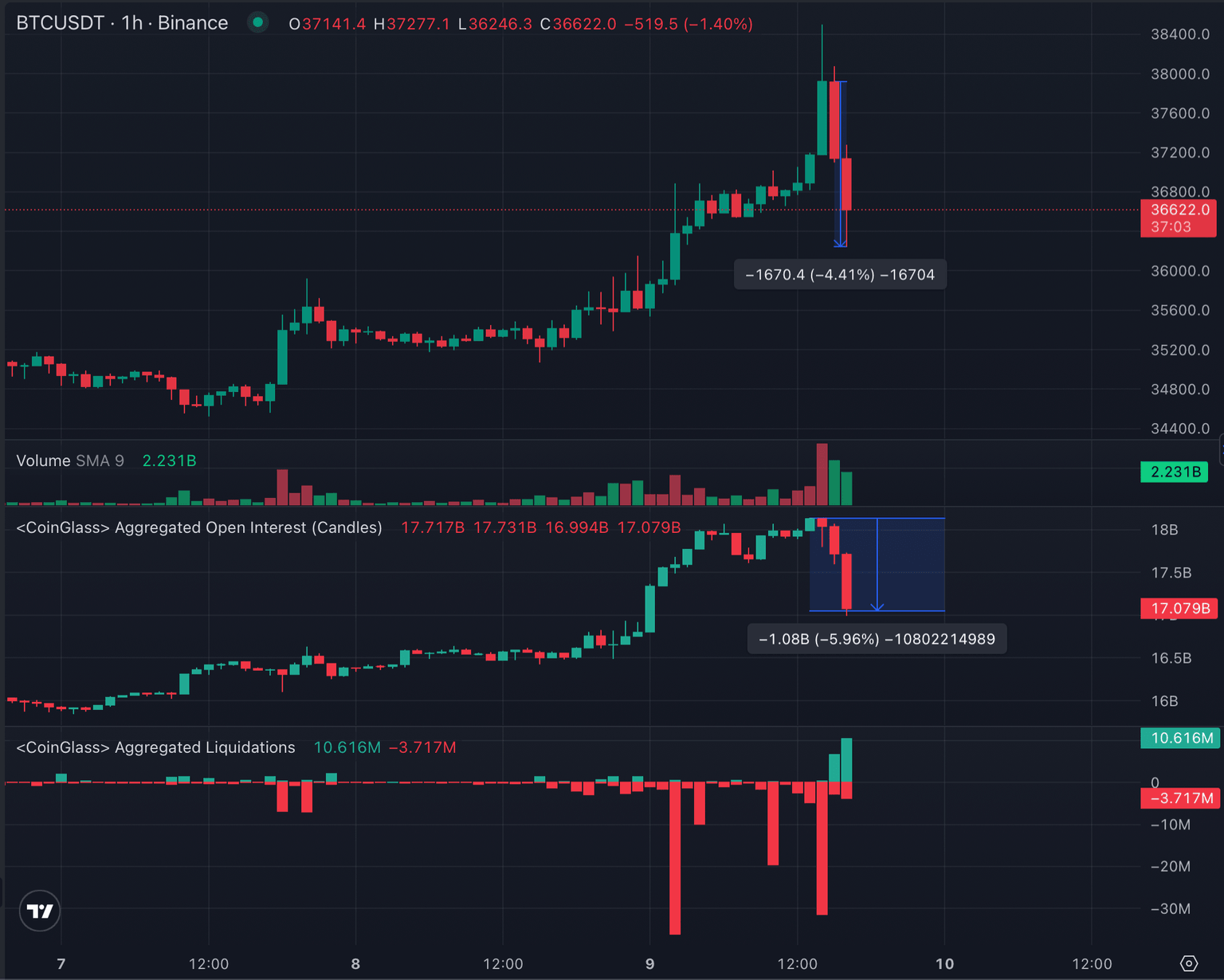

- Bitcoin price peaked above the $38,400 level, wiping out $1.56 million worth of shorts.

- Shorts were squeezed and longs are trapped, leading to around $1 billion in open interest wiped out.

- It comes a day after Bloomberg’s James Seyffart reinvigorated the market with prospects of a spot BTC ETF approval within eight days.

Bitcoin (BTC) price has been nothing but volatile on Thursday. BTC surged higher via a short squeeze and countered with a long squeeze shortly after, leaving perpetual traders wrecked as BTC speculators front-run a spot Bitcoin exchange-traded fund (ETF) approval from the US Securities & Exchange Commission (SEC).

Also Read: Bitcoin 'short squeeze' bumps prices to nearly $37k as spot ETF hopes strengthen

Bitcoin wrecks perps as BTC speculators front-run ETF approval

Bitcoin (BTC) price soared almost 8%, sprinting past the $36,000 and $37,000 psychological levels to record an intra-day high above $38,400. This was in favor of longs as more than $1.56 million in short positions were liquidated.

However, the elation was only momentary before the markets crashed, with the king of crypto spiraling almost 5% lower. The long squeeze liquidated up to $17 million worth of long positions, with approximately $1 billion in open interest wiped out in only hours.

BTC open interest

For the layperson, a short squeeze is an unusual condition that triggers a rapid rise in the price of an asset. It occurs when the asset has many short sellers, meaning lots of investors are betting on its price falling. The short squeeze begins when the price jumps higher unexpectedly and gains momentum as a huge number of the short sellers decide to cut losses and exit their positions.

The hard pump comes as Bitcoin speculators continue to get ahead of spot Bitcoin ETF approvals following a recent proclamation by a specialist with Bloomberg Intelligence. James Seyffart said, “ A 'brief window' opens tomorrow for SEC to potentially approve all 12 spot BTC ETF applicants, including Grayscale GBTC. It will be open for at least 8 days."

Interestingly, it comes near the anniversary of FTX's demise. The now-defunct cryptocurrency exchange filed for bankruptcy around this time last year.

Author

FXStreet Team

FXStreet