Bitcoin price recovery bound to be delayed as Texas power crisis threatens miner reserves

- Bitcoin price has been hovering around $25,500 to $26,000 for almost three weeks now with no sign of recovery.

- The BTC miners in Texas are being forced to shut down due to the ongoing power crisis, which could impact the hash rate.

- As Texas is the home to AntPool, which contributed to 22.5% of the HashPower, the crisis could result in miner selling.

Bitcoin mining may not sound like a care-intensive process, but it certainly is an energy-intensive process. The need for a power supply to validate the blocks has raised concerns in the past surrounding its impact on the resources. But the consequences of the same are now also impacting the BTC miners.

Bitcoin mining in Texas in trouble

Bitcoin miners in the state of Texas are shutting down their machines as the state continues to struggle with its power crisis. The low energy costs and relatively loose regulation made Texas one of the topmost destinations for BTC miners. The place also houses some of the biggest Bitcoin mining companies in the world’s facilities, like Riot and Marathon Digital.

However, due to extreme weather in the past few years, the power crisis is only getting worse in the state, reaching the point where the Biden Administration declared a power emergency in the state this week. Lee Bratcher, president of the Texas Blockchain Council, said,

“We have consistently been seeing 90% plus curtailment of Bitcoin mining each day this week that power conditions tightened. The power that is not off is most power to the office buildings and backup systems that are on site and not the machines themselves.”

Consequently, all the industrial-scale Bitcoin miners are now shutting down their machines, sticking with the rules. As is the low BTC prices, increasing competition and declining rewards following the next halving are major concerns for miners, and the power crisis would only add to it.

Impact on Bitcoin

When it comes to the contribution of Texas to the BTC mining industry, the state does not stand much behind it. Texas houses the facilities of AntPool, the second biggest Bitcoin mining pool, contributing to about 22.27% of the entire Hash Power. Shuttering of mining in the state would certainly impact this pool, consequently impacting the Hash Rate.

Although there is no historical evidence of a price decline associated with a fall in the Hash Rate, Bitcoin takes a hit when miners compensate for their losses. Since such a power crisis would necessitate the shuttering of mining, miners would be forced to sell their holdings to pay their bills.

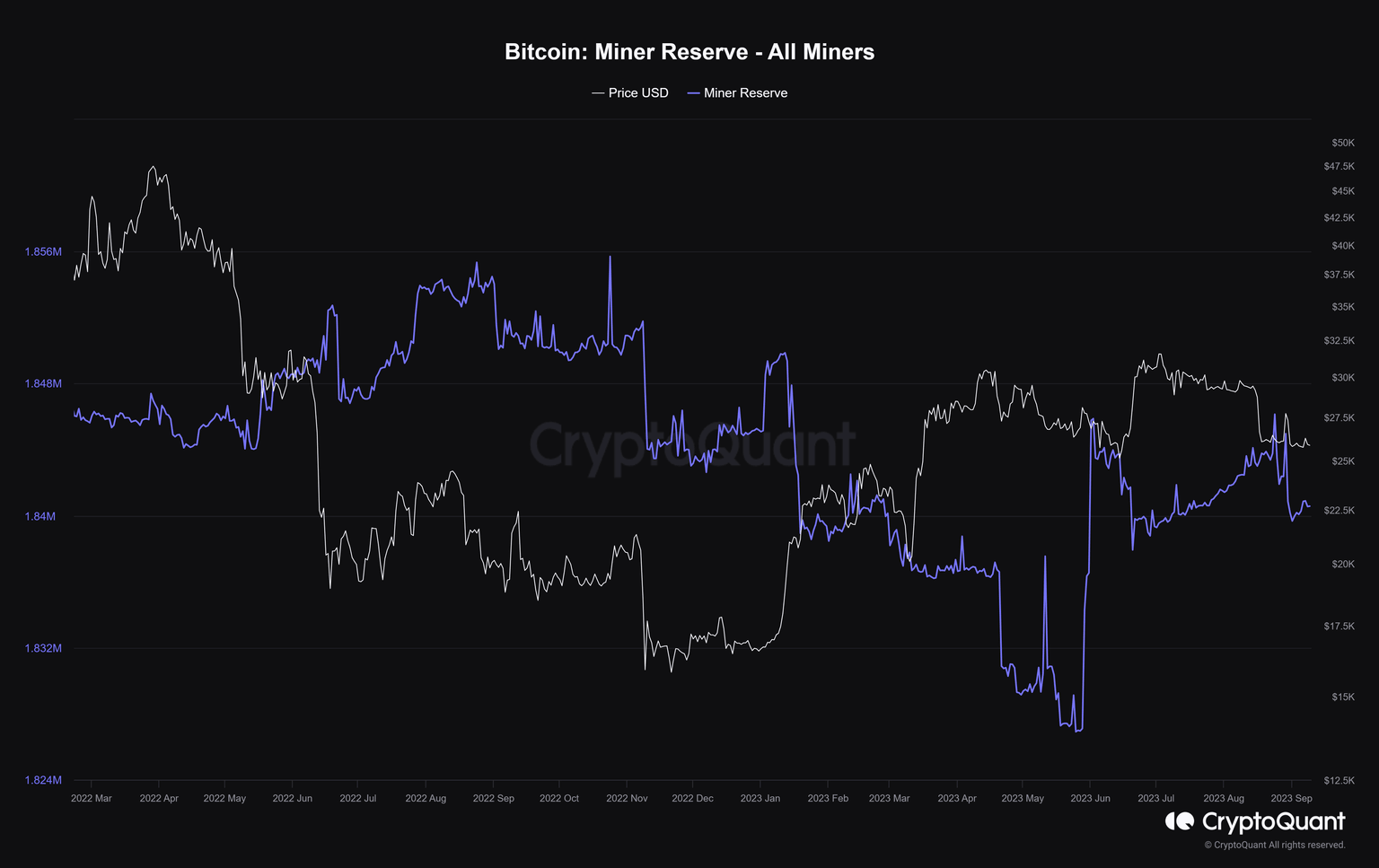

The only way to do this would be by pulling BTC out of the miner reserves, and heavy selling would naturally make a bearish impact on the cryptocurrency’s price. Miner selling has been associated with sudden price crashes, an instance of which is the crash of August end. Following a price rise, miners sold close to 4,900 BTC worth close to $126 million.

Bitcoin miner reserves

The very next day, Bitcoin price crashed and has since been hovering around $25,700. Thus, the biggest cryptocurrency in the world might invite its own doom if the power crisis does not come to an end.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.