Bitcoin Price Forecast: BTC extends decline as tensions around Greenland mount

- Bitcoin price slips below $91,000 on Tuesday, printing six consecutive red candlesticks.

- Gold hits a fresh all-time high, while risk assets continue to sell off amid rising geopolitical and tariff tensions.

- The technical outlook suggest deeper correction, with momentum indicators flashing early bearish signals.

Bitcoin (BTC) price extends losses, trading below $91,000 at the time of writing on Tuesday amid escalating geopolitical tensions over Greenland. Investors are moving toward safe-haven assets, with Gold (XAU) hitting fresh all-time highs, while BTC continues to nosedive. The technical outlook for the Crypto King suggests a deeper correction ahead, with momentum indicators signaling early bearish signs.

Greenland geopolitical risks lift Gold, weigh on Bitcoin

Bitcoin opened the week on a negative note, following weekend news that US President Donald Trump threatened to impose tariffs on eight European nations that opposed his plan to take Greenland. Trump announced a 10% tariff on goods from countries including Denmark, Sweden, France, Germany, the Netherlands, Finland, the United Kingdom (UK), and Norway, starting on February 1, until the US is allowed to buy Greenland.

In response to Trump’s tariff threats, on Sunday, the EU capitals are considering imposing €93 billion ($101 billion) in tariffs on the US or restricting American companies' access to the bloc’s market.

On Tuesday, geopolitical uncertainty intensified early after Trump posted on his Truth Social account that he had spoken with Mark Rutte, the Secretary General of the North Atlantic Treaty Organization (NATO), regarding Greenland.

Trump explained in his post that Greenland is “imperative for national and world security” and confirmed plans for discussions involving multiple parties at the upcoming World Economic Forum in Davos, Switzerland.

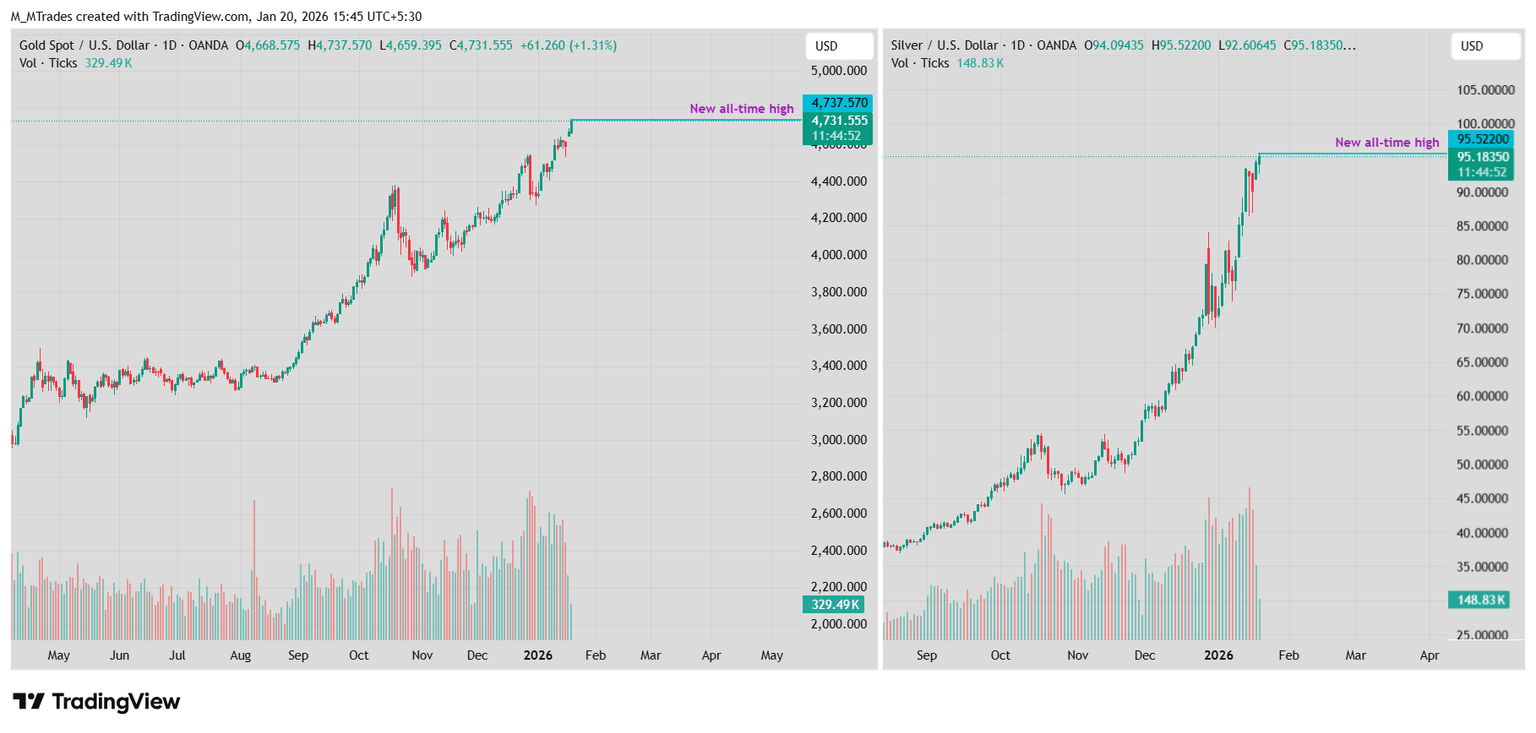

These comments added to broader geopolitical unease, prompting investors to move toward safe-haven assets such as Gold (XAU) and Silver (XAG), whose prices hit fresh all-time highs (ATHs) of $4,737.57 and $95.22, respectively, as shown in the chart below.

Bitcoin Price Forecast: BTC could extend a deeper correction

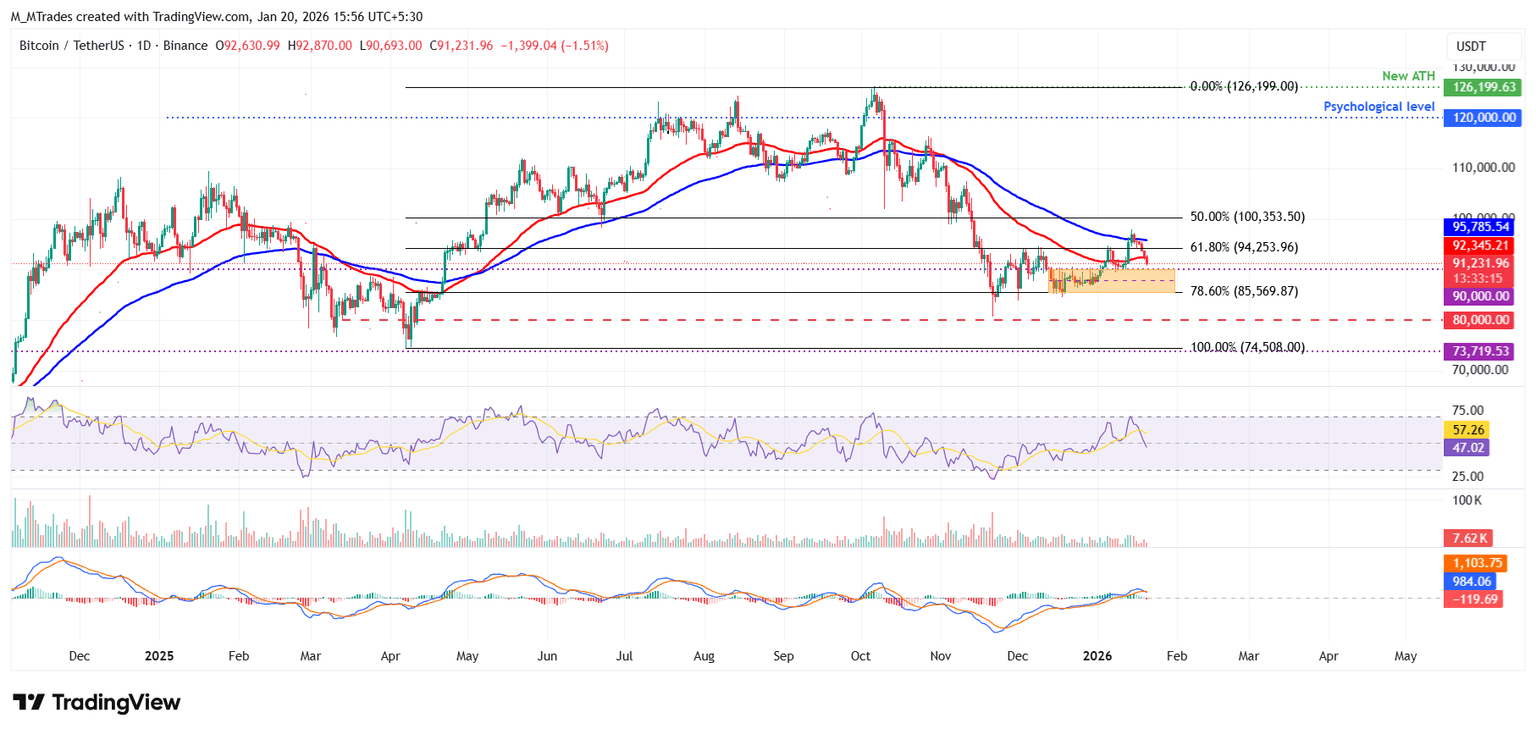

As of writing on Tuesday, Bitcoin price is trading down, slipping below the 50-day EMA at $92,345 and nearing the next immediate support at $90,000.

If BTC fails to find support around $90,000 (previously broken upper consolidation zone), it could extend the decline toward the lower consolidation boundary at $85,569, which coincides with the 78.6% Fibonacci retracement level (from the April low of $74,508 to October’s all-time high of $126,199).

The Relative Strength Index (RSI) on the daily chart is 47, slipping below the neutral 50 level, indicating bearish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) indicator also shows a bearish crossover on Tuesday, further supporting the bearish view.

However, if BTC recovers, it could extend the advance toward the 61.8% Fibonacci retracement level at $94,253.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.