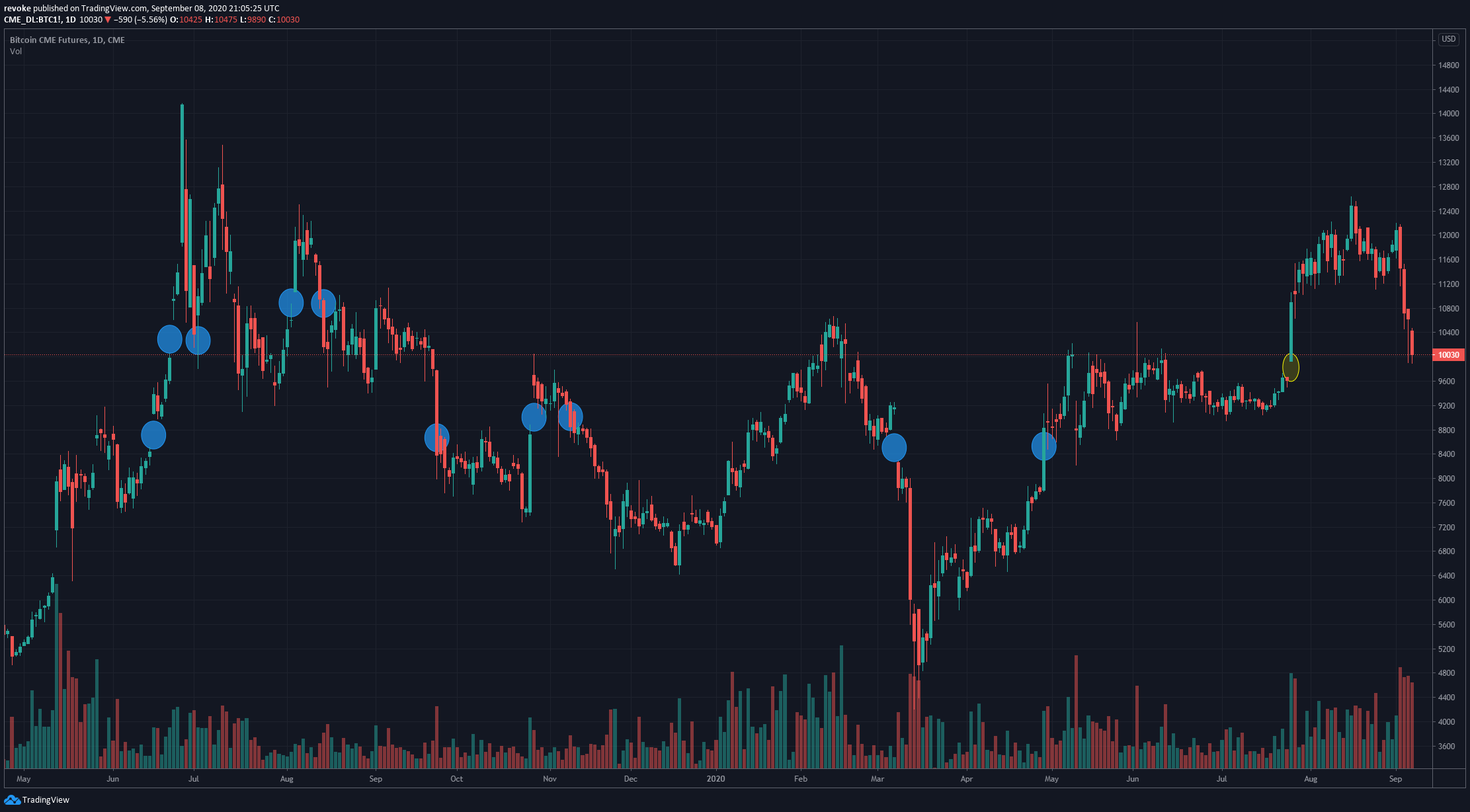

- Bitcoin formed a gap on July 24 that hasn’t closed yet.

- Historically, CME gaps have always been good indicators of future price action.

The bitcoin market is open 24/7, which means it never closes and cannot form gaps, however, CME, a derivatives marketplace, does. CME Bitcoin futures created its most recent gap at $9,665 on July 24. This happens when the market closes and then opens at a different price, leaving a gap behind.

Looking at the CME Bitcoin chart, we can see that, historically, every single gap has actually closed. Some gaps only take a few days to fill, while others can take up to three months, like the one in June 2019. Bitcoin touched $9,890, which is still notably higher than $9,665, and the gap is currently not considered filled.

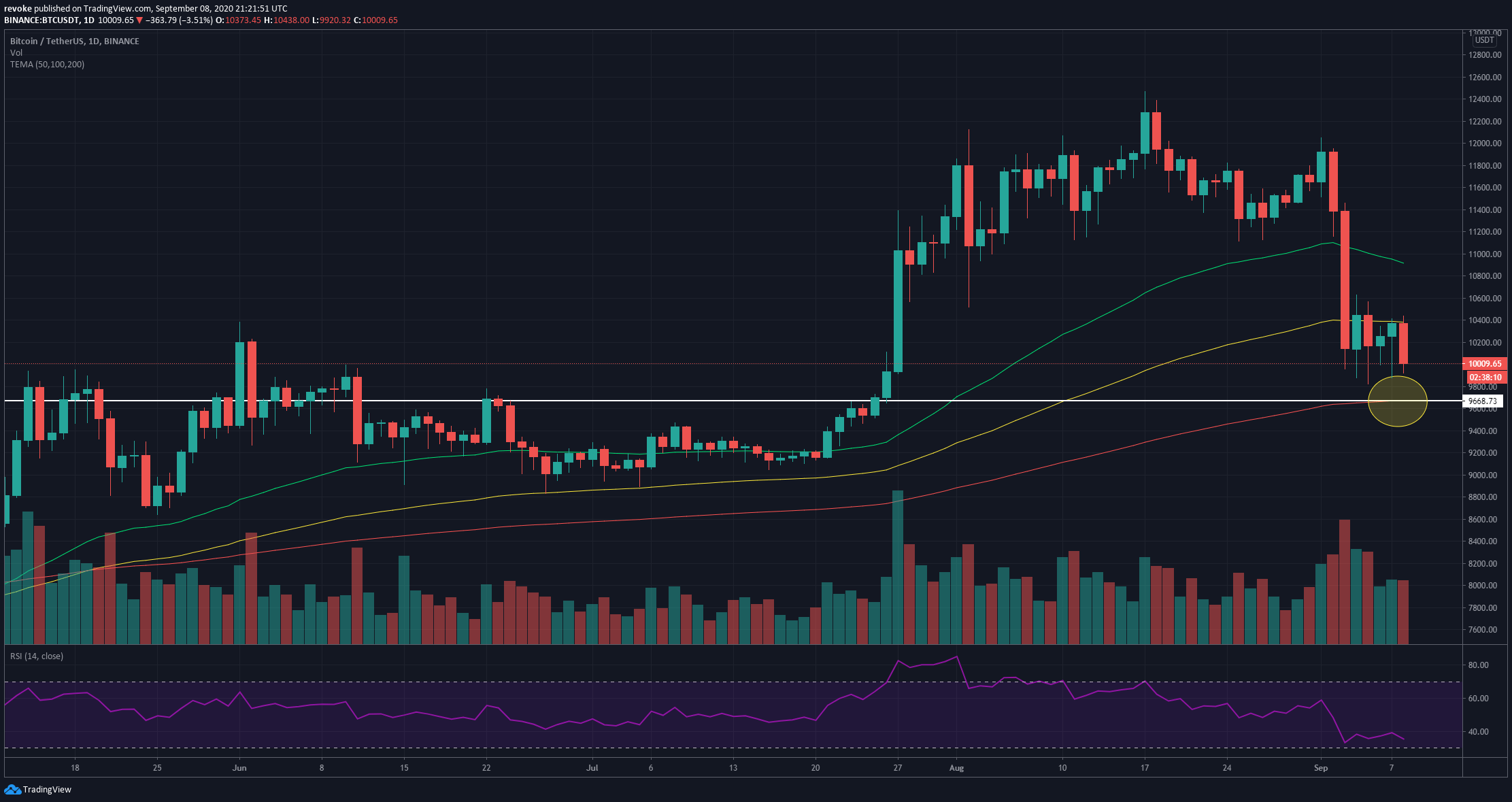

BTC/USD daily chart

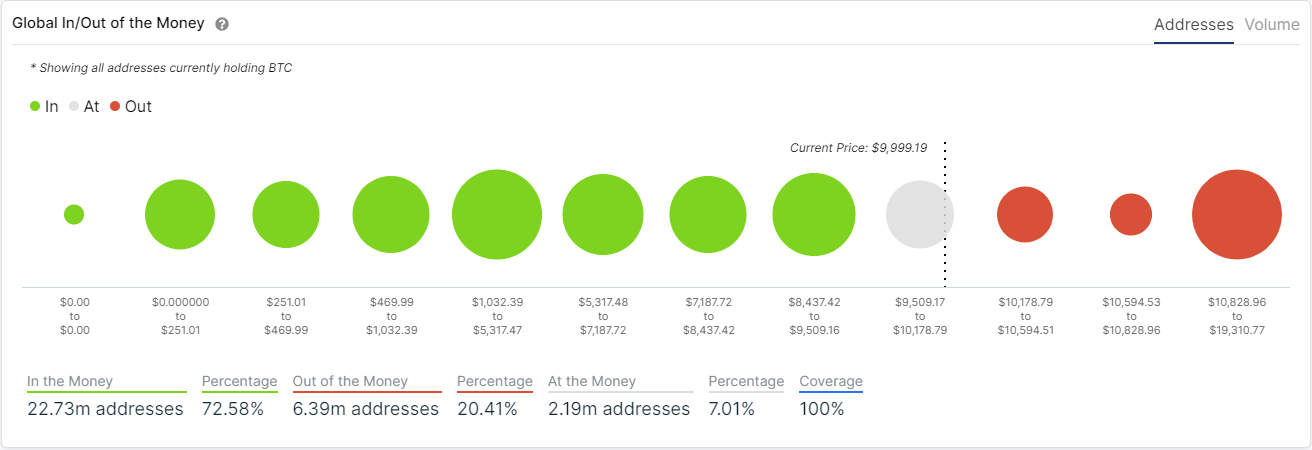

Bitcoin is exceptionally close to filling the gap, but it seems bulls are already buying the dip and not allowing the pioneer digital asset to fall below $10,000. On Binance, Bitcoin touched $9,825, again, reasonably close to the $9,665 gap. There are two main pathways that BTC could take.

Bitcoin bulls could continue buying the dip and allow the gap to fill at the same time. A flash crash to $9,665 right into a bounce is a realistic scenario considering how healthy the $10,000 level is and that the RSI would be oversold if Bitcoin were to fall below $9,700. Additionally, this level coincides with the 200-MA as well.

We could also see Bitcoin losing both levels, at $10,000 and $9,665 and form a new low as below this last support level, Bitcoin doesn’t have other support points until $9,047.

BTC/USD 4-hour chart

BTC has established a slight uptrend on the 4-hour chart after holding the low of $9,825 and forming a higher low at $9,875 followed by a higher high at $10,438 compared to $10,347. Bulls have defended the $9,875 low establishing a new higher low at $9,920 and are now waiting for the leg up above $10,438 ideally.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin price reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum price holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple price coils up for a move north as XRP bulls defend $0.5000.

Jack Dorsey's Block is under investigation by US Prosecutors for crypto lapses, says NBC

According to a report from NBC on Wednesday, former Twitter CEO Jack Dorsey's company, Block, is under investigation by the US federal government. The allegations against the company are charges of processing transactions linked to sanctioned countries and even terrorists.

Ethereum attempts comeback after Fed decision not to tamper with rates

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana (SOL) price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

-637351977155645881.png)