Bitcoin Elliott Wave technical analysis [Video]

![Bitcoin Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/BTC-neutral-object_XtraLarge.png)

Elliott Wave Analysis TradingLounge Daily Chart.

Bitcoin/ U.S. Dollar (BTCUSD).

BTC/USD Elliott Wave technical analysis

-

Function: Counter Trend.

-

Mode: Corrective.

-

Structure: Triangle.

-

Position: Wave (D).

-

Next higher degree direction: Wave ((4)).

-

Invalidation level: -

-

Details: Bitcoin's price is in the final stages of a Triangle Correction (A-B-C-D-E), which is a 4-wave correction phase.

Bitcoin/US Dollar (BTC/USD) trading strategy

The market is currently in the late stage of a Triangle Correction (A-B-C-D-E) within Wave 4. BTCUSD is expected to be forming Wave D, moving upwards to test the key resistance level at 105,234 USD (Fib 0.786). Following this, a potential correction to Wave E may occur before entering a major uptrend in Wave 5, extending into Wave III.

Trading strategies

-

Strategy:

-

Long Strategy:

-

Consider buying at 96,500 USD if a reversal signal appears.

-

-

-

Risk Management:

-

Invalidation Point: Cut losses if the price drops below 91,347 USD.

-

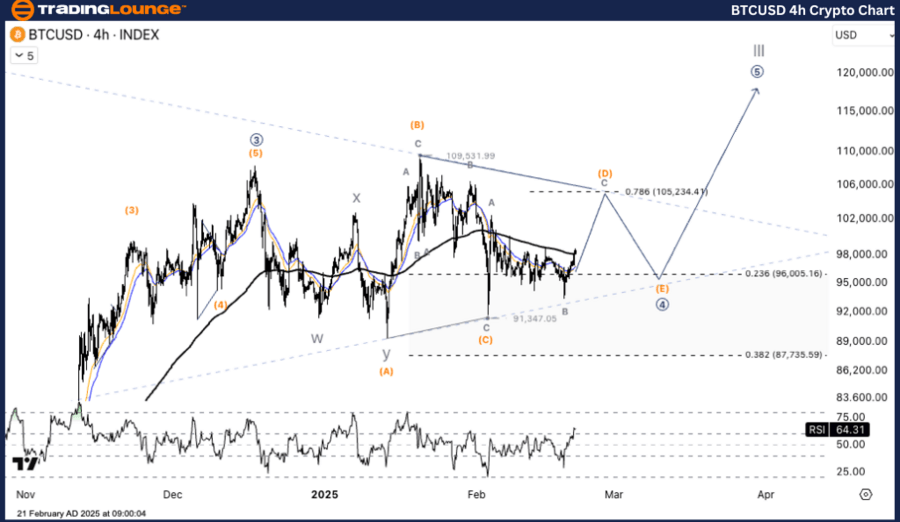

Elliott Wave Analysis TradingLounge H4 Chart.

Bitcoin/ U.S. Dollar (BTCUSD).

BTC/USD Elliott Wave technical analysis

-

Function: Counter Trend.

-

Mode: Corrective.

-

Structure: Triangle.

-

Position: Wave (D).

-

Next higher degree direction: Wave ((4)).

-

Invalidation level: -

-

Details: Bitcoin's price is currently in the final stages of a Triangle Correction (A-B-C-D-E), forming part of a 4-wave corrective structure.

Bitcoin/US Dollar (BTC/USD) trading strategy

The price remains in the late stage of the Triangle Correction (A-B-C-D-E) within Wave 4. BTCUSD is projected to be in Wave D, rising to test the major resistance at 105,234 USD (Fib 0.786). A retracement to Wave E could occur before the market resumes an uptrend into Wave 5, progressing into Wave III.

Trading strategies

-

Strategy:

-

Long Strategy:

-

Consider buying at 96,500 USD if a reversal signal is confirmed.

-

-

-

Risk Management:

-

Invalidation Point: Exit positions if the price falls below 91,347 USD.

-

TradingLounge analyst: Kittiampon Somboonsod, CEWA.

BTC/USD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.