Bitcoin Elliott Wave technical analysis [Video]

![Bitcoin Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/BTC-bullish-chart_XtraLarge.png)

BTC/USD Elliott Wave technical analysis – Daily chart

-

Function: Follow Trend.

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave 3.

- Direction: Next higher degrees expected to continue upward.

Bitcoin (BTC/USD) trading strategy

After BTC surpassed $110,590 to complete wave (1), it's now consolidating in wave (2) ABC, with sub-wave C testing a key support level before wave (3) likely resumes to the upside.

Trading strategies

For short-term traders (swing trade):

-

Aggressive entry: If BTC falls into the $107,200–$106,300 zone and shows a bullish reversal signal (e.g., bullish engulfing pattern, RSI divergence).

-

Conservative entry: Wait for confirmation with BTC closing above $110,600, indicating wave (3) has resumed.

Wave count invalidation:

-

Invalidation level: $105,149.53.

-

If BTC drops below this price, the wave count becomes invalid.

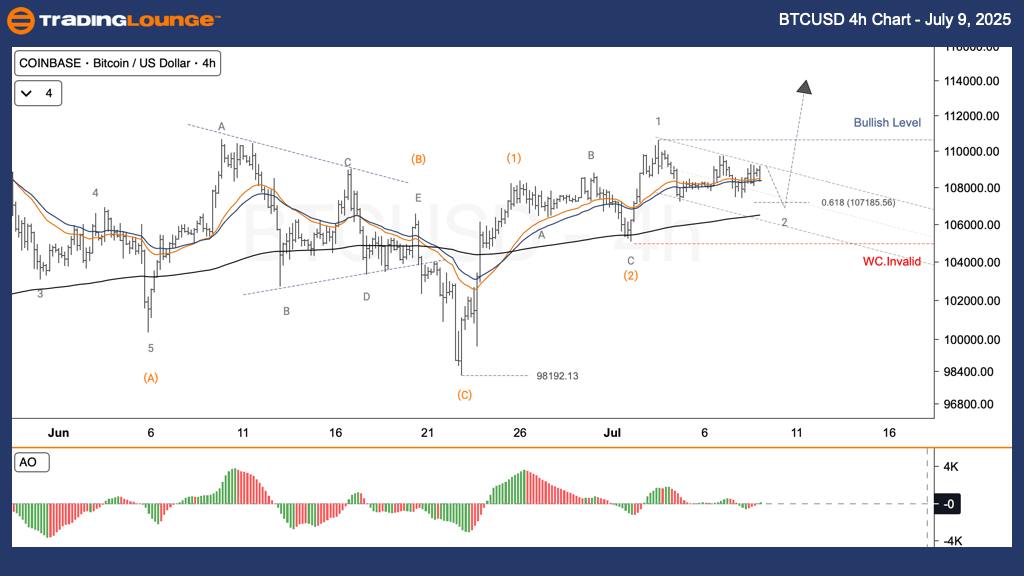

BTC/USD Elliott Wave technical analysis – Four-hour chart

-

Function: Follow Trend.

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave 3.

BTC price outlook

Post the breakout above $110,590, the asset has entered an ABC corrective phase for wave (2). Sub-wave C is testing crucial support. A rebound from this area is likely to begin wave (3) higher.

Trading strategies – Summary

For short-term traders (swing trade):

-

Aggressive entry: Enter between $107,200–$106,300 if a bullish pattern appears.

-

Conservative entry: Confirm breakout above $110,600 to enter.

Invalidation point:

- $105,149.53 – Falling below this invalidates the current wave count.

Bitcoin (BTC/USD) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.