Base surges to 2M daily transactions following Dencun upgrade

Daily transactions on the Coinbase Ethereum layer-2 network Base skyrocketed to a record 2 million on March 16, just a few days after the Dencun upgrade.

Before the upgrade, Base was processing around 440,000 transactions per day. The day after, this climbed to 1.1 million and continued to rise in the days following, hitting 2,064,920 on March 16.

Daily new users on Base also spiked to 666,866 on March 16, a massive 3,200% increase from the average for the days leading up to Dencun.

Base daily transactions graph. Source: Dune Analytics

The 350% jump in transactions has been linked to a vast reduction in fees for Base following the Dencun upgrade. Average transaction fees on Base have fallen by more than 60% since the upgrade, according to Blockscout.

Launched by Coinbase in August, Base is the sixth-largest network in the Ethereum layer-2 ecosystem with total value locked of $1.46 billion and commanding a 4.1% market share of layer 2s, according to industry tracker L2beat.

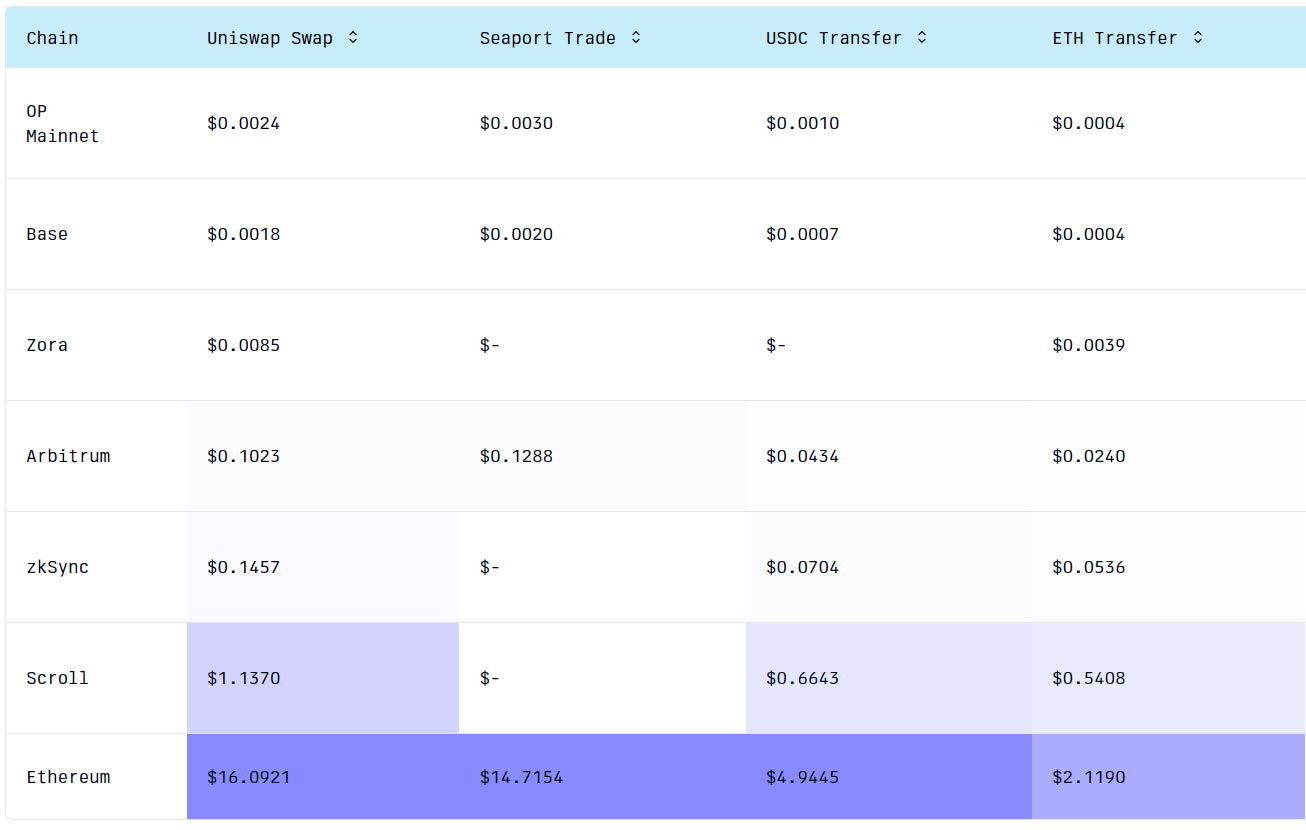

The Ethereum Dencun upgrade rolled out Ethereum Improvement Proposal 4844, which reduced layer-2 transaction fees by introducing data blobs or proto-danksharding. The upgrade enhanced L2 data availability, which reduced gas costs by as much as 90% for some networks.

Average transaction fees on leading layer-2 networks Arbitrum, Optimism, Base and zkSync Era fell by between 60% and 90% following the upgrade, according to Dune Analytics.

Average layer-2 fees compared. Source: Dune Analytics

Arbitrum and Optimism still dominate the layer-2 ecosystem with a combined total value locked of $23 billion, giving them a market share of 42% and 23%, respectively.

Gas fees for token swaps on decentralized exchange Uniswap’s Optimism deployment fell as low as $0.01 following Dencun, as noted by protocol founder Hayden Adams.

Meanwhile, Ethereum layer-1 gas fees have been high recently as the asset topped $4,000 but has since fallen back. An Ether (ETH $3,628) transfer currently costs around $2.1, a USD Coin (USDC $1.00) transfer around $5, but a swap on Uniswap is around $16, according to Gasfees.io.

Comparison of Ethereum L1 and L2 fees, March 18. Source: Gasfees.io

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.