Axie Infinity price rallies 20% with surge in unique wallets boosting AXS

- Axie Infinity price rise led the crypto market gainers over the past 24 hours, rallying by 21% during the intra-day session.

- The reason behind this is speculated to be the 77% increase in unique active wallets on the project in the past day.

- While active deposits hit a three-month high, the supply on exchanges noted a decline, suggesting buying pressure superseding selling pressure.

Axie Infinity price rise is evidence that any iota of optimism is serving as a motivation for investors to act bullish, given the condition of the crypto market. AXS holders rushed to stack up on the token, resulting in the cryptocurrency noting double-digit gains.

Axie Infinity price finds support for recovery

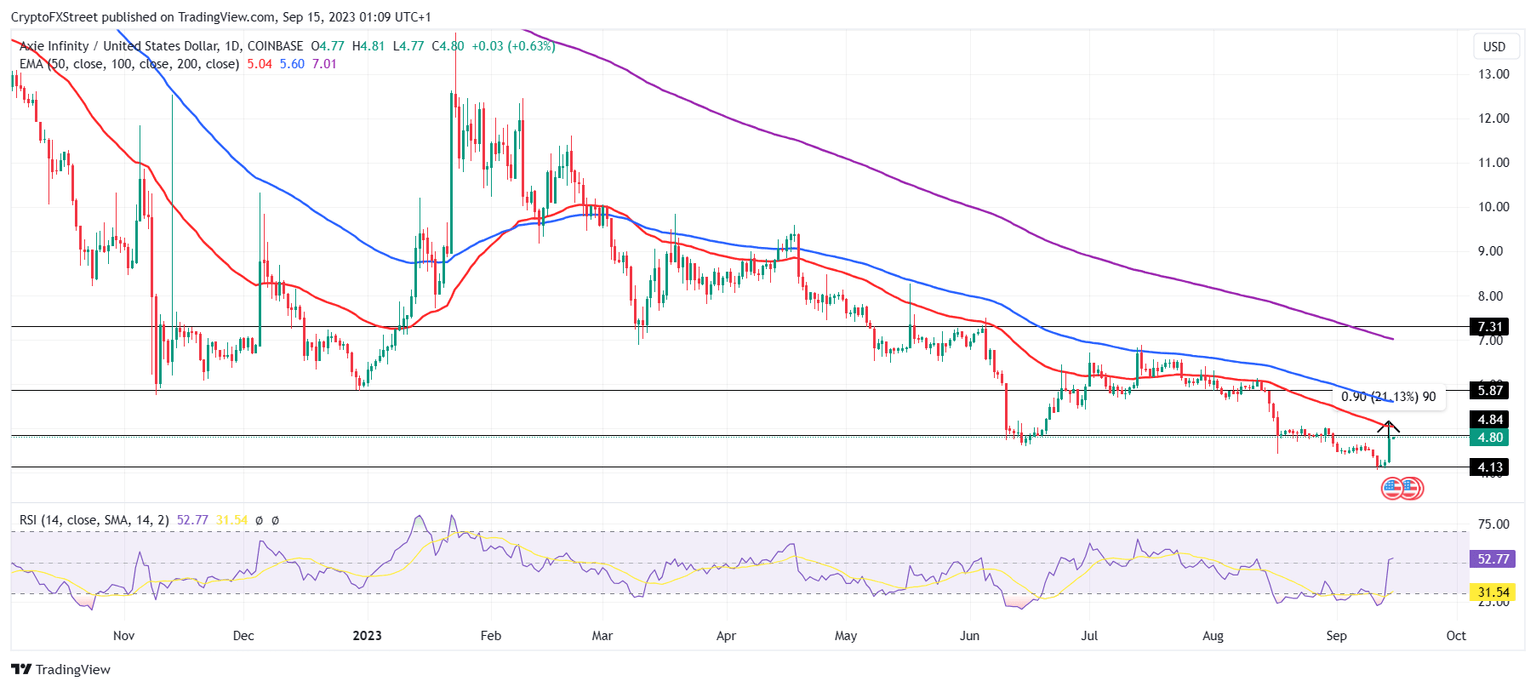

Axie Infinity price at the time of writing could be seen hovering around the $4.80 mark, noting an 11% rise in the past 24 hours. The altcoin’s rise scaled down slightly after increasing by almost 21% during the intra-day trading hours. This rise acted as a much-needed recovery for the cryptocurrency, which marked a fresh year-to-date low of $4.13 this past week.

The Relative Strength Index (RSI) suggests that the potential for further recovery is solid as the indicator line is well above the neutral line at 50.0. A few more green bars would see a bounce off of it.AXS was oversold just a few days ago.

Further recovery would push Axie Inifnity price through the barrier marked at $4.84 and enable the DeFi token to reclaim the 50-day Exponential Moving Average (EMA) at $5.03.

AXS/USD 1-day chart

However, if the retest of the $4.84 resistance line fails and the cryptocurrency falls back to $4.13, it could very well slip through it and form new 2023 lows, invalidating the bullish thesis.

Axie Infinity finds newfound interest

Given the market conditions, even short-term bullishness is drawing investors to make a move in the upward direction. Evidence of this can be found in the case of AXS. The DeFi application observed a sudden increase in the unique active wallets on the platform, shooting up by 77% in a day to hit 24.3k.

Axie Infinity unique active wallets

This is potentially what drove AXS holders to act bullish, resulting in the rise in price. The active deposits hit a three-month high of 128 soon after the price increase, marking a 287% growth in the daily figures. This suggests that the investors were potentially looking to sell their AXS holdings in order to make the most of the rally.

Axie Infinity active deposits

However, the supply on exchanges observed a decline in the AXS tokens stored in the wallets. In the span of 24 hours, this supply went down by 600k from 2.7 million AXS to 2.1 million AXS. Worth around $2.85 million at the current price, this outflow hints towards the fact that investors are more keen on adding AXS to their portfolio than subtracting it as they expect a further increase in price.

Axie Infinity supply on exchanges

This suggests that the buying pressure in the market is superseding the selling pressure and that Axie Inifnity price could find some support in its efforts of recovery going forward.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%20%5B05.37.11%2C%2015%20Sep%2C%202023%5D-638303358203517551.png&w=1536&q=95)

%20%5B05.37.41%2C%2015%20Sep%2C%202023%5D-638303358425851360.png&w=1536&q=95)