Axie Infinity price is on its way to $10

- Axie Infinity price has strong Fibonacci retracement targets at $10 and $4.

- Volume indicates a re-entrance of bears in the market.

- Invalidation of the bearish downtrend is a breach at $44.

Axie Infinity price displays reasons to believe in further momentum to the downside. Traders should cautiously approach a short bias or avoid the digital asset until the invalidation target is breached.

Axie Infinity price due for more decline

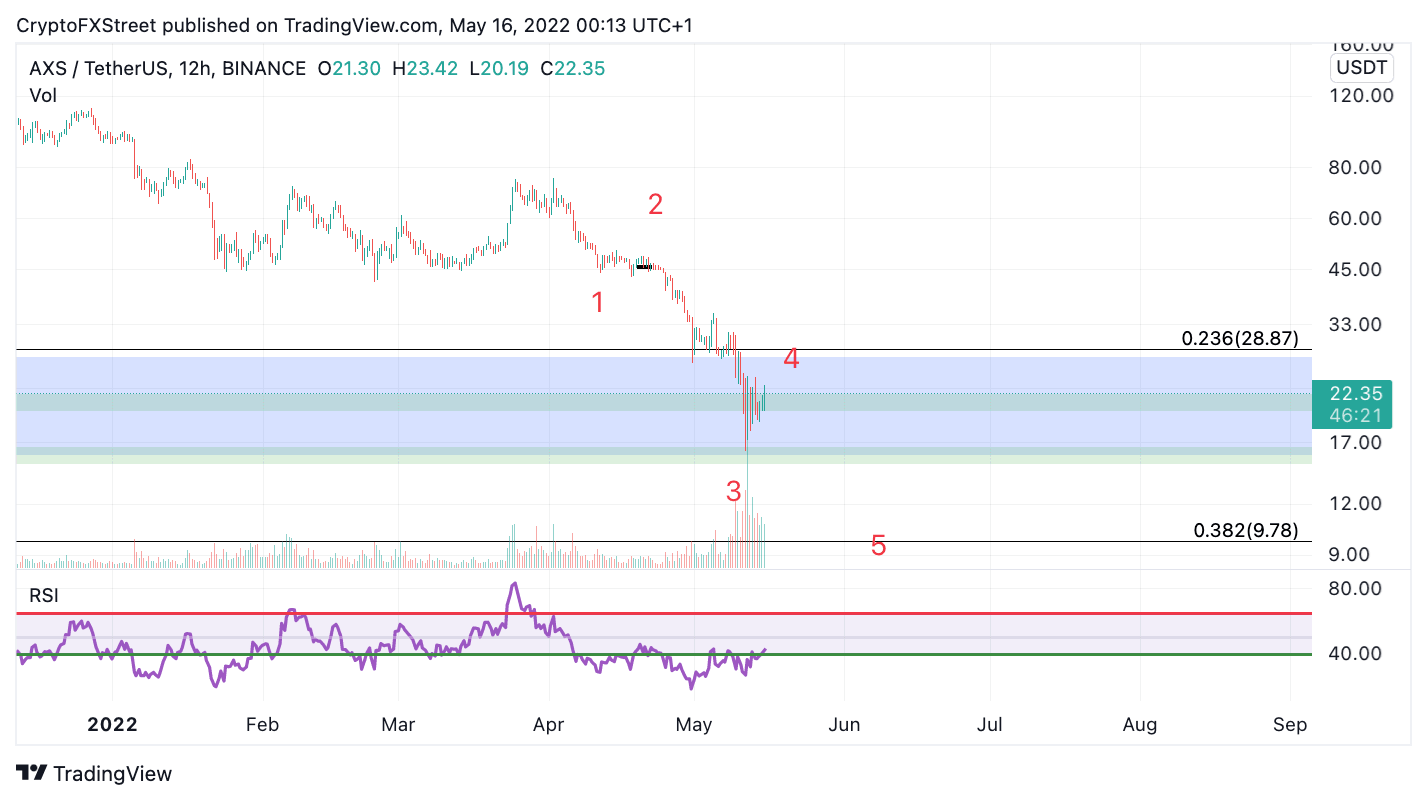

Axie Infinity price appears to be unfolding a wave three down like many other cryptocurrencies to start this week’s trading session. The 2-day chart displays bearish evidence on multiple fronts. For one, the bearish downtrend is progressively getting steeper. Secondly, the bulls have yet to display a candlestick of significant value to compete with the bearish price action.

Axie Infinity price also provides further bearish confluence by using the Fibonacci retracement tool surrounding the all-time lows & all-time highs. A 38.2% Fibonacci retracement level is currently marked at $10. From a macro perspective, the AXS price could fall between 10 and $4 at the 50% FIb level before making a new all-time high. The volume profile indicator displays a subtle ramping pattern in favor of the bears on the 2-day chart. When combined, it appears the AXS price is due for more decline.

AXS/USDT 12-Hour Chart

Still, an invalidation is necessary for traders to maintain the right side of the trend. The bulls should not be able to breach $44 if these technicals are correct. If they breach $44, the AXS price could re-route to $80, resulting in a 200% increase from the current AXS price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.