Axie Infinity price could bottom out at $1.00

- AXS price is experiencing a steep decline.

- Axie Infinity price action has Fibonacci levels coinciding with a $1.00 target.

- Invalidation of the bearish thesis is still a breach at $44.42.

Axie Infinity price continues a sharp decline. Fibonacci and Elliot Wave Theory suggest a $1.00 bottom.

AXS price to land at $1.00 eventually

Axie Infinity price could potentially fall further before seeing a definitive market bottom.

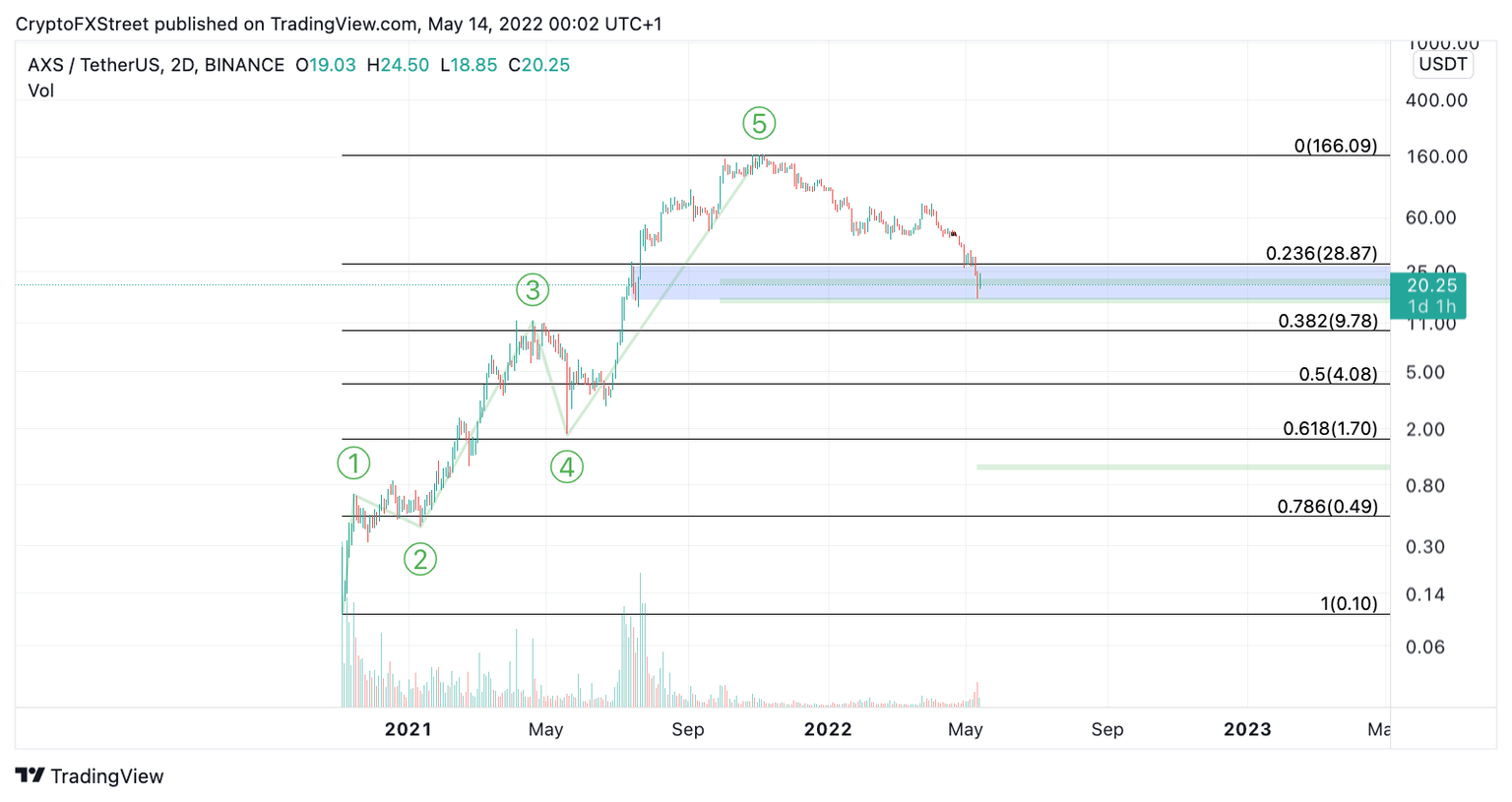

Axie infinity price has printed three clear impulsive waves. Elliott wave theory suggests a 50 to 61.8% retracement level usually occurs after seeing three sets of impulse waves. A Fibonacci retracement tool surrounding all-time lows and all-time highs suggests a 61.8% retracement level at the $1 price vicinity.

Axie Infinity price could be printing the first corrective structure set to send the AXS price to $1.00. There could be countertrend rallies before the target is reached, but overall a $1.00 price level is a likely target for long-term investors who have no interest in intraday trading.

AXS/USDT 2-Day Chart

The best confirmation for the end of the current downturn will be a breach at $44.42. If this price spike occurs, the bulls could invalidate the downward trend and send the AXS price back to $88, resulting in a 200% increase from the current AXS price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.