- Arbitrum network will unleash 92.65 million tokens to the market on Tuesday, worth nearly $107 million.

- ARB could dip 10% to $1.00 as investors, among other token recipients, are likely to cash in for quick gains.

- A flip of $1.73 roadblock into support would invalidate the bearish thesis.

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply. The Arbitrum network is among the projects lined up for cliff token unlocks this week, meaning traders must brace for volatility.

Arbitrum cliff token unlocks

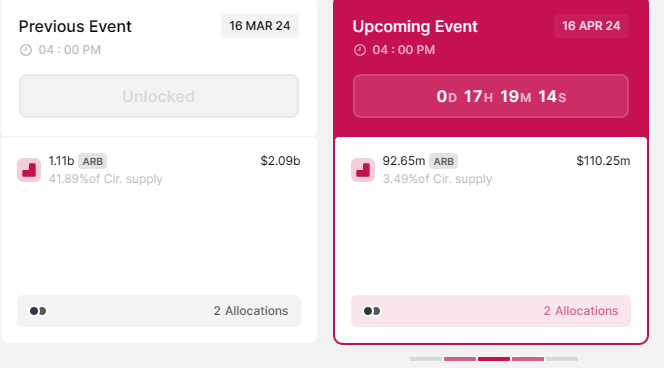

The Arbitrum network will unlock 92.65 million ARB tokens worth approximately $107 million and composing 3.49% of the network’s circulating supply. The event, slated for April 16, will see the tokens allocated to the Arbitrum team, the future team, and future advisors and investors.

ARB token unlocks schedule

The last unlocks happened on March 16, where 1.11 billion ARB tokens comprising 41.89% of the circulating supply were allocated to the team, future team and advisors, and investors. The unlock saw Arbitrum price drop by over 10%. If history repeats, the Ethereum Layer 2 (L2) token could register similar losses.

Arbitrum price outlook ahead of ARB unlocks event

Arbitrum price attempted a recovery on Sunday after bottoming out around $0.85 on Saturday. However, the recovery proved premature as the L2 token now suffers robust resistance from the north. As traders flee the market to escape being caught in exit liquidity, Arbitrum price risks further downside.

The likely play is a retest of the $1.00 psychological level, which would mark a 10% downswing. In a dire case, however, the WIF price could descend to the Saturday bottom at $0.8556. This would constitute a 25% fall below current levels.

ARB/USDT 1-day chart

On the other hand, increased buying pressure could facilitate a strong move north, sending the ARB price above the 200-day SMA at $1.45. However, for the bearish thesis to be invalidated, the price must break and close above $1.73.

A breach of the aforementioned level, which coincides with the 50-day SMA at $1.71, would encourage more buyers, sending ARB price above the forecasted target.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

LINK price jumps 10% as Chainlink races toward tokenization of funds

Chainlink (LINK) price has remained range-bound for a while, stuck between the $16.00 roadblock to the upside and $13.08 to the downside. However, in light of recent revelations, the token, which powers the verifiable web of the decentralized computing platform, may have further upside potential.

Gaming token Notcoin down by almost 50% after airdrop launch

NOT experienced a rapid decline hours after its anticipated launch on Thursday, shedding almost 50% of its value. This continues the cycle of huge selling pressure faced by cryptocurrency airdrops after their launch, especially the launch of gaming tokens in recent times.

Ethereum drops below $3,000 again, spot ETH ETF sparks debate in crypto community

Ethereum again went below the $3,000 key level on Thursday after posting signs of a rally. The price action follows predictions from the community regarding the SEC's decision on spot ETH ETFs next week.

SUI price defends $0.8880 amid multiple Sui network integrations

Sui (SUI) price failed to heed to the broader market recovery on Wednesday, extending the fall to the $0.8880 support level. However, with multiple network integrations in the works, the altcoin has pivoted around this level and is scaling a recovery.

Bitcoin: Why BTC is close to a bottom

Bitcoin (BTC) price efforts of a recovery this week have been countered by selling pressure during the onset of the American session. However, the downside potential appears to have been capped.