Algorand price prepping for a 25% rally

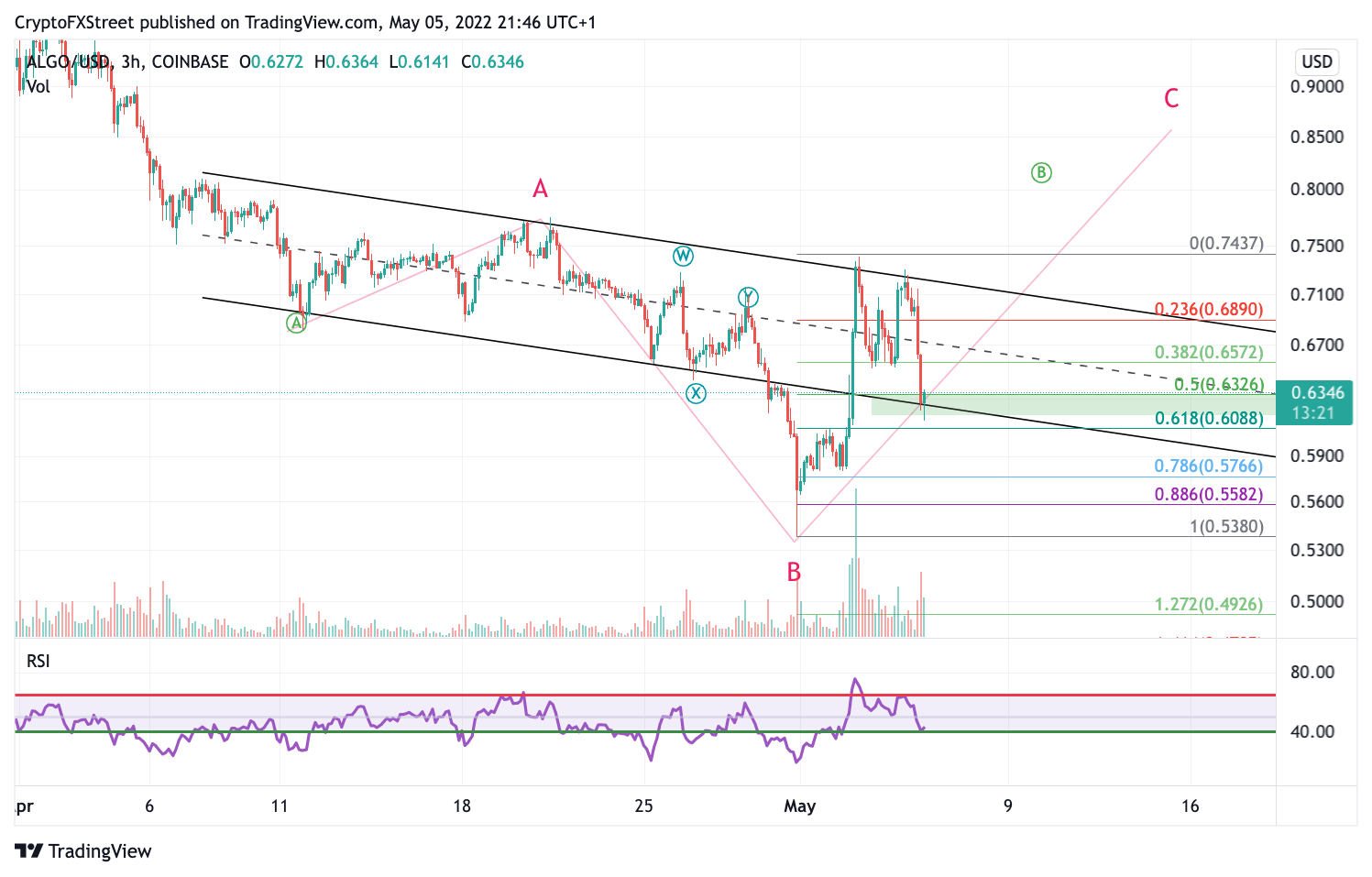

- ALGO price is inches away from retracing into the 61.8% Fibonacci level.

- Algorand price is retesting a breached support zone.

- Invalidation of the bullish uptrend is a breach below the swing low at $0.54.

Algorand price is displaying bullish signals. Traders should keep an eye on the digital asset and find an entrypoint.

Algorand price is a buy

Algorand price is coming back to retrace a breached support zone after an impressive 40% rally that kickstarted the month of May. The $0.63 level could be a good entry point for swing traders looking to join the uptrend. Analyzing the current ALGO price action, the bears could likely get challenged around the $0.77 swing highs that occurred in April. The following targets would be $0.80 and $0.86 to complete the c wave of the expanding flat that could be forming.

Algorand price provides further bullish confluence as the support zone matches the 61.8% Fibonacci retracement level surrounding the initial 40% rally. If the technicals are correct, the bulls could be printing the final corrective low around $0.60.

ALGO/USDT 3-Hour Chart

Still, having an invalidation level is vital for knife-catching traders. Under no circumstances should the Algorand price breach the swing lows at around $0.54. If this bearish event happens, consider the entire uptrend scenario void. A $0.45 ALGO price could be the next bearish target resulting in a 30% decrease from the current ALGO price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.