Algorand Price Forecast: ALGO could quickly drop to $1.15 as technical turn bearish

- Algorand has been rejected at record highs and is now seeking higher support.

- A spike in the social media volume is a bearish signal.

- Support above $1.6 will ensure that buyers focus on rolling to highs above $2.

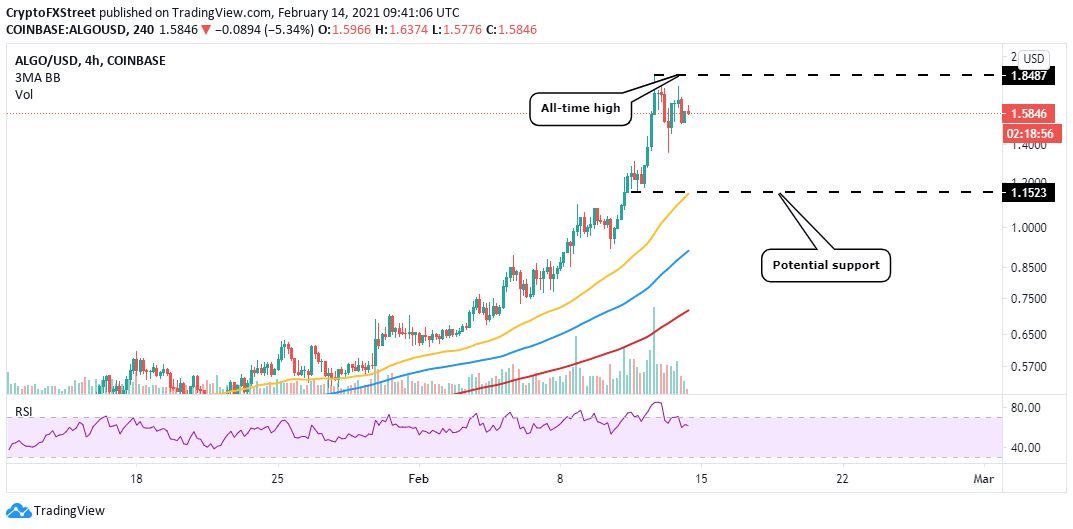

Algorand is moving away from the recently achieved record high of $1.85 amid a strengthening bearish grip. The rally to this incredible price level started last year, but January and February have yielded massively for Algorand. However, the upswing appears vulnerable to losses, especially with a possible breakdown eyeing $1.15.

Algorand correction seems unstoppable

The rejection from $1.85 has left buyers in search of higher support. However, the absence of near-term buyer congestion zones hints at the breakdown extending to the next target. The 50 Simple Moving Average (SMA) on the 4-hour chart is in line to provide the much-needed support if losses head towards $1.

The comprehensive short-term analysis reinforces the pessimistic outlook, especially with the Relative Strength Index rejected from the overbought region.

ALGO/USD 4-hour chart

According to Santiment, a leading on-chain analytics platform, Algorand's social media-related mentions have soared to the highest level over the last 30-days. The volume model tracks the number of ALGO-related mentions across hundreds of social channels.

A spike in social media volume is not necessarily a bullish signal. Often it shows that the uptrend is reaching exhaustion and a correction is imminent. Therefore, this massive surge adds credibility to the potential downswing.

Algorand social volume

Looking at the other side of the picture

Another upswing to new all-time highs will come into the picture if ALGO secures higher support, preferably above $0.6. Moreover, price action towards above the current record high will call out to more investors to jump on board for liftoff to highs above $2.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B12.48.25%2C%252014%2520Feb%2C%25202021%5D-637488935179357232.png&w=1536&q=95)