USD/JPY Weekly Forecast: Mr. Kuroda declines an invitation to the rate party

- USD/JPY takes profit on Wednesday and Thursday, rebounds on Friday.

- BoJ leaves base rate and JGB yield control unchanged.

- USD/JPY rallies two figures after the BoJ decision.

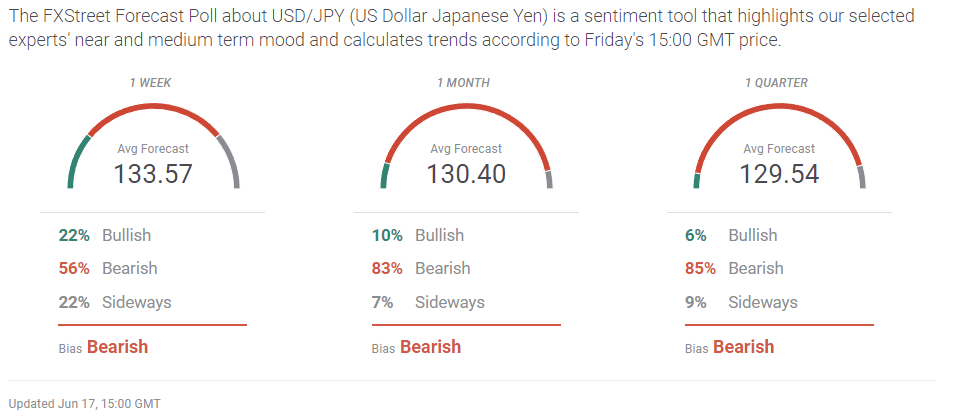

- FXStreet Forecast Poll is uniformly bearish to one quarter.

There was never much chance that the Bank of Japan would modify its perennial easy money policy at its meeting on Friday. But when the possibility, however remote, was weighed against the 6.7% gain in the USD/JPY over the past three weeks and universal central bank tightening, the two-day profit run to below 132.00 on Wednesday and Thursday was eminently sensible. That it reversed at the 38.2% Fibonacci level of the May 30 to June 14 (127.01-135.47) move underlined its essential motivation.

The Bank of Japan (BOJ) left the base rate unchanged at -0.1% and did not alter its Yield Curve Control (YCC) policy defending yields in the Japanese Government Bond (JGB) market. The USD/JPY promptly reversed adding more than two figures from open to close on Friday in Tokyo.

Speculation that the BoJ might curb its monetary support had been based on the wave of central bank rate hikes–the Federal Reserve, the Bank of England and the Swiss National Bank, being the most recent–a reported comment in the Diet by BoJ Governor Haruhiko Kuroda that a shift in the bank’s monetary policy was possible, and by the evident hardship for Japanese consumers and importers caused by the yen’s excessive weakness.

The USD/JPY recovery came despite a drop in US Treasury rates this week as markets computed the odds of a US recession.

The Federal Reserve’s 75 basis point hike to a 1.75% upper target for the fed funds at Wednesday’s Federal Open Market committee (FOMC) meeting had been prompted by an unexpected 8.6% reading in May’s annual Consumer Price Index (CPI).

That acceleration above the March high of 8.5%, reported last Friday, led the Fed to the unusual step of changing its rate outlook during its two-week media blackout before the Federal Open Market Committee Meeting (FOMC).

At the previous FOMC on May 4, Chair Jerome Powell had said that a 0.5% hike was likely at the next meeting. May’s higher CPI was clearly a shock to the governors.

On Monday, the Wall Street Journal published an article, assumed to be sourced from the Fed, that the rate prescription for the Wednesday meeting was now 0.75%. Markets took the information as gospel.

Mr. Powell dropped a number of broad hints in his press conference that more 75 basis point increases are possible, though the Treasury markets paid more attention to the rising possibilities of a recession.

The Fed also issued its updated economic and rate projections, the second of four each year.

The year-end estimate for the fed funds rate rose to 3.4% from 1.9% in March, implying a doubling from its current level. Economic growth in 2022 dropped to 1.7% from 2.8%, PCE inflation rose to 5.2% from 4.3% and core to 4.3% from 4.1%. Inflation is still expected to decline in 2023 to 2.6% for headline and 2.7% for core, barely changed from the March projections.

There were no changes to the balance sheet reduction program that began this month with a $47.5 billion roll-off of maturing securities.

The US dollar fell after the Fed meeting, partly in a normal reaction to a highly anticipated event, partly from some judicious profit-taking on the long ascent and partly from lower Treasury yields.

Economic growth prospects in the US slipped as the Atlanta Fed GDPNow model, one of the most widely followed indicators, lowered its second quarter estimate to 0.0% from 0.9% after Retail Sales and other statistics were weaker than forecast.

Japanese economic data was limited and of no market impact. Industrial Production was slightly weaker in April than forecast as were annual exports in May, though imports were stronger.

American Retail Sales were unexpectedly negative in May, Housing Starts fell by the most since April 2020 at the height of the pandemic lockdowns and the Producer Price Index was over 10% annually for the fifth month in a row.

Inflation is no longer just a consumer annoyance in the US but is beginning to affect economic activity. Industrial Production in May at 0.2% was lower than the 0.4% prediction, though April was revised to 1.4% from 1.1%.

USD/JPY outlook

The conclusion of the Fed and BoJ meetings returned the USD/JPY to a firm dollar advantage. Of more importance will be the restraint of the Treasury market on Fed intentions. At the moment the retreat of yields has been minimal in comparison to the huge recent gains. But the Treasury market will go its own way, regardless of stated Fed policy. It is entirely conceivable that if US economic data points south, rates will continue to come off. That is the primary risk for the USD/JPY which otherwise has few reasons to retreat.

Japan’s National CPI numbers for May should confirm the impact of global inflation, but with the BoJ decision past, they will have no market effect.

In the US, Existing Home Sales could fall more than the 0.2% forecast in May, confirming the impact of rising mortgage rates and adding one more item to the recession list. The revision to June’s Michigan Consumer Sentiment number does not normally attract attention, but given its record low, it will be watched for a further decline.

The outlook for the USD/JPY is higher with the caveat that declining US Treasury rates could again excite profit-taking on the large gains since early March.

Japan statistics June 13–June 17

US statistics June 13–June 17

Japan statistics June 20–June 24

FXStreet

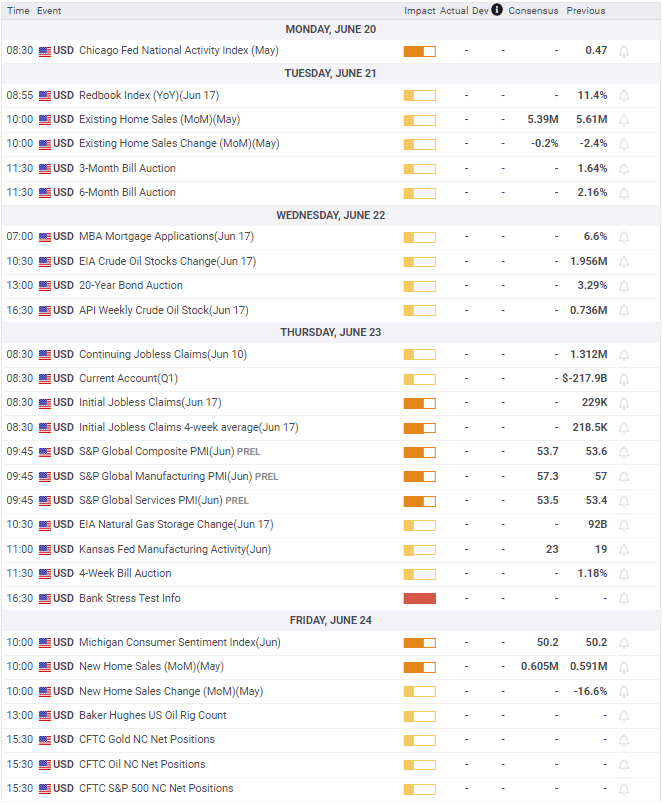

US statistics June 20–June 24

FXStreet

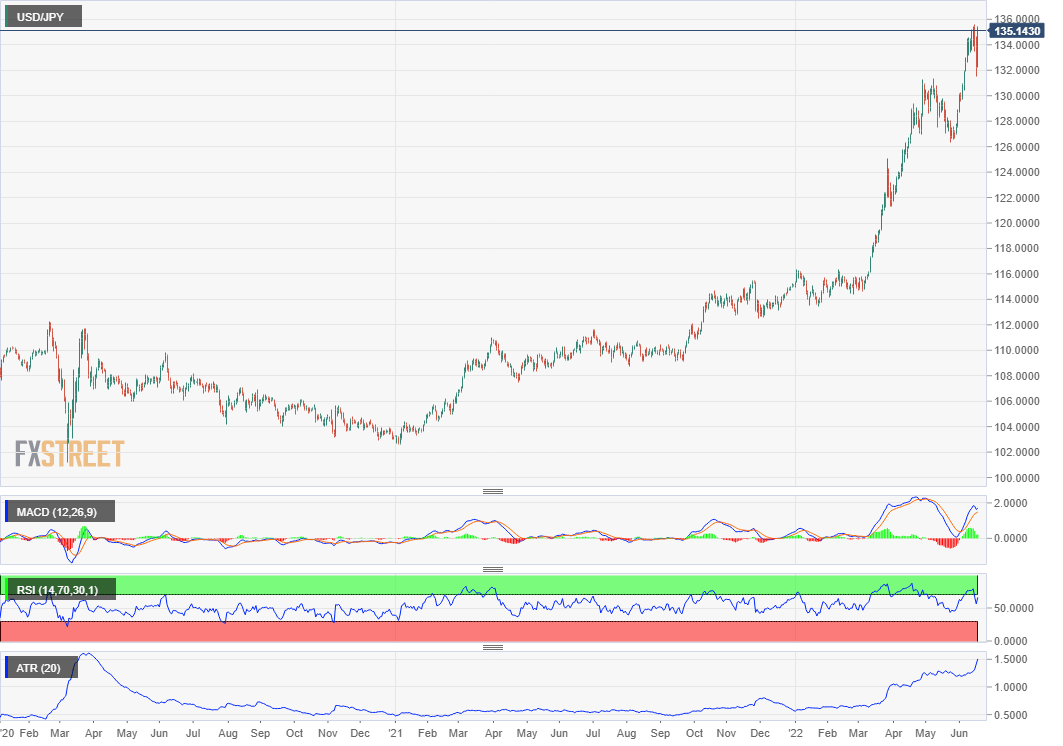

USD/JPY technical outlook

Technical indicators are mildly supportive of a higher USD/JPY. The MACD (Moving Average Convergence Divergence) and the Relative Strength Index (RSI) rebounded with Friday’s two-figure surge. The MACD price line came close to crossing the signal line on Thursday and the reopened spread is not a strong signal. The USD/JPY failed to establish a new high on Friday trading to 135.42 just under Wednesday’s top at 135.60. The angle of the ascent from May 30 was unsustainable so the fall below the trendline is not indication that that upward momentum is broken.

Volatility in the Average True Range (ATR) is as high as it has been since the lockdowns of March 2020.

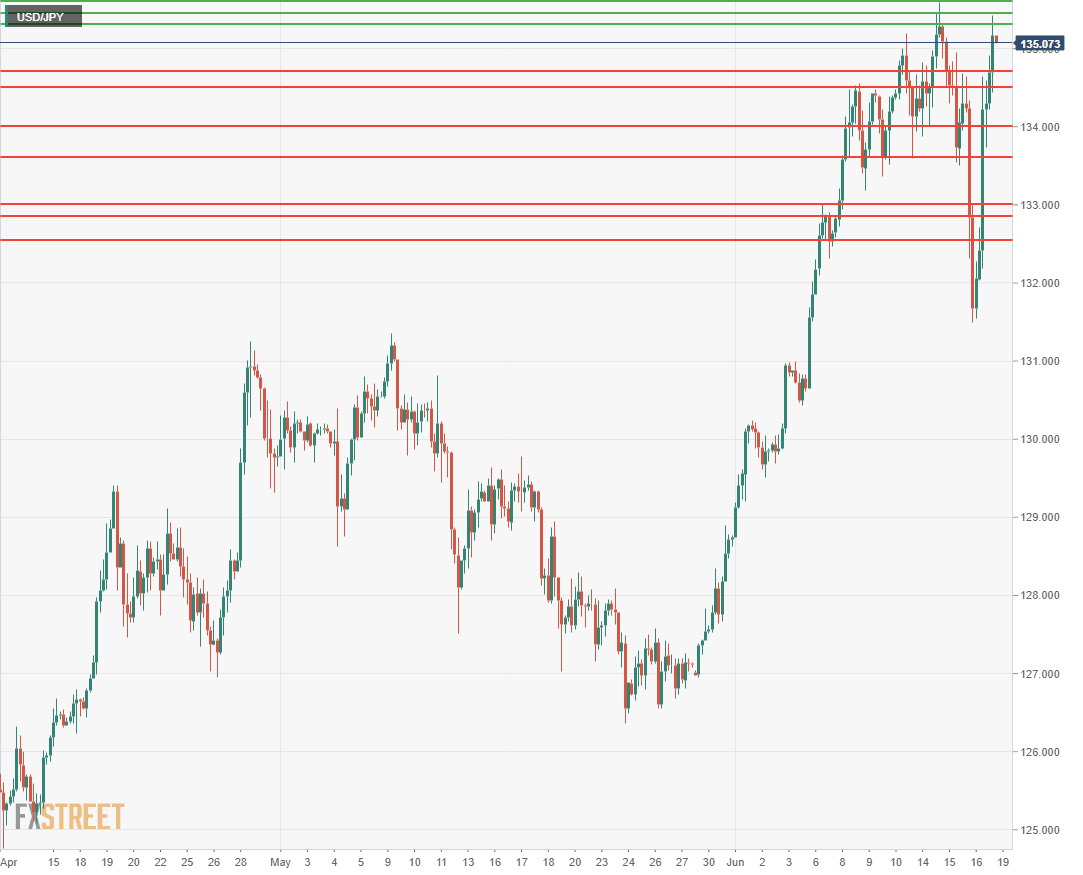

Support and resistance above 131.00 is best ascertained on the four-hour chart reinforced by the dailies. Support is far more plentiful and frequent beneath with the main range definition at 133.60.

Four-hour chart

Resistance: 135.30, 135.45, 135.60

Support: 134.50, 134.00, 133.60, 133.00, 132.85, 132.55

Daily chart

Resistance: 135.50, 135.60

Support: 133.50, 132.60, 132.25, 131.88, 130.88

FXStreet Forecast Poll

The FXStreet Forecast Poll looks to progressive profit-taking declines in the USD/JPY breaching support at 133.60 in the coming week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.