US Michigan Consumer Sentiment September Preview: Happy consumer, happy economy?

- Consumer outlook forecast to improve marginally in September.

- Inflation is eroding purchasing power and sentiment.

- Labor and supply shortages have lowered third quarter economic growth.

- Markets see sentiment as a prelude to consumer spending and the Fed's taper.

Consumers have exchanged pandemic uncertainty for inflation and the trade may be starting to damage the economic recovery.

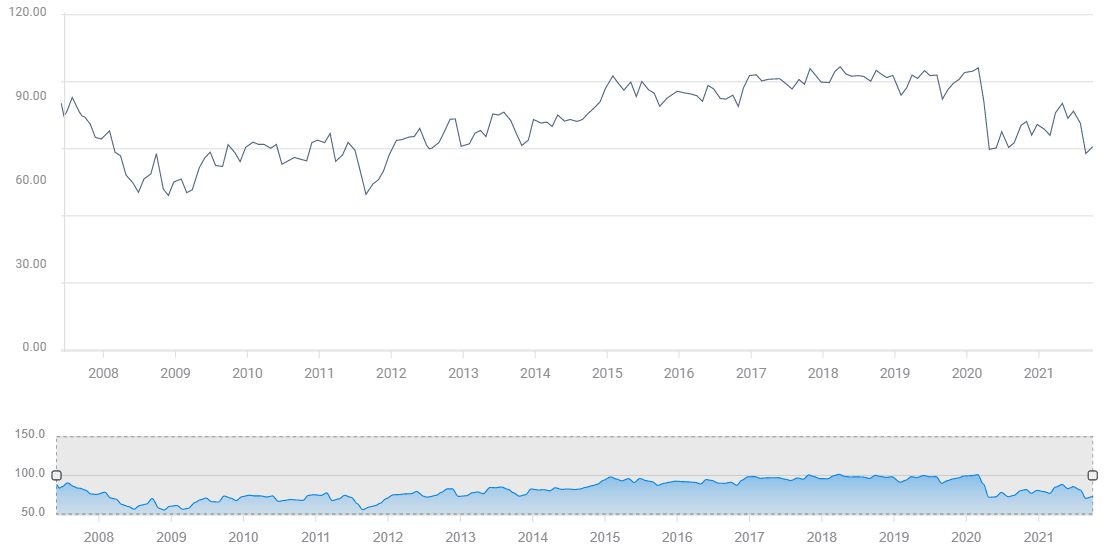

The University of Michigan Consumer Sentiment Index is expected to rise slightly to 73.1 in October from 72.8 in September. Outlook reached a pandemic low of 70.3 in August.

Michigan Consumer Sentiment Index

Wages and inflation

Consumers dislike inflation. Rising prices are a direct and immediate tax on income. Wages increase only at long intervals, household expenses can climb every shopping trip.

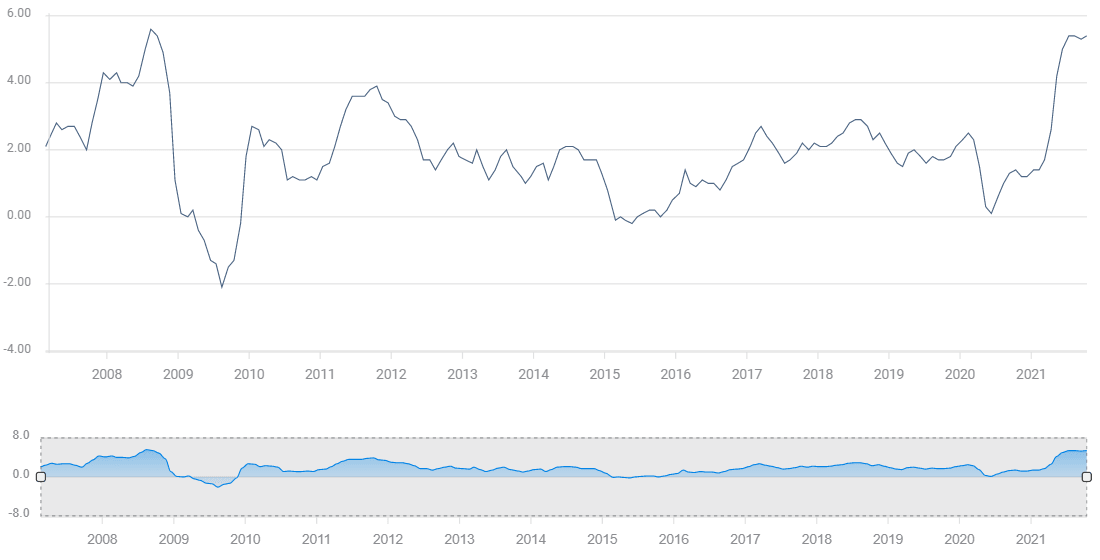

Average Hourly Earnings gained 4.6% on the year in September. Annual consumer inflation was 5.4% in September, the highest since July 2008, and the second largest annual gain in three decades.

CPI

FXStreet

A typical family's purchasing power shrank by the 0.8% difference last month. Multiply that for 12 months and you have a potential 9.6% drop in consumption in a year. The effect on purchases is conditional because families often dip into savings to make up the difference.

Even so, September’s 5.4% increase in the Consumer Price Index (CPI) does not capture the full impact of inflation on household budgets and by extension on the economy.

The Federal Reserve prefers tracking core inflation rates, excluding food and energy costs, as more reflective of long-term price trends. Households and the economy do not have that option.

For consumers food and energy are inelastic goods, their consumption does not drop when prices rise.

Americans do not drive appreciably less when gas is over $3 a gallon as it is now, than when it was under $2 just a year ago. The trucks that deliver food, the trains that cart products from the West coast ports to the rest of the country, the police cars, ambulances, FedEx vans and fire engines do not change their schedules for gasoline prices.

Energy and most food costs have been rising much faster than the general index.

Food prices climbed 1.2% in September after a 0.4% increase in August and were 4.5% higher on the year. Meat expenses were up 3.3% in September and 12.6% annually.

Gasoline prices rose 1.2% last month following a 2.8% increase in August and a 2.4% gain in July, bringing the annual surge to 42.1%. Fuel oil, which heats many older homes, jumped 3.9% in September and is 42.6% more costly on the year.

Americans have not seen this kind of damaging inflation in a generation. With no surcease on the horizon, even the Fed has admitted current inflation will be longer and higher than anticipated, consumer attitudes are becoming gloomy.

Labor market

In a normal economy the ability to find work is a major component of consumer optimism.

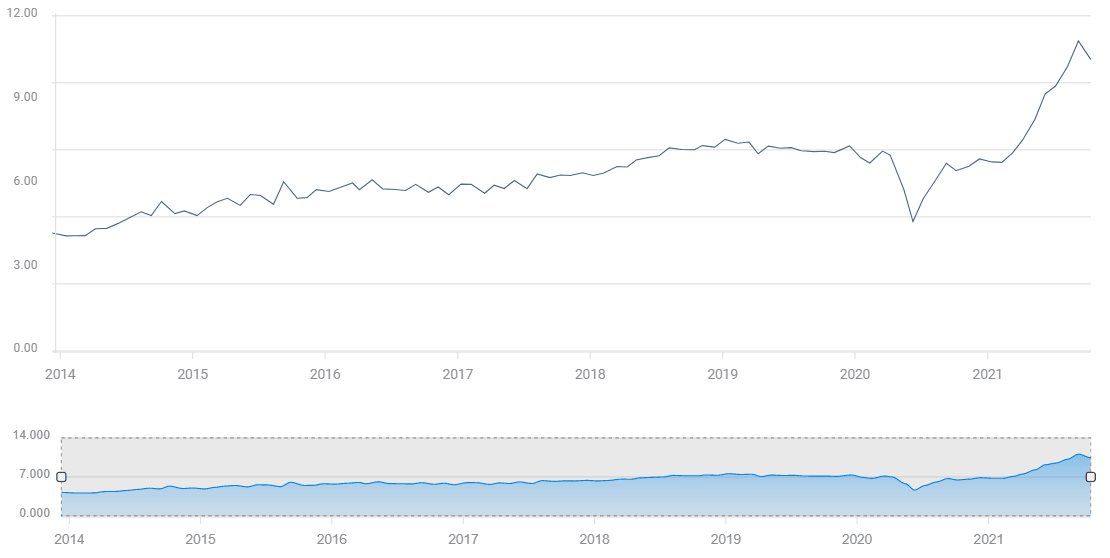

Even though there were 10.5 million open jobs in August, according to the Jobs Openings and Turnover Survey (JOLTS), and that is down from a record 11 million in July, workers remain pessimistic. Employers filled only 194,000 positions in September and 366,000 in August, far less than forecast and the one million average in June and July.

JOLTS

FXStreet

Worker diffidence has been blamed on the continuing pandemic, vaccination mandates, excessive unemployment benefits and a preference for flexible homework which may not register in official statistics and is probably a combination of several factors..

While the cause may be puzzling, the effect of the labor shortage is not. Employers in many fields have been forced to offer higher wages and in some cases signing bonuses, all inflationary, to find workers. Yet even this standard reaction to the labor shortage has not permitted wages to keep pace with inflation.

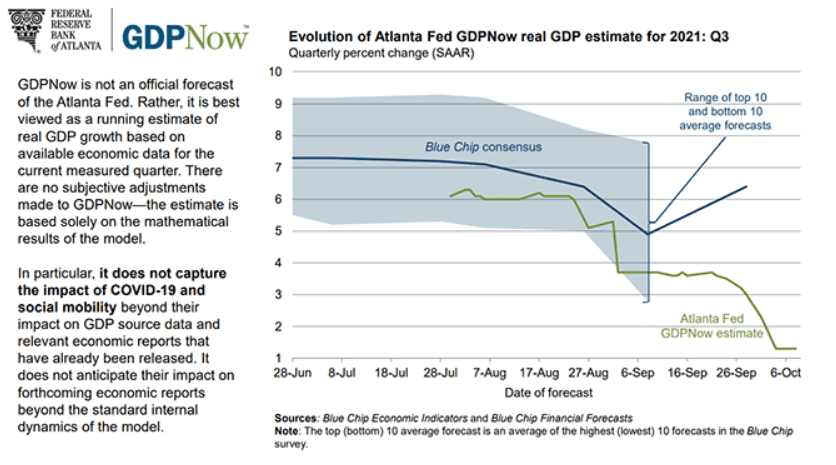

US GDP

The impact of labor and supply shortages on the US economy has been substantial. The Atlanta Fed’s GDPNow estimate for the third quarter has fallen steadily from over 6% in August to just 1.3%. The next revision is after Retail Sales on Friday October 15.

Conclusion: The state of the economy does matter to the Fed

Consumer sentiment usually provides an early insight into consumption. In the US economy the well-known 70% of GDP that is tied to consumer spending is the logic behind market attention. That connection did not pan out in August when the Michigan Index plunged to 70.3 from 81.2 but Retail Sales rebounded from a 1.1% loss in July and rose 0.7%.

The negative risk to consumption is the main economic connection for sentiment. If US consumers pull back on spending, weak GDP growth in the third quarter could easily turn negative. Retail Sales in September are forecast to fall 0.2%. The longer consumers remain depressed the greater the likelihood their angst carries over into spending.

Weak sentiment and perhaps ebbing consumer spending will not dissuade the Fed from beginning its bond reductions before the end of the year. The taper, however, is a flexible device. If consumers are unhappy, the rush to sell Treasuries, raising yields and the dollar will likely abate until optimism returns.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.