US Dollar Weekly Forecast: Demand for definitive tariff guidance grows

- The US Dollar Index tumbled to new two-month lows.

- The US tariffs narrative lost momentum as the Dollar’s support.

- Chair Jerome Powell said there is no rush to adjust policy further.

Another dreadful week for the US Dollar (USD) saw the currency slip back into the sub-107.00 region for the first time since mid-December, as measured by the US Dollar Index (DXY).

Indeed, the index retreated for the second week in a row amid the ongoing lack of clarity on the White House’s trade policies, while President Donald Trump’s back-and-forth on tariff announcements appears to have tested the market’s patience, all against a backdrop of growing skepticism.

Between inflation and tariffs: The Greenback’s balancing act

The ongoing turmoil over tariffs continues to weigh on the Greenback, thanks to the Trump administration’s unpredictable trade stance. Yet, Federal Reserve (Fed) Chair Powell’s recent reminder that the United States (US) economy is still “in a very good place” suggests it’s not all doom and gloom for the dollar.

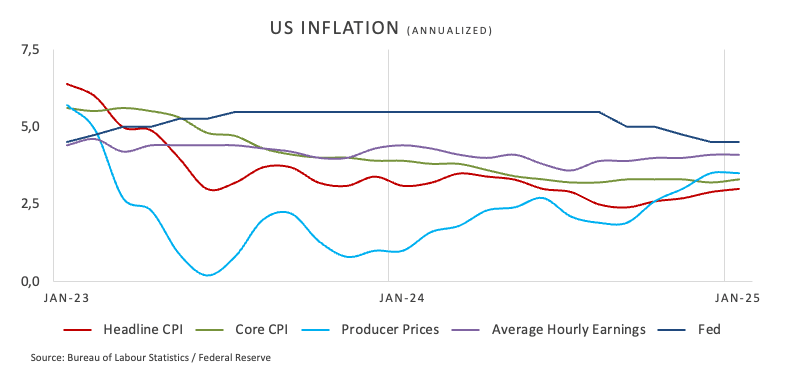

Even after fresh inflation data—reflected in stronger-than-expected Consumer Price Index (CPI) and Producer Price Index (PPI) readings—sparked a brief rally, the Greenback slipped back from its weekly highs, leaving the door open for more short-term downside.

Yes, higher inflation has investors revisiting the Fed’s possible policy moves, but the market’s gaze seems locked on any new trade-policy announcements from Washington—especially where tariffs are concerned.

Looking ahead, a sturdy labour market, persistent inflation, and generally robust economic activity should keep the Greenback on solid footing, fueling expectations for another upbeat year.

The Fed prefers to maintain its prudent stance

The Federal Reserve kept interest rates steady within the 4.25% to 4.50% target range at its January 29 meeting, marking a pause after three consecutive rate cuts in late 2024. While this decision signals confidence in the economy’s resilience, policymakers cautioned that inflation remains “somewhat elevated,” suggesting ongoing challenges.

In semiannual testimonies before Congress, Federal Reserve Chair Jerome Powell indicated that the central bank was in no hurry to cut interest rates, pointing to a strong economy, low unemployment, and inflation still above the 2% target. He was said to have warned that easing monetary policy too soon could hamper progress on inflation and reiterated that any future rate cuts would depend on economic conditions. Powell, meanwhile, declined to comment on the Trump administration’s tariffs but acknowledged continuing trade-related concerns.

Earlier in the week, Federal Reserve Bank of Cleveland President Beth Hammack reportedly mentioned that she did not expect the central bank to raise its interest rate target in the coming months. She noted that rate hikes were not part of her baseline forecast and anticipated that the current policy stance would remain in place for an extended period. Hammack also reportedly observed that it was still unclear how much of last year’s rate cuts had filtered through to the broader economy.

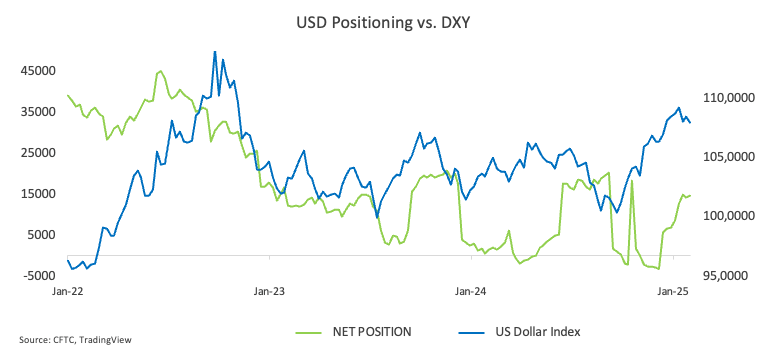

From the positioning front: Tread carefully

Non-commercial players, also known as speculators, have been adding to their USD-long positions since last November. According to the latest CFTC Positioning Report for the week ending February 4, net long positions have reached levels last seen in September 2024, around 14.5K contracts.

These crowded longs are expected to be more vulnerable to any negative news affecting the US Dollar, potentially triggering a rapid unwind and exacerbating any correction in the index.

However, open interest has declined over the past three weeks, which could ultimately limit the downside risk.

What’s next?

All eyes will be on next week’s US economic calendar, where the spotlight will shine on the release of the FOMC Minutes and the latest advanced PMIs. Meanwhile, traders and analysts alike will stay alert for any fresh commentary from Fed officials—not to mention the occasional curveball from President Trump—that could further shake up the debate.

DXY in focus: Momentum signals and critical levels

If sellers maintain control, the US Dollar Index (DXY) is likely to find its first line of defense at the 2025 bottom of 106.56 (February 14), followed by the December 2024 trough (105.42) and the all-important 200-day SMA at 104.89.

Staying above that moving average should keep the bullish narrative alive.

On the upside, sporadic bursts of buying could propel the index back toward its February 3 high at 109.88 and possibly even the January 13 peak at 110.17. A break above that threshold would open the door to the 2022 peak at 114.77, set on September 28.

Momentum signals send mixed signals: the daily Relative Strength Index (RSI) is declining to 35, hinting at budding downside potential, while the Average Directional Index (ADX), hovers around 15 points to weak trend strength overall.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.