Here is how to pick winning stocks to outperform in a bear market or market correction [Video]

Here is the exact blueprint you need to follow to pick the winning stocks and the next multibaggers in a bear market or market correction, with case studies on Lantheus Holdings (LNTH) and ServiceNow (NOW).

Focus on spotting the strength in the market structure when comparing to the S&P 500 (ES) as explained in the video below.

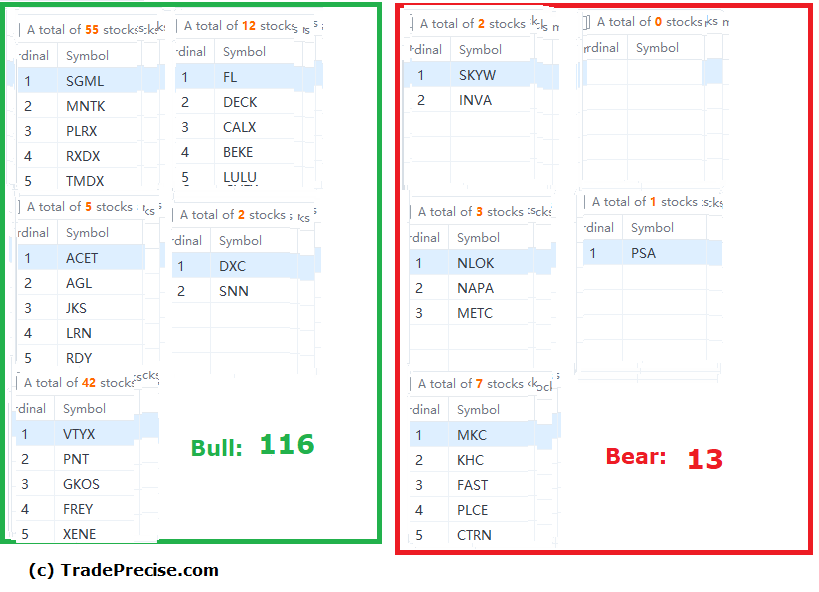

The bullish setup vs. the bearish setup is 116 to 13 from the screenshot of my stock screener below.

Picking the outperforming stocks in the strong sectors such as solar, lithium, renewable energy, Biotech and health tech, is the key to thrive in this volatile market. The sharp decline in the market breadth suggested challenging trading market environment.

So far, there are 25 stocks satisfy the criteria of the market leaders and the characteristics of accumulation structure as updated in the Weekly live session membership module.

The change of character bar triggered by the CPI data came with spike of supply, suggested more weakness ahead in S&P 500. The immediate support level at 3900 could be vulnerable. Nevertheless, the market bottom indicator as demonstrated by the breadth thrust is still a valid bullish scenario.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.