GBP/USD Forecast: Boom and bust on Boris' re-elections chances, and also watch the BOE

- GBP/USD has been advancing as the UK avoids Brexit, and election campaigning begins.

- Opinion poll and the BOE's decision stand out.

- Early November's daily chart is pointing to further gains for the pound.

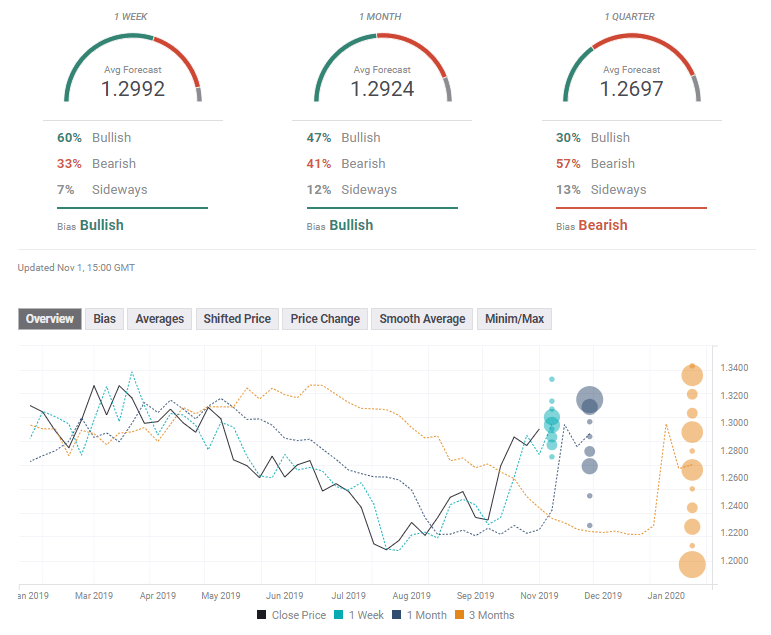

- The FX Poll is showing that experts are bullish in the short and medium terms but bearish in the long-term.

Prime Minister Boris Johnson has not died in a ditch – and he even leads the polls – after the October 31 deadline came and went. The focus turns to the December 12 elections with some impact reserved for the Bank of England's "Super Thursday."

This week in GBP/USD: Brexit out, elections in

The week's political drama was triggered by an announcement from the Liberal Democrats and the Scottish National Party (SNP). Both pro-Remain parties concluded that a second referendum on Brexit would be unachievable in the current parliament and laid down a motion for elections.

The move convinced France – that had held out on granting a three-month delay to the UK's exit – that Brits were indeed going to the polls. The EU then announced that an official postponement to January 31, 2020, providing some relief for markets, which feared a shorter extension.

Labour, the main opposition party, initially rejected a fresh campaign – officially due to the still existing chances of a hard Brexit – but more likely because of its poor numbers in opinion polls. However, leader Jeremy Corbyn eventually steered the party toward the polling booths. After a short battle on the exact date – December 12 received a thumping majority from parliament.

Boris Johnson wants elections to break the deadlock and promises to ratify his deal in the House of Commons if he wins. While his version of Brexit is hard – it provides certainty. Moreover, investors are allergic to Corbyn's hard-left economic policies.

Nigel Farage, head of the Brexit Party, aims to field candidates in all constituencies but left the door open to an alliance with the Conservatives. Most analysts think that withdrawing candidates will help Johnson win, but others say it may instead help Labour.

The US Federal Reserve has cut interest rates and signaled a pause, as expected. The dollar initially advanced as the Fed sounded optimistic, but then changed course. Jerome Powell, Chair of the Federal Reserve, indicated that the bar is high for reducing rates again – but even higher for hiking them. Only a sustained increase in inflation would cause the bank to consider raising rates. The greenback's drop propelled GBP/USD higher.

US data has been mixed, with Gross Domestic Product rising by 1.9% annualized in the third quarter – better than expected but slower than beforehand.

The US Non-Farm Payrolls report beat expectations with an increase of 128,000 jobs and upwards revisions worth 95,000 for previous months. The data allowed the greenback to recover.

On the trade front, President Donald Trump said that talks are "ahead of schedule" and Chinese officials have also expressed optimism in public. However, sources in Beijing have told the media that they are skeptical that a broad trade deal can be achieved with Trump. The US president is set to meet his Chinese counterpart Xi Jinping in mid-November, but the meeting is far from being confirmed.

UK events: Election polls, BOE decision

Opinion polls are toward the elections that are due out daily. So far, they have consisted of significant gaps, but all point to a Conservative lead. While a double-digit lead previously indicated a landslide victory, the fragmented nature of the British political landscape means uncertainty is high.

The Brexit party may chip away votes from the Conservatives. The pro-Remain camp is split between Labour and the Lib-Dems. Best of Britain, a pro-Remain outfit, is calling for tactical voting – but it is unclear how much its calls will be heeded.

Moreover, the projected gains for the SNP in Scotland may hurt the Conservatives. Last but not least, former PM Theresa May lost her majority despite a broad lead in the polls. Johnson may surely feel the same fate, especially as voters' primary identity is around Brexit, while their loyalty to parties has diminished.

All in all, polling may move the pound, but voters' opinions are prone to changes, and these surveys may be wrong and hard to translate into seat allocation in parliament.

Markit's forward-looking Purchasing Managers' Indexes (PMIs) kick off the week on the economic calendar with figures for the struggling construction sector and the comprehensive services one. After the Manufacturing PMI beat expectations – partly due to a dose of certainty around Brexit – a recovery in these figures may be seen as well. The Servies Services PMI is expected to rise to 50 – the level that separates expansion from contraction.

The Bank of England is set to leave interest rates unchanged in Mark Carney's penultimate decision as Governor. Recent economic figures have been mixed, with falling inflation but an upbeat labor market.

The bank publishes new forecasts in its Quarterly Inflation Report (QIR), and Carney will explain the findings and the BOE's assessment in the press conference that follows. He will likely avoid making a guess about Brexit in his last presser. Nevertheless, the new figures and comments about the global economy and its impact on the UK may impact the pound.

The BOE has been waiting for clarity around Brexit – and that will have to wait for Carney's successor. Speculation about the next governor may play a role in moving the pound.

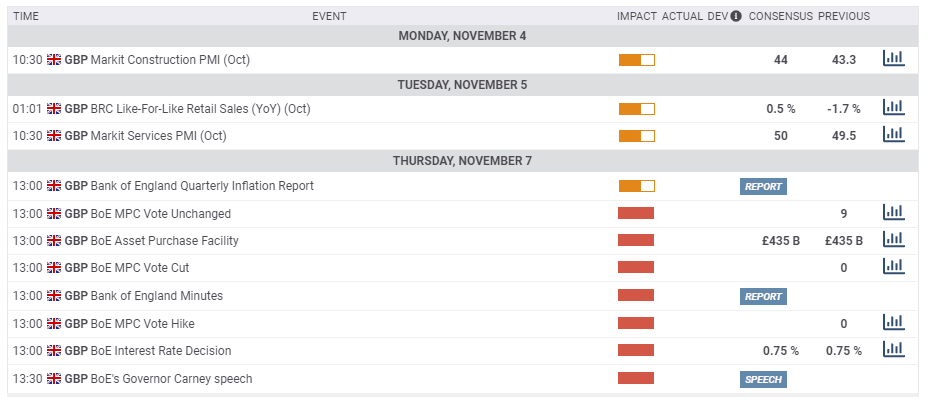

Here is the list of UK events from the FXStreet calendar:

US events: Services figures and trade stand out

The pace of US-Sino trade talks may pick up ahead of a potential summit between the presidents of both countries later this month. If Washington and Beijing announce an encounter, markets may rise, and the risk-on mood may benefit the pound against the safe-haven dollar. Concerns about a breakup in talks may trigger a downfall.

The economic calendar kicks off with manufacturing – the weaker side of the US economy. The main economic release is Tuesday's ISM Non-Manufacturing PMI. The services sector has been growing, albeit at a slower pace. The forward-looking figure tends to have a substantial impact on markets.

Another considerable forward-looking figure is the preliminary Consumer Sentiment Index from the University of Michigan for November. While the figure is off the highs near 100, upbeat confidence is set to continue and drive the economy forward.

Here are all the top US events on the economic calendar:

GBP/USD Technical Analysis

The Relative Strength Index on the daily chart is close to 70 – thus nearing overbought territory. This implies that is has limited toom to the upside before a break is needed. Momentum remains upbeat, and the currency pair trades above the 50, 100, and 200 Simple Moving Averages – a bullish picture, yet perhaps with a limited short-term scope.

Resistance awaits at 1.2980, which capped GBP/USD in late October. It is followed by 1.3013, which is the five-month high seen several weeks ago. The next lines date to early in the year, and these include 1.3035, 1.3080, and 1.3145.

Support awaits at 1.2865, which worked as support in the spring and also recently. Next, 1.2785 was a swing low in mid-October and a peak in June. It is followed by 1.2705, which was a swing high in early October and converged with the 200 SMA. Next, we find 1.2580 and 1.2500.

GBP/USD Sentiment

For the pound, it is hard to tell how opinion polls will sway the mood, and only high volatility can be predicted with some caution. The US Dollar may extend its recovery after the NFP.

The FX Poll is showing that experts are upbeat and see GBP/USD holding up its high levels in the short and medium terms. However, they foresee a drop afterward. Do they suspect that the December elections will be messy? Targets have been upgraded in the short and medium terms but unchanged in the long-term.

Related Forecasts

- USD/JPY Forecast: Can the dollar recover from the Fed? Trade talks hold the key

- EUR/USD Forecast: Market needs to finishing digesting Fed’s hit

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637082044664183919.png&w=1536&q=95)