USD/JPY Forecast: Can the dollar recover from the Fed? Trade talks hold the key

- USD/JPY has failed to break higher after the Fed and mixed data.

- The US services sector and US-Sino relations stand out in the first full week of November.

- Early November's daily chart is painting a mixed picture.

- The FX Poll is pointing to further losses for USD/JPY in all timeframes.

The Federal Reserve's hawkish cut has almost sent USD/JPY to six-month highs – until a late twist and trade uncertainty sent it lower. US-Sino talks and data from the stronger parts of the US economy are set to dominate trading now.

This week in USD/JPY: Up and quickly down

Fed Chair Jerome Powell's late dovish twist has sent the dollar down in a dramatic decision. The world's most powerful central bank cut interest rates for the third time in a row, as expected, and signaled a pause. Instead of pledging to "act as appropriate," the Fed now says monetary policy is in the right place. Moreover, the Washington-based institution is pleased with the state of the US economy.

But while Powell said that it would take a "material reassessment" to cut rates again, the bar for hiking is higher. The Fed would first want to see inflation rising and would only then raise rates. That asymmetry reversed the dollar's gains and sent USD/JPY back below 109.

The Fed decision came hours after US Gross Domestic Product beat estimates with a growth rate of 1.9% annualized in the third quarter. The first estimate for the period ending in September also revealed that the US consumer continues carrying the economy forward, while manufacturing and investment remain a drag.

Friday's figures triggered a whipsaw in the dollar. Non-Farm Payrolls beat expectations with an increase of 128,000. The revisions to previous figures were even more impressive – 95,000. Annual wage growth rose to 3% and other figures were within expectations.

USD/JPY advanced on the news, but then dropped in response to the disappointing ISM Manufacturing Purchasing Managers' Index. The forward-looking indicator remained below 50 – indicating a contraction in the sector.

Similar to the Fed, US-Sino trade news has seen several twists. President Donald Trump said that talks were going well and were "ahead of schedule," and a summit with his Chinese counterpart remained on the cards. Chile's cancelation of the APEC conference does not impede a meeting between the leaders.

On the other hand, China has reportedly cast doubt about reaching a full trade deal with the US under Trump. Moreover, Beijing has refused to budge on structural issues – thus impeding a broad accord. The safe-haven yen gained ground in response to these downbeat reports.

The Bank of Japan left interest rates unchanged as expected, but abandoned the time limit related to its promise to keep rates at low levels. Investors shrugged off the BOJ's dovish tilt, as inflation remains below 1% according to the latest data for October from the Tokyo region. BOJ Governor Haruhiko Kuroda expressed concern about the global economy in his press conference.

In the Brexit front, the EU granted the UK a three-month Brexit extension to January 31, 2020. The UK parliament approved early elections on December 12, in an attempt to unlock the Brexit deadlock. The removal of an imminent no-deal Brexit has been greeted by markets and provided some support to USD/JPY.

US events: Updates on the economy's strengths

The pace of negotiations between the world's largest economies may ramp up as they aim to conclude Phase One of talks by November 17. Tweets by Trump and by Hu Xijin – the influential editor of the Chinese Global Times – tend to surprise markets. Confirmation of a meeting between Xi and Trump may raise USD/JPY, while downbeat reports may push it down.

Apart from the ongoing talks, there are several figures of interest.

Will consumption pull the industry higher, or will pessimism hit retail sales? The central bank remains optimistic, and further data may provide some clues to the economy's direction. The week kicks off with the weaker side of the economy. Factory Orders are expected to show another monthly drop.

Markit's final Purchasing Managers' Indexes are of interest but probably only serve as a warm-up toward the all-important ISM Non-Manufacturing PMI. This important gauge of the services sector – America's largest – has been slowing down but remained upbeat – above 50 points. A minor increase is on the cards.

Wednesday's productivity and labor costs figures are also of interest. The final word of the week belongs to the University of Michigan's preliminary Consumer Sentiment Index for November. The early indicator is set to drop from previous levels but to remain upbeat. As previously mentioned, consumption has led the economy higher, and any sign of weakness may scare markets.

Here are the top US events as they appear on the forex calendar:

Japan: Trade, North Korea, and the BOJ minutes

The Japanese Yen remains the safe-haven currency of choice, and any jitters in trade talks may boost the currency. Another source of worry is North Korea's military experiments. While the topic has had little impact on markets, an escalation may occur at any moment.

The minutes from the previous BOJ decision stand out on the Japanese calendar. The document may reveal splits within the Tokyo-based institution about the next moves. The bank is unsure if the negative interest rate pushes inflation higher or only hurts banks.

Overall Household Spending is also of interest, as the increase in the sales tax may have triggered changes in consumption.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

USD/JPY has failed to break above the all-important 200-day Simple Moving Average – and also above the critical peak of 109.35 recorded in August. The rejection is a bearish sign. The currency pair is challenging the uptrend support line that has accompanied it since late August. Momentum remains positive, but it may be insufficient for holding up.

All in all, the picture is mixed.

Support awaits at 107.50, which worked as support in July and is also the confluence of the 50 and 100 SMAs. The round number of 107 worked as support in mid-September. It is followed by a swing low of 106.50, seen in early October. Lower, we find 105.75 and 105.05.

Resistance awaits at 108.50, which was a double top several weeks ago. Next, we find 109, which capped USD/JPY on its way up, and 109.35, which has become a more substantial level to watch. The next lines are 109.95, 110.65, and 111.05.

USD/JPY Sentiment

USD/JPY may now become more sensitive to trade talks and may continue struggling if the US and China settle for a limited deal.

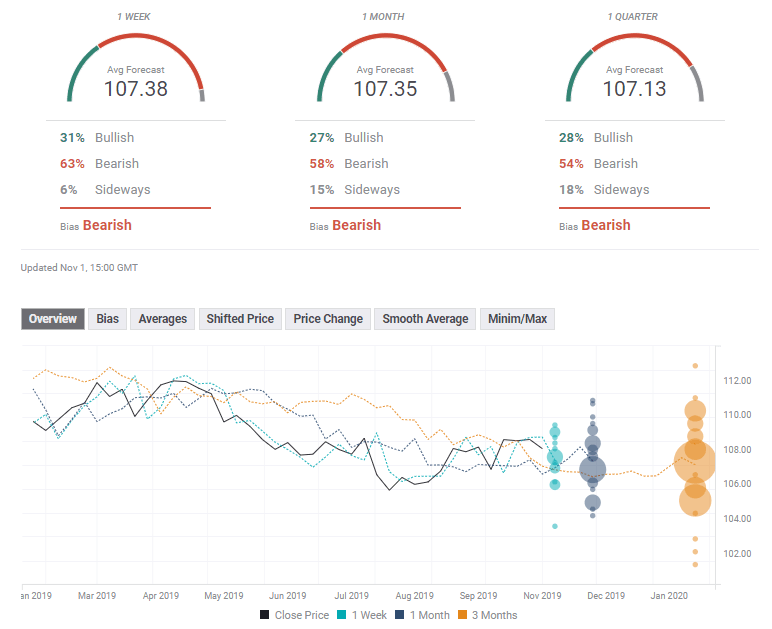

The FX Poll is showing that experts are bullish for all timeframes with similar targets in the 107 handle. The goals for all periods have been downgraded.

Related Forecasts

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637081355598390158.png&w=1536&q=95)