EUR/USD Weekly Forecast: US Federal Reserve’s and European Central Bank’s last shots

- The United States Federal Reserve may have a last ace under its sleeve.

- The European Central Bank may surprise with a hawkish decision.

- EUR/USD is bullish in the long term, but central banks could break technicals.

A quiet week ends with the EUR having extended its rally against the US Dollar to a six-month high of 1.0594, holding nearby ahead of the weekly close. EUR/USD trades around the 1.0540 level as market players gear up for the US Federal Reserve (Fed) and the European Central Bank (ECB) monetary policy decisions.

Federal Reserve’s quantitative tightening

Against what investors have experienced for most of the year, uncertainty rules ahead of the announcements. On the one hand, the US Federal Reserve suggested it will slow the pace of tightening and is expected to deliver a 50 basis points (bps) rate hike, despite the latest macroeconomic figures enabling one more 75 bps move. On the other, European policymakers hinted at a potential 75 bps hike, but the most likely scenario is a more conservative 50 bps one.

The EUR/USD pair bottomed at an over-twenty-year low of 0.9535 at the end of September, changing course on the back of hopes central banks will take more conservative stances on quantitative tightening. The Reserve Bank of Australia (RBA) threw the first stone, hiking by a modest 25 bps in its early October meeting, while the Bank of Canada (BoC) followed at the end of the same month.

Their actions fueled speculation the Fed would follow suit, which was later confirmed by Chairman of the Fed Jerome Powell. Speaking at the Hutchins Center last week, Powell hinted slowing tightening could come as soon as next December, although he warned monetary policy is likely to stay restrictive for some time until real signs of progress emerge on inflation. But will the Fed take a cautious approach next week? Market players are not sure.

A United State recession is around the corner

Concerns about a global recession have also taken their toll on financial markets. Most major stock indexes closed the week in the red, with limited losses, but still reflecting investors' doubts on what’s coming up next. Central banks’ announcements next week may shed some light, but would likely fall short of reversing recession-related fears.

Meanwhile, United States government bond yields stay depressed, adding weight to the American Dollar. The yield on the 10-year Treasury note bottomed this week at 3.40% after reaching a multi-year peak of 4.22%. Nevertheless, the yield-curve inversion widened the most since 1980, as the 2-year Treasury note yield surged beyond 4.4% mid-week. An inverted curve is seen as an early sign of an upcoming recession.

Europe's tug of war with Russia

Across the pond, European Commission President Ursula von der Leyen proposed the ninth package of sanctions against Russia after agreeing with G-7 partners to introduce a price cap on Russian oil earlier this month at $60 a barrel. Additionally, new Türkish insurance rules governing oil tankers coming from Russia have caused bottlenecks between the Black Sea and the Mediterranean. Crude Oil prices edged lower in the past week, pulling off some pressure on European energy costs. Still, Moscow has anticipated it is preparing a response to the latest sanctions, and prices could bounce back, fueling inflationary pressure in the Euro Area.

Central banks and more

Data-wise, there have been some encouraging signs from the United States. The November ISM Services PMI improved to 56.5 against an expected setback to 54.4. October Factory Orders rose by 1%, while the Goods and Services Trade Balance posted a deficit of $78.2 billion, beating the market’s expectations. Finally, wholesale inflation eased in November, as the Producer Price Index (PPI) rose at an annual pace of 7.4%, as expected. The core reading eased from 6.7% to 6.2%, slightly higher than the 6% expected.

The Euro Area delivered mixed signs. S&P Global downwardly revised the November PMIs, indicating a steeper economic contraction. Retail Sales in October were down by 1.8% MoM and declined by 2.7% YoY. On a positive note, growth in the three months to September was up by 0.3%, according to the Gross Domestic Product Q3 estimate, slightly better than the 0.2% expected.

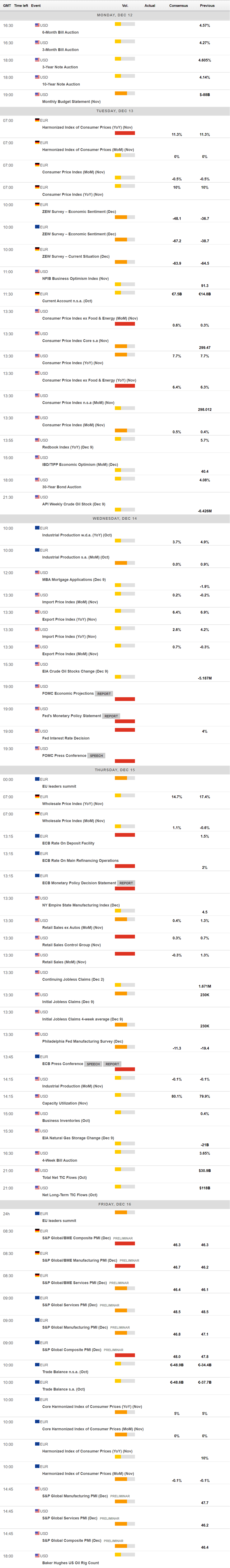

Beyond central banks’ announcements, the upcoming week will also bring the German Harmonized Index of Consumer Prices (HICP), foreseen in November at 11.3% YoY, and the United States Consumer Price Index for the same month, expected at 7.7% YoY. The US will later unveil November Retail Sales, while the EU will publish its November inflation figures.

EUR/USD technical outlook

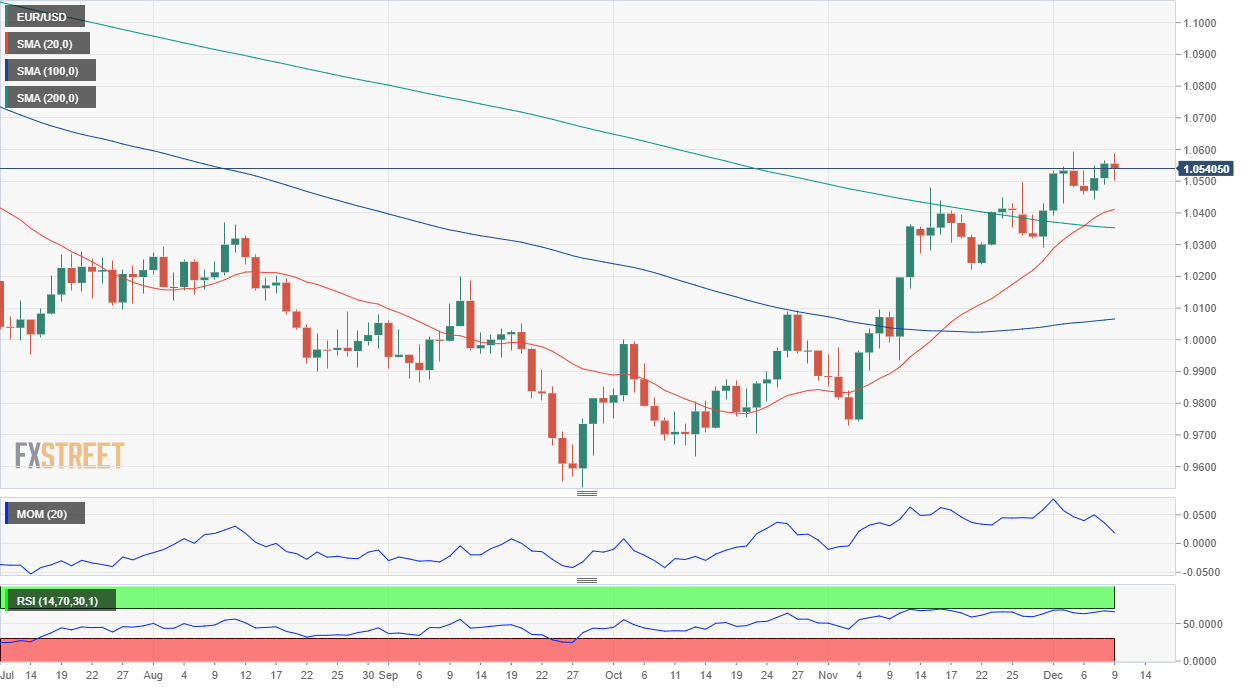

The EUR/USD pair weekly chart shows that the pair posted a higher high and a higher low, maintaining the risk skewed to the upside. The same chart shows that the 20 Simple Moving Average (SMA) advances far below the current level, at around 1.0080, while technical indicators consolidate near overbought readings, all of which favors a bullish continuation. Finally, the 100 SMA is crossing below the 200 SMA, both far above the current level, losing relevance as a bearish signal.

The daily chart shows that EUR/USD spent the week above all of its moving averages, with the 20 SMA partially losing its bullish strength, but still heading higher above the longer ones. The Momentum indicator aims north well into positive territory, and after bouncing from its midline, reflecting strong buying interest defending the downside. Finally, the Relative Strength Index (RSI) has spent the week consolidating just ahead of overbought readings, still directionless at around 65.

EUR/USD needs to break above 1.0580 to be able to extend its gains towards 1.0620 first, and 1.0700 later. A break above the latter should bring the 1.1000 figure to the table. Buyers stand at around 1.0490, while the next support level is 1.0420. An unlikely slide below the latter could favor a downward extension towards 1.0300.

EUR/USD sentiment poll

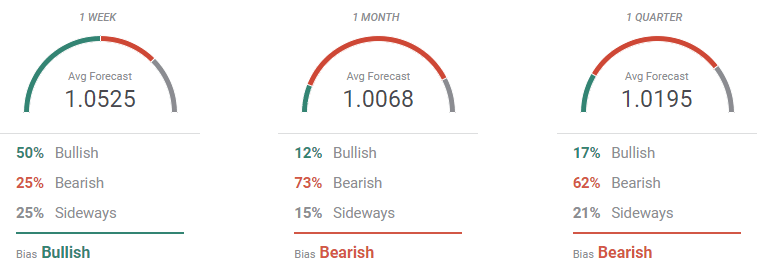

The FXStreet Forecast Poll hints at more gains in the docket in the near term. 50% of the polled experts are beating for higher levels, while 25% expect some consolidation ahead. The pair is seen on average at around 1.0525, with an even spread of potential targets above the 1.0400 mark. The longer-term views are showing that bearish banks still weigh on the average, but the pair is now expected to remain above parity, as more experts bet for higher highs ahead.

According to the Overview chart, the shorter moving average lacks directional strength but remains at a multi-month high. The longer ones picked up, heading firmly north and reaching fresh multi-week tops. What seems more relevant is that the number of bets above 1.0500 continues to increase, while those below parity retreat. As time goes by, higher highs and higher lows are seen in the pair, a notorious, but late, signal of a shifting sentiment.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.