Dollar at the wheel and EUR/USD feels the pressure

The U.S. dollar extended gains, shifting very short-term momentum back in its favor.

At the same time, EURUSD broke below the important technical support and reached an area where sellers may start losing control. This puts both markets at an inflection point, where the next few sessions should clarify direction.

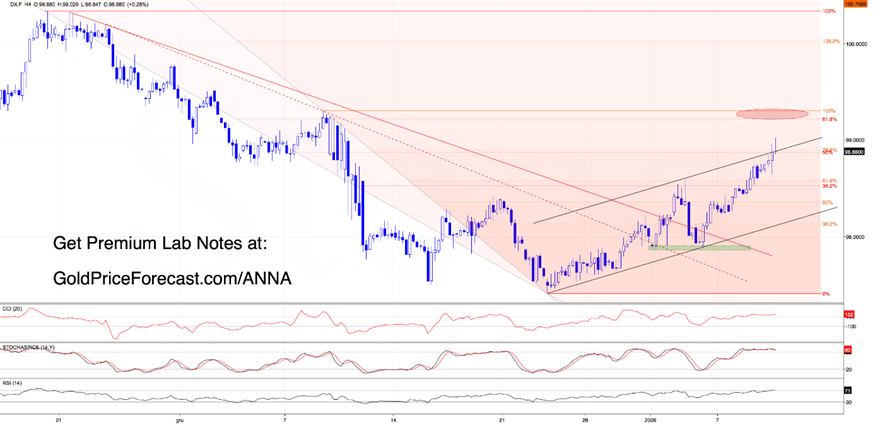

USD Index (DX.F) - Strength meets resistance

Let’s start with the dollar. As discussed in the Lab Note #61, the USD broke above the first resistance zone, opening the door toward the next resistance area created by the upper border of the rising black channel, the 50% retracement of the entire decline that started in late November, and the 78.6% retracement of the full December drop.

So far, bulls have tried twice to push through this zone, and twice sellers stepped in, especially around the 99.00 area, keeping the price capped.

At the same time, momentum indicators have moved into overbought territory, increasing the risk of sell signals appearing soon. When overbought conditions align with strong resistance, it often warns that a short-term reversal and pullback may be close.

If sellers regain control and close the day under the upper line of the channel, their first downside target will likely be the previously broken area around 98.53. A clean break below that level could expose 98.26, and potentially even a move toward the lower border of the mentioned channel.

In short: the dollar is getting stronger but reached into a zone where bulls need to prove they still have fuel.

EUR/USD - Pressure builds, but exhaustion is showing

In Lab Note #57, we wrote the following:

“(…) BUT (a word of caution) … daily indicators are already flashing:

- bearish divergence

- sell signals

So, while momentum isn’t dead - risk is rising.

Therefore, if EUR/USD closes the day back below the orange consolidation, sellers will likely go hunting again.

Their first mission?

Re-test bulls’ determination to defend the black rising channel.”

From today’s perspective, we see that scenario played out and bears not only pushed price back to the channel boundary, but they successfully closed the day below it, triggering follow-through selling.

Additionally, the subsequent breakdown verification attracted even more bears, driving EURUSD into the 50% Fibonacci retracement and a green support zone built on early-December lows.

At the same time, momentum indicators have now dropped into oversold territory, which combined with the dollar stalling near resistance, creates conditions where a countermove or short-term reversal becomes increasingly likely.

IF bulls step in, their first upside target would likely be the previously broken upper line of the black channel - currently around 1.1732.

This doesn’t mean a very short-term trend change yet, but it does suggest that downside momentum may be losing steam.

Lab takeaway - What to do right now

USD: strength remains intact, but price is now pressing into a heavy resistance zone. Chasing longs here carries increasing risk - watch for either a clean breakout or a confirmed rejection.

EURUSD: bears are still in control structurally, but oversold conditions and USD resistance suggest a pause or bounce is possible.

Action plan: this is a wait-for-confirmation environment. Let the price show its hand before committing - reactions around resistance (USD) and support (EURUSD) will set the tone for early next week.

Stay sharp, stay tactical, and have a wonderful weekend!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Anna Radomska

Sunshine Profits

Anna's passion for drawing evolved into a fascination with colorful lines and shapes, which later inspired her interest in the stock market.