Is Venezuela about Crude Oil, or Yield Curve control and affordability?

On the surface, the US economy appears robust. The employment rate is below 5%, the stock market is near all-time highs, and home prices have doubled in the last decade. Yet, under the surface, the majority of Americans are suffering from an affordability crisis; stubborn inflation and high interest rates are a challenging environment for those who weren’t fortunate enough to be asset owners (stocks, real estate, metals, etc.). This dual economy, in which the rich get richer and the poor get poorer, has been on the radar of politicians for years, but it is now in the crosshairs and under heavy fire.

The US has declared war on affordability, and regardless of what we think about the legality or morality of the methods, there is a chance of results desirable to the majority, and there could be profound impacts on financial and commodity markets.

The White House is not only thinking outside the box; they have completely destroyed the box. The events that occurred in Venezuela over the weekend can, and should, be scrutinized and questioned. But from a financial market standpoint, we might someday look back on this as a critical turning point. The jury is still out on whether the intended consequences occur or if unintended consequences leave us in dire straits, but if the mission succeeds, we could see a chain of events that paves the road for a more balanced economy with less concentration of prosperity. After all, lower oil prices and a higher dollar, a primary goal of the Venezuelan experiment, would right a lot of wrongs when it comes to affordability. If this works, it will be fun to watch.

Is Crude Oil the key to lower inflation?

The President believes lower energy prices are the magic wand to fix our inflation problem. The theory is that crude oil, natural gas, gasoline, and heating oil are primary inputs to most goods and services; if they are cheaper, the related goods and services should also deflate. According to my AI search (which shouldn’t be considered completely accurate but likely gives us a good idea), in a pre-COVID supply chain fiasco world, the CPI is positively correlated with oil at about 27%, but it is tied to the PPI at about 70%! So, we can assume lower energy would generally be disinflationary.

Can we assume the actions taken in DC will actually lead to lower energy prices? No. There is a lot that can go wrong, which could have the opposite effect. Oil is a complicated market with big stakes; there will always be two-sided volatility, much of it irrational. Yet, in the distant future, assuming things go smoothly, we might look back at this event the way we see fracking. Fracking changed the landscape of the global oil market by shifting pricing power away from OPEC and giving the US a stronger cushion against political turmoil. Eventual access to Venezuelan oil could have the same impact. Yet, even game-changing events don't remove the crude from crude oil. We will likely see lower highs on the next cycle, but those highs could be above $100; in the meantime, we will be looking for capitulation selling into the low $40.00s, or even under $20.00 if things get out of hand as they have in previous bear markets.

Lower energy prices might not be a silver bullet, but it is a start. However, we believe the narrative that crude oil is the endgame in Venezuela misses the big picture. Crude oil is just a tool to potentially influence other aspects of the economy. Let’s look at the dollar and interest rates.

Or is the US Dollar steering the ship?

In an overly simplistic view, a lower dollar allows asset prices to appreciate more than they otherwise might have. This is because many goods and services traded around the world, such as crude oil, are traded in US dollars. Further, as the dollar depreciates against other fiat currencies or even against itself, the number of dollars needed to purchase goods and services increases (inflation).

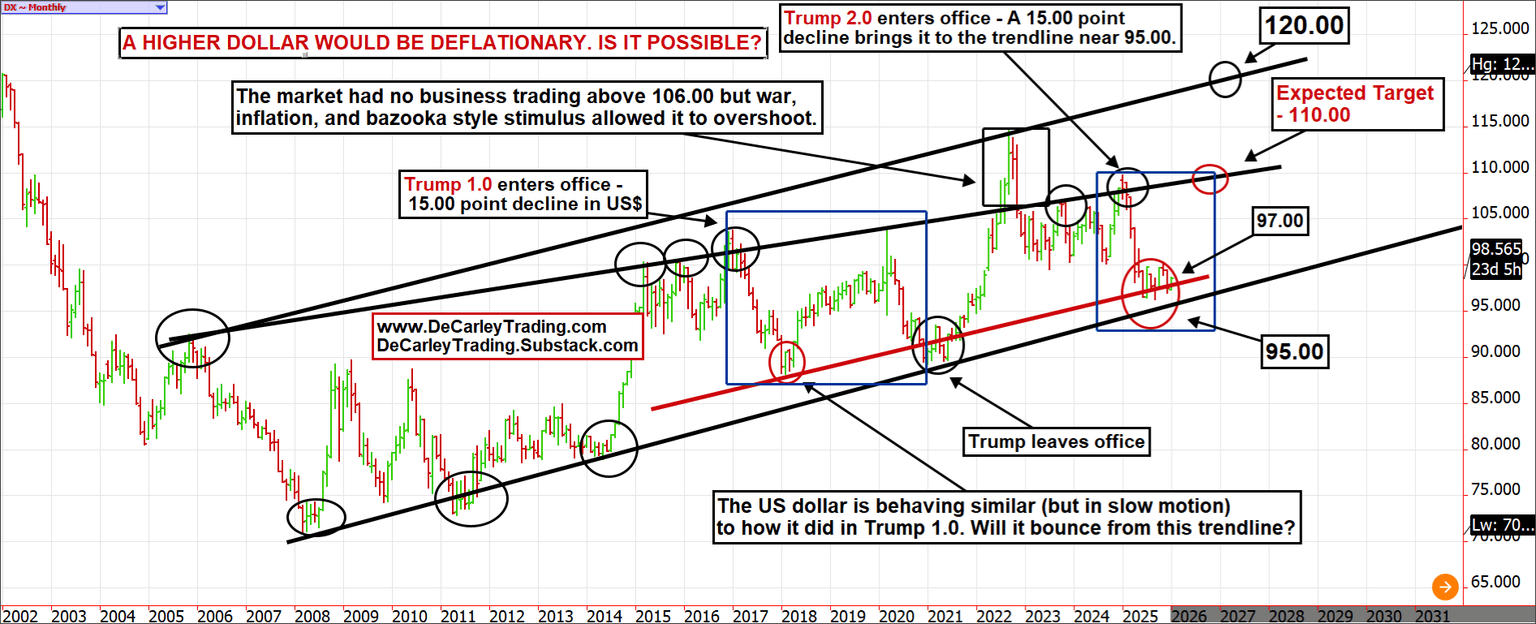

The “debasement trade” has become a topic du jour; this is the premise that the US dollar, and even fiat currencies as a whole, lose value over time. Accordingly, some market participants have allocated funds to stocks, precious metals, cryptocurrencies, and real estate to avoid a decline in buying power. If, and it is an if, the US dollar index, which pairs the dollar against a basket of global currencies, finds a way to rally off trendline support, the narrative could change quite quickly. This alone could thwart rising asset prices and pressure commodities, which in turn would work against inflation.

The dollar index is behaving similarly to the first time Trump was in office, but with an obvious delay. During Trump 1.0, the dollar collapsed as he took office, trading near 90.00; it later rallied to the top of its historical trading range. This time, support lies between 97.00 and 95.00. If the dollar fails to hold these levels, we may see a massive repricing across currencies and assets in line with current trends. But if the dollar appreciates from support, it will repeat the trading channel pattern and flip the current narrative on its head. Perhaps recent events in Venezuela were intended to support the dollar in the global marketplace. After all, prior to this week, Venezuelan oil was traded on the black market in currencies other than the greenback. It will now be traded in petrodollars, sending a warning shot to BRIC nations conspiring to move away from dollar dominance.

The weekly chart confirms support via an alternative trend line near 96.00. We don’t know how this plays out, but whatever happens will be monumental in the coming year, or even decades. That said, markets generally don’t behave as most expect them to. According to the Consensus Bullish Sentiment Index, only 36% of industry insiders polled are bullish on the dollar. This leaves plenty of room for a change of heart. Furthermore, the seasonal low in the dollar is often in early January.

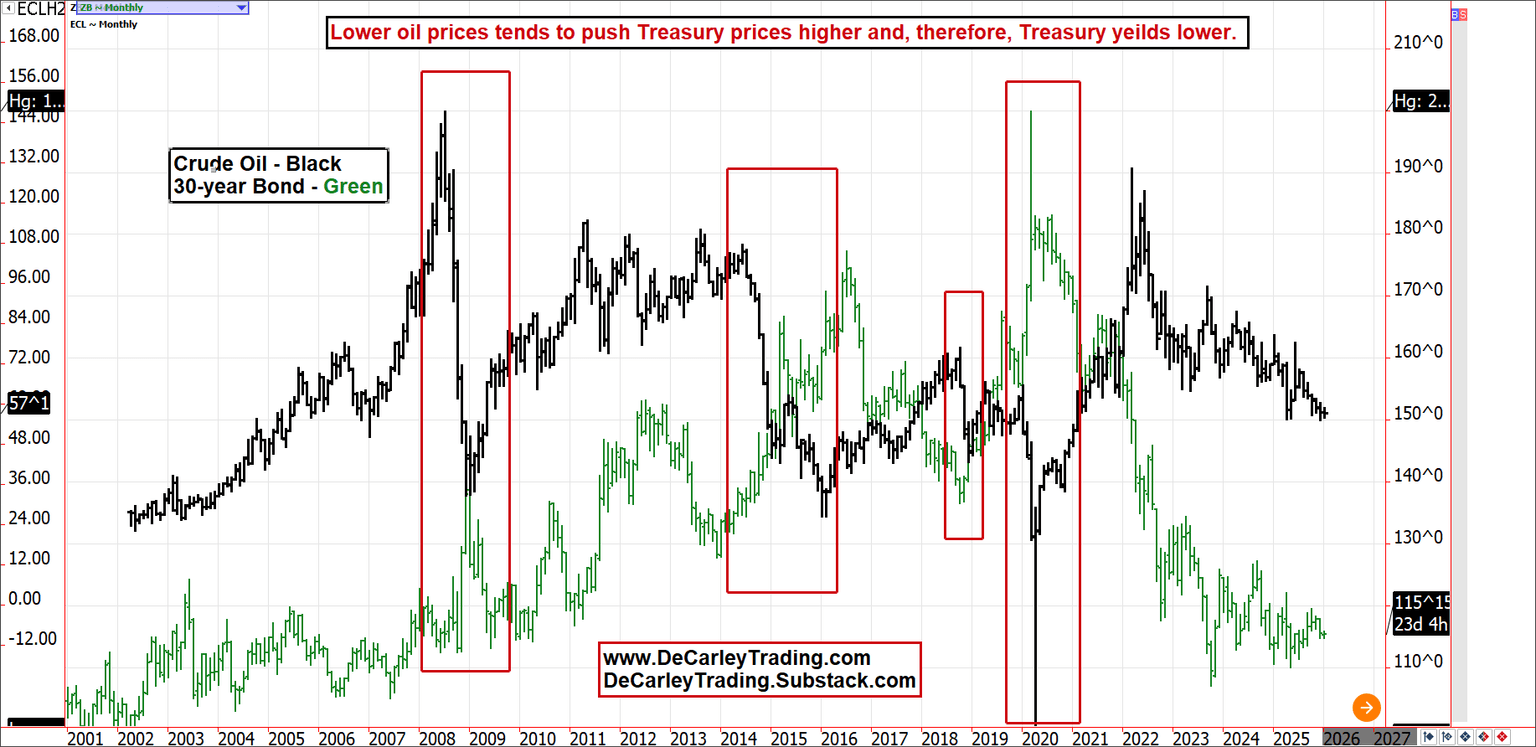

If lower Oil equates to lower inflation, interest rates should fall

While the Fed controls interest rates at the short end of the curve, it is market forces that include speculation, fear, greed, and everything in between that control the long end of the curve. Yet, a large piece of the puzzle is inflation. If inflation is lower, Treasury yields are more attractive. With the 30-year bond near 5% and the 10-year note near 4%, a thawing of the inflation narrative could lure investors into those products, which, in turn, would lower borrowing costs for businesses and consumers. This, too, aids deflation and might help to narrow the gap between the two economic realities; wealthy people earn interest while others pay it.

Throughout the last quarter of a century, there has been a negative relationship between crude oil and Treasuries. When crude oil sells off, Treasuries rally, driving interest rates lower. We can argue over which is the dog and which is the tail, but it is hard to argue that this is not a simple truth. With the Fed Chair change not due until May and the question of whether short-term rate changes would affect long-term rates, those in charge are probably looking for ways to influence the yield curve through unconventional means. Lower oil prices would check all the boxes.

We are witnessing a high-stakes experiment with an uncertain outcome. Further, the enormity of the implications won’t be known for years. Nevertheless, the US has dropped the MOAB (Mother of all Bombs) in its war on affordability by attempting to shift the pricing power of oil away from OPEC and the pricing power of the dollar away from BRICS. If the mission succeeds, it supports the dollar in its time of need and ultimately drives yields lower (a higher dollar generally pressures commodity prices such as oil). If it works, the affordability crisis will be a thing of the past. If it fails, we might have just added gas to the fire.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.