EUR/USD Price Forecast: US Dollar resumes slide on tariffs woes

EUR/USD Current price: 1.0820

- US President Donald Trump's announcements on tariffs weigh on the market’s mood.

- US Consumer Confidence is expected to have shrunk further in March.

- EUR/USD recovered from a lower low, struggling for directional strength.

the

The EUR/USD pair trades with a soft tone for the fifth consecutive day, extending its slide to 1.0776, the lowest since March 6. However, broad US Dollar (USD) weakness mid-European session sent the pair into positive territory.

On the one hand, tepid European data limited the Euro (EUR) advance. Germany released the March IFO Business Climate Index, which rose to 86.7 from 85.3 in February, although it missed the 86.8 expected. Additionally, the Current Economic Assessment Index improved to 85.7 from 85 in February, while Expectations rose to 87.7 in the month, against the 85.6 previous, both beating the market’s forecast.

On the other hand, headlines indicate that United States (US) President Donald Trump is planning to adopt a two-step approach as his tariff strategy. The news came after Trump threatened to impose 25% tariffs on countries purchasing oil and gas from Venezuela, on Monday. As a result, the USD came under renewed selling pressure amid concerns that tariffs will have on economic progress and future interest rate movements.

The US session will bring a slew of Federal Reserve (Fed) speakers, and March CB Consumer Confidence foreseen at 94.2, easing from the 98.3 posted in February. The US will also release February New Home Sales and the March Richmond Fed Manufacturing Index.

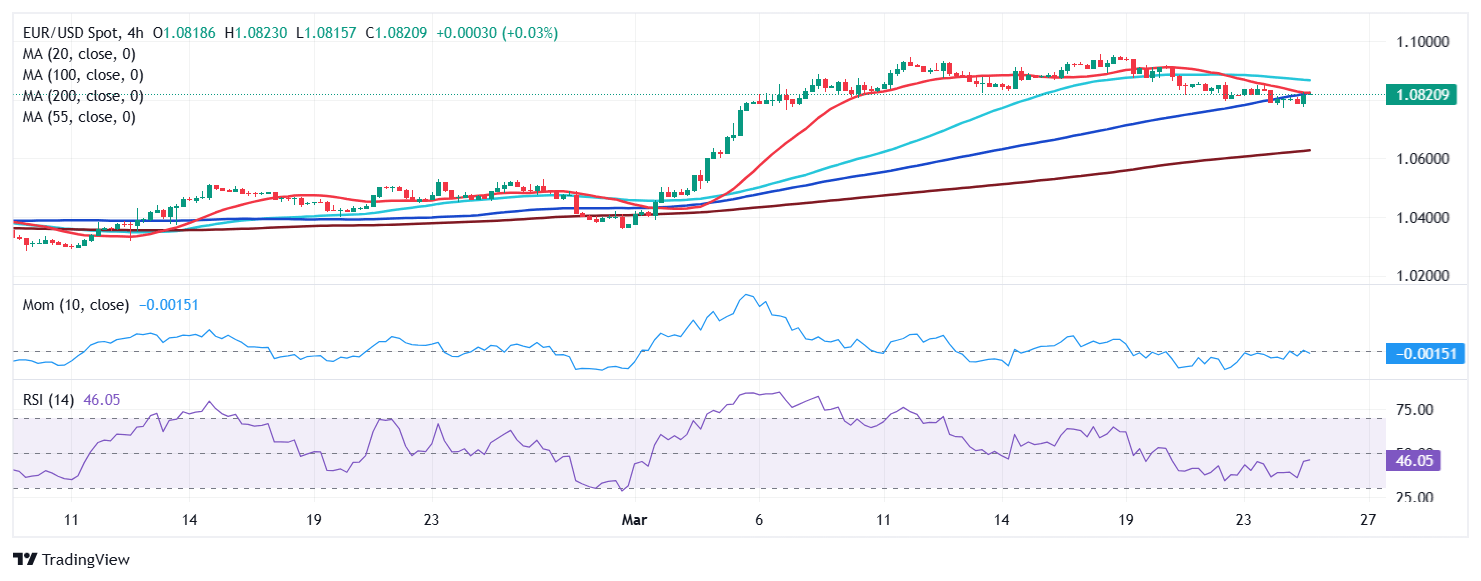

EUR/USD short-term technical outlook

From a technical point of view, the daily chart for the EUR/USD pair shows the pair holds on to most of its intraday gains, while at the same time, it posted a lower low and a lower high. EUR/USD keeps developing above a bullish 20 Simple Moving Average (SMA) which advances above directionless 100 and 200 SMAs, which limits the bearish potential. The Relative Strength Index (RSI) indicator is flat at around 59, also limiting the downside, while the Momentum indicator maintains its bearish slope just above its 100 line, reflecting persistent selling pressure.

In the near term, and according to the 4-hour chart, the bearish potential seems limited, although additional gains are still out of the picture. The EUR/USD pair is finding buyers around a bullish 100 SMA, but is unable to advance beyond a bearish 20 SMA. Finally, technical indicators aim higher, but remain within negative levels.

Support levels: 1.0785 1.0745 1.0710

Resistance levels: 10830 1.0860 1.0905

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.