EUR/USD Price Forecast: Trump’s trade war crosses the Atlantic

EUR/USD Current price: 1.0893

- The US Consumer Price Index eased by more than anticipated in February.

- Trade war tensions continue as US President Trump threatens more tariffs.

- EUR/USD battles around 1.0900, risk skews to the upside.

The EUR/USD pair eased from fresh 2025 highs and traded around 1.0900 ahead of Wall Street’s opening, retreating from a late Tuesday peak at 1.0947 by fresh trade war headlines. The US Dollar (USD) was affected by fresh trade war headlines as United States (US) President Donald Trump announced he would double tariffs on Canadian steel and aluminium, pushing them up to 50% starting Wednesday.

The announcement came after Canada unveiled plans to impose a 25% levy on electricity exports to the US and even threatened to shut down energy provision to the neighbour country, should the levies’ plan continue. Trump finally backed off and so did Canada, with representatives from both countries announcing more talks in the coming days.

Yet, the trade war crossed the Atlantic. The European Commission released a statement announcing counter-tariffs to Trump’s 25% duties on steel and aluminium. The European Union (EU) will levy US industrial and agricultural products starting on April 1, worth $28 billion. European Commission President Ursula von der Leyen noted that the bloc “will always remain open to negotiation” following the counter-measures announcement.

Tuesday’s tensions resulted in Wall Street closing in the red, while the dismal mood extended into Asian trading. Calm returned to financial markets after the London opening and most European indexes traded in the green.

Meanwhile a certain dose of caution kept markets at familiar levels, as speculative interest was waiting for the release of the US Consumer Price Index (CPI). Inflation in the US, as measured by the CPI, was up 0.2% MoM in February, while the annual figure printed at 2.8%. Finally, core annual inflation rose 3.1%, with all figures coming below expected. As a result, the USD ticked lower, with markets struggling for direction early in the American session.

EUR/USD short-term technical outlook

The daily chart for the EUR/USD pair shows the pair could extend its corrective decline, given overbought conditions. Technical indicators are retreating but still within extreme levels. At the same time, a firmly bullish 20 Simple Moving Average (SMA) advances beyond a flat 100 SMA, while below a directionless 200 SMA all of them far below the current level, which limits the bearish potential of the pair.

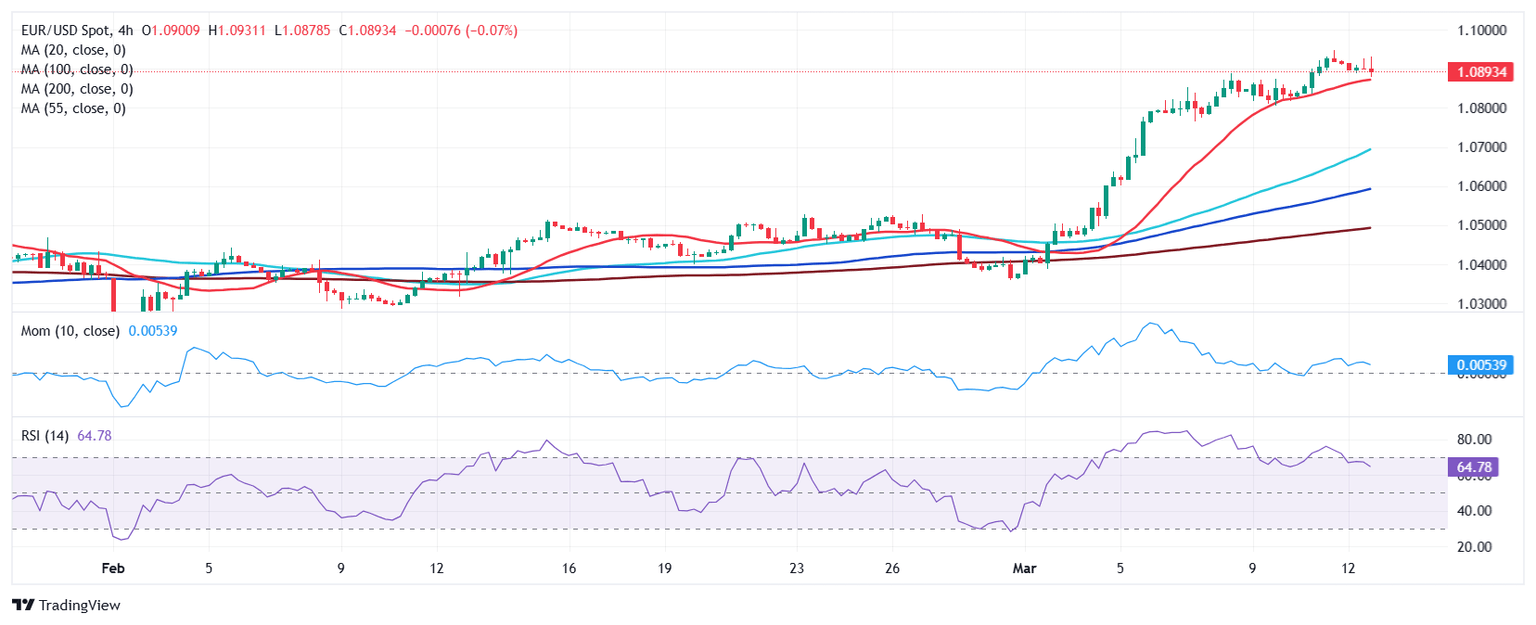

The near-term picture shows the risk skews to the upside. In the 4-hour chart, EUR/USD develops above a bullish 20 SMA, which advances beyond also bullish 100 and 200 SMAs. Technical indicators, in the meantime, lack clear directional strength while standing above their midlines.

Support levels: 1.0885 1.0830 1.0790

Resistance levels: 1.0925 1.0960 1.1000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.