EUR/USD Forecast: Fears to maintain Euro under selling pressure

EUR/USD Current price: 1.0752

- Far-right parties stood out in European Parliamentary Elections, spurring risk aversion.

- The United States Federal Reserve will announce its decision on monetary policy this week.

- EUR/USD bearish potential intact, break through 1.0700 at sight.

The EUR/USD pair gapped lower at the weekly opening, falling to 1.0732 during European trading hours, its lowest in a month. The result of the European Parliamentary Elections hit the Euro hard. Despite the centrist coalition managing to keep a narrow majority, far-right parties won in France, Austria, and Germany, leading to French President Emmanuel Macron calling for a snap parliamentary election in his country. Concerns about far-right parties gaining momentum pushed financial markets into risk-averse mode, boosting demand for the safe-haven US Dollar.

Demand for the Greenback pared ahead of Wall Street’s opening, although the USD holds on to gains against most major rivals. Meanwhile, European indexes trimmed a good part of their early losses but remain in the red. Across the pond, US indexes are poised to open with modest losses after falling on Friday following the release of a much stronger than anticipated United States (US) Nonfarm Payrolls (NFP) report.

Data-wise, the Eurozone published the June Sentix Investor Confidence index, which improved to 0.3 from -3.6 in May. The US has nothing to offer on Monday but will release the May Consumer Price Index (CPI) next Wednesday. The Federal Reserve (Fed) will announce its decision on monetary policy afterwards and publish alongside fresh economic projections. It seems hard that markets will move too far away from their current levels before the news.

EUR/USD short-term technical outlook

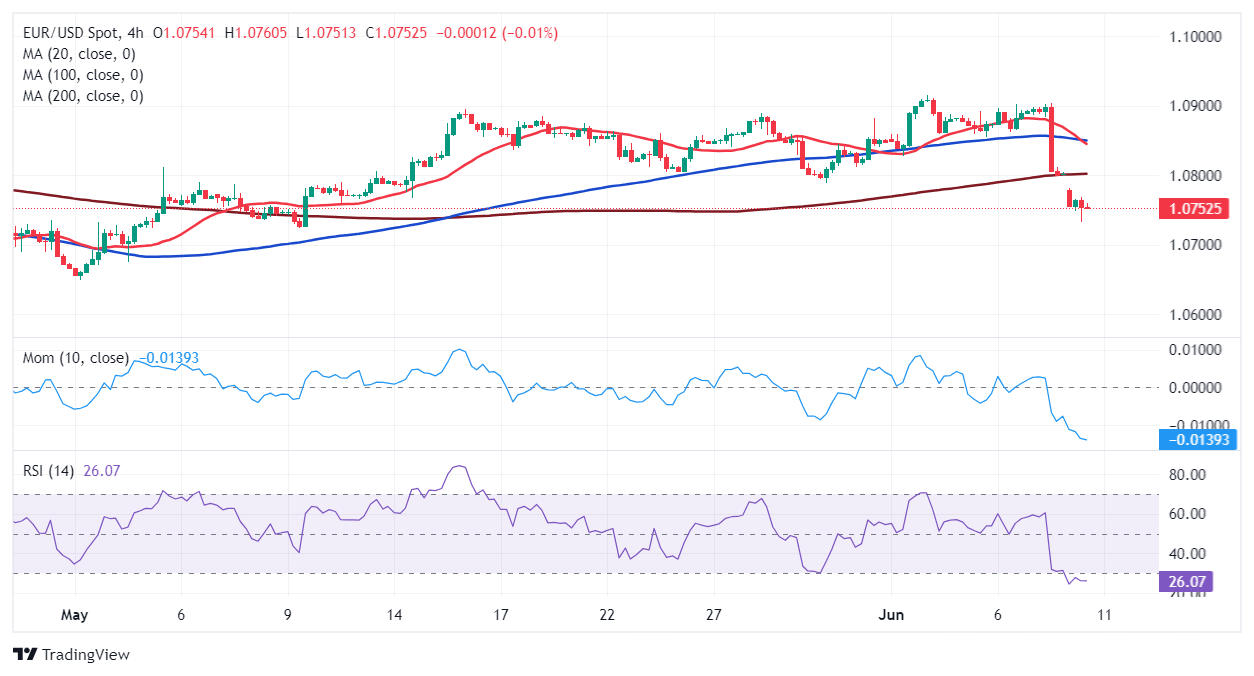

From a technical point of view, the EUR/USD pair is currently trading at around 1.0750, maintaining the bearish momentum. In the daily chart, the pair is developing below all its moving averages, with the 20 Simple Moving Average (SMA) having lost its bullish strength but holding above the longer ones, which hold directionless. At the same time, technical indicators head firmly south within negative levels, in line with another leg lower.

In the near term, and according to the 4-hour chart, EUR/USD is oversold. The Momentum indicator heads firmly south within negative levels, while the Relative Strength Index (RSI) indicator stabilized at around 23. Finally, the 20 SMA turned sharply south and is currently crossing below the 100 SMA, converging in the 1.0850 price zone. The 200 SMA, in the meantime, provides dynamic resistance in the 1.0800 price zone.

Support levels: 1.0730 1.0690 1.0645

Resistance levels: 1.0805 1.0850 1.0895

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.