Gold prices eye a rebound after Monday’s $240 wipeout

Gold steadied Tuesday after Monday’s pullback, with New York futures up 1% at $4,380 a troy ounce and still hovering near record highs. The metal has surged in 2025, but futures slid about 3% Monday after CME Group hiked margin requirements, forcing metals traders to post more cash on their positions.

Precious metals bounced back on Tuesday after a sharp selloff in the previous session, as markets shifted their focus back to geopolitical and economic risks, reigniting gold’s rally and cementing its best year since 1979.

Spot gold (XAU=) climbed 0.8% to $4,362.14 per ounce at 2:34 p.m. ET (1934 GMT). On Monday, it logged its biggest daily percentage drop since Oct. 21, as profit-taking knocked it down from Friday’s record high of $4,549.71.

The U.S. Federal Reserve approved an interest rate cut at its December meeting only after an in‑depth debate over the risks currently facing the U.S. economy, according to minutes from the most recent two-day meeting.

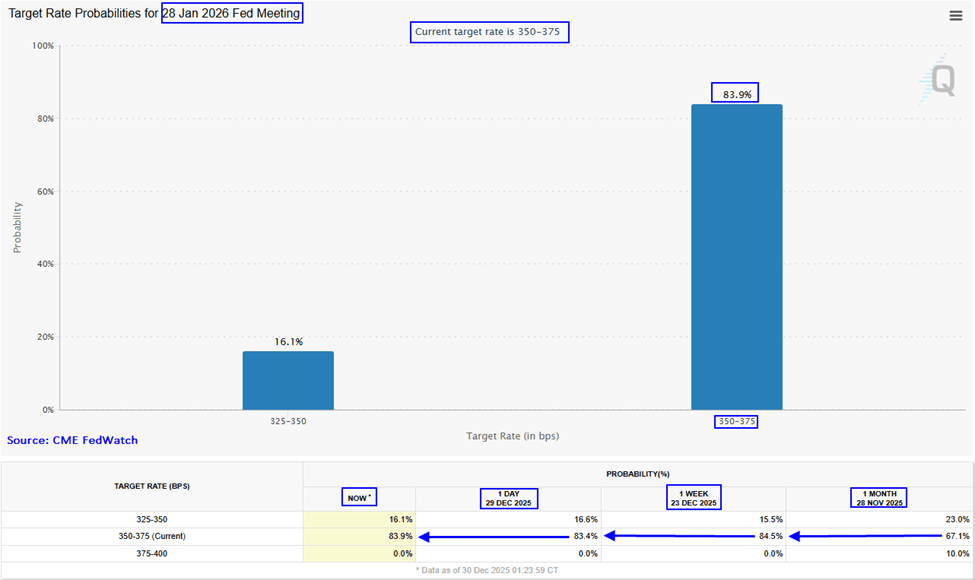

CME FedWatch:

Current Target Rate = 3.50 - 3.75

· CME FedWatch January no rate change probabilities have moved higher to 83.9% today from 67.1% on November 28, 2025.

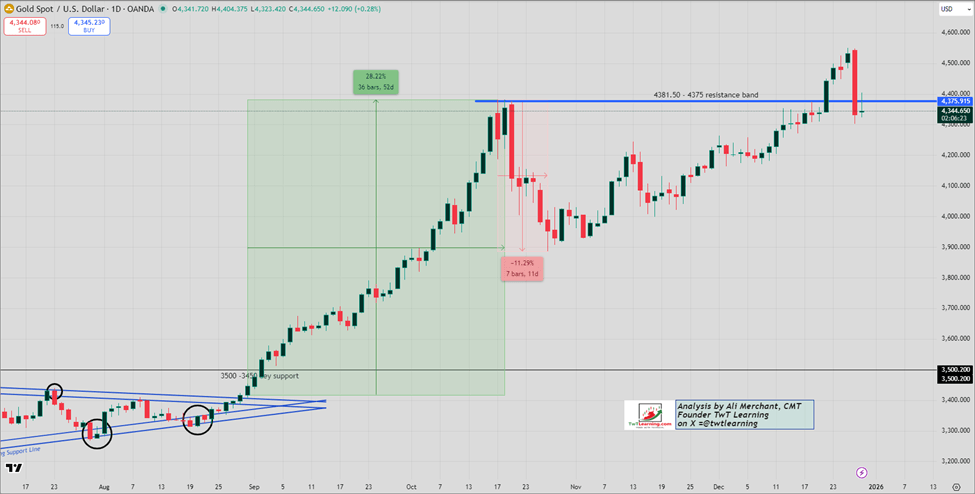

Technical analysis perspective:

Gold / US Dollar:

· Spot gold set a fresh record high at $4,550.15 on Friday, Dec. 26, 2025.

· On Monday, prices failed to break above that peak and sold off sharply, retesting and dipping below the prior record around $4,380.

· This move is a technical retest of the former all-time high flagged in Friday’s report.

· Bulls now need to reclaim the $4,380 level to open the way toward resistance at $4,450.

· A failure to hold here would pull gold back toward the $4,310–$4,300 area.

Gold Daily chart:

Gold/Silver Ratio:

· The gold-silver ratio tracks how many ounces of silver are required to buy one ounce of gold by dividing gold’s price by silver’s price. It is key metric investors use to judge relative value and anticipate potential market moves.

· The gold-silver ratio dipped to 54 yesterday before closing at 60, its lowest level since March 2013.

· Historically, a ratio at or below 60 has often preceded a sharp decline in both gold and silver prices.

GLD (SPDR Gold Trust) ETF:

· GLD printed a new all-time high of 418.45 on Friday, leaving a sizable upside gap.

· The ETF then gave back those recent gains with a downside gap on Monday.

· Price is now trading within the prior record-high zone between 403 and 398.

· If this area holds, a corrective rebound toward 406–408 is likely, with potential extension to around 412.

GLD daily chart:

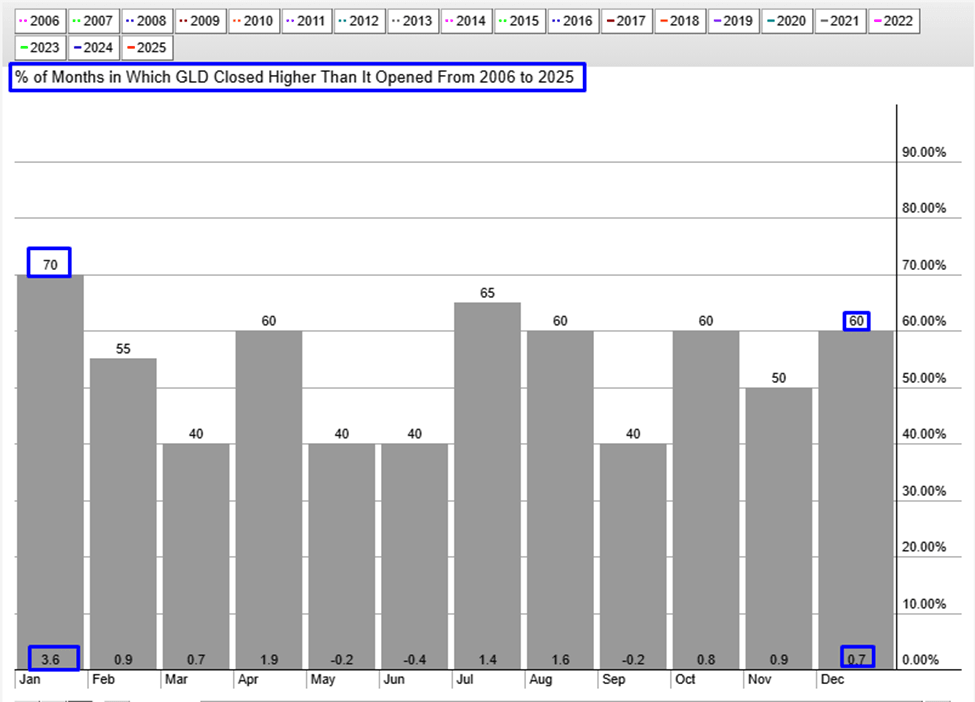

GLD Seasonality:

Since 2006, GLD has risen an average of 0.7% in December 60% of the time, and 3.6% in January 70% of the time. However, this seasonal pattern has had little influence so far this month.

Author

Ali Merchant, CMT

TwT Learning

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, & Fund Management, He has been trading FX, FX options, US stock