AUD/USD Weekly Forecast: Bears in control as fear returns

- Risk aversion dominated financial markets amid signs of stalling growth.

- The RBA and the Fed surprised market participants with dovish stances.

- AUD/USD has room to extend its decline toward a mid-term strong static support at 0.7250.

The AUD/USD pair is down for a second consecutive week, trading near a fresh 2021 low of 0.7409. The Australian dollar capitulated to the dismal market mood, dragged lower by renewed fears of slowing global growth. Generally speaking, investors were disappointed by central bankers, which stubbornly maintained dovish stances.

Dovish surprises from central bankers

The US Federal Reserve released the Minutes of its June meeting, surprising on the downside as market participants were waiting for a more hawkish stance from American policymakers. However, the Federal Open Market Committee noted progress in the economic recovery but added that they need to see “substantial further progress” toward their inflation and employment goals. They repeated that higher inflation will likely be temporal and that tapering is not a priority.

The greenback appreciated against the aussie on the back of risk-aversion, which boosted demand for safe-haven assets. US government bond yields soared, sending yields to their lowest levels since last February. The yield of the 10-year US Treasury yield bottomed at 1.25%, recovering toward the 1.35% area but the end of the week.

The Reserve Bank of Australia had a monetary policy meeting this week, and as its overseas counterparts, policymakers remained committed to maintaining highly supportive monetary conditions. Bond purchases will continue at the rate of A$4 billion a week until at least mid-November, while the target of 10 basis points for the April 2024 bond. As it happened with the Fed, investors were looking for a hawkish twist.

Meanwhile, Australia has extended focused lockdowns amid increasing covid cases. In Sydney, restrictive measures were extended to July 16 after reporting 44 new cases on Friday. The slow vaccination rate in the country plays a negative role, as only 9% of the population has been immunized against coronavirus. The country has limited the use of the AstraZeneca vaccine to those above 60 while falling short of other shots to protect those under that age. While the pandemic spread remains contained, the latest measures imply another setback in the economic comeback.

Decelerating economic growth

Australian data was positive but unimpressive. The June AIG Performance of Construction Index printed at 55.5, below the previous 58.3, although the Commonwealth Bank Services PMI ticked higher in the same month, coming in at 56.8. The June estimate of TD Securities Inflation resulted in 0.4% MoM, better than the previous -0.2%.

In the US, the official US ISM Services PMI for the same month printed at 60.1, contracting from the previous 64. Also, Initial Jobless Claims for the week ended July 2 ticked higher, to 373K against the expected contraction to 350K.

The upcoming week will bring Australian NAB’s Business Confidence and NAB´s Business Conditions for June. The country will also publish July’s Westpac Consumer Confidence and Consumer Inflation Expectations. On Thursday, the focus will be on the June monthly employment report. On the other hand, the US will release its June inflation figures, while on Thursday, the country will publish the usual employment-related numbers. Finally on Friday it will be the turn of June Retail Sales.

AUD/USD technical outlook

From a technical point of view, the risk remains skewed to the downside for AUD/USD. In the weekly chart, the pair holds below a mildly bearish 20 SMA, approaching directionless longer ones. The Momentum indicator consolidates right below its midlines while the RSI accelerated its decline, currently around 43.

Technical readings in the daily chart favor another leg south, as the pair trades below all of its moving averages, with the 20 SMA heading firmly lower below the longer ones. The Momentum indicator recovered from oversold readings but lost bullish strength within negative levels, while the RSI indicator barely bounced from oversold readings.

Bears maintain control, and the pair is set to extend its decline toward the 0.7340 price zone. A break below the latter could see the pair testing a long-term critical threshold around 0.7250. The weekly peak at 0.7598 is the level to beat for the bearish pressure to ease, although sellers will likely reappear if the pair approaches the 0.7700 mark.

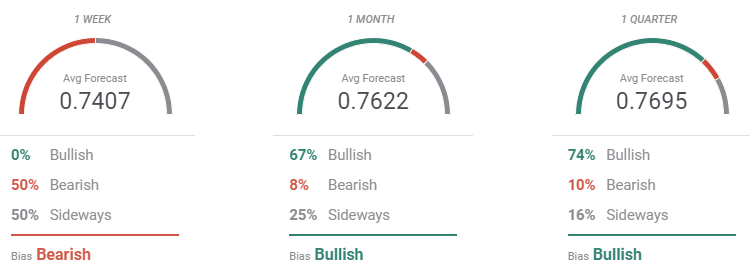

AUD/USD sentiment poll

The FXStreet Forecast Poll shows that the greenback may extend gains next week, but could give up afterwards. Nevertheless, AUD/USD gains are expected to remain limited. The pair is seen on average at around 0.7400 next week, while the following recovery is not expected to extend beyond the 0.7700 mark.

The Overview chart indicates that on a monthly basis, most targets remain around or below the current level, although in the quarterly perspective, the number of those better for higher levels increased, with most targets accumulating in the 0.77/0.79 price zone.

Related Forecasts:

USD/JPY Weekly Forecast: Look to your 2021 profits

EUR/USD Weekly Forecast: Growth concerns will likely support the safe-haven dollar

GBP/USD Weekly Forecast: A third week of declines? Delta, data and dollar strength promise action

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.