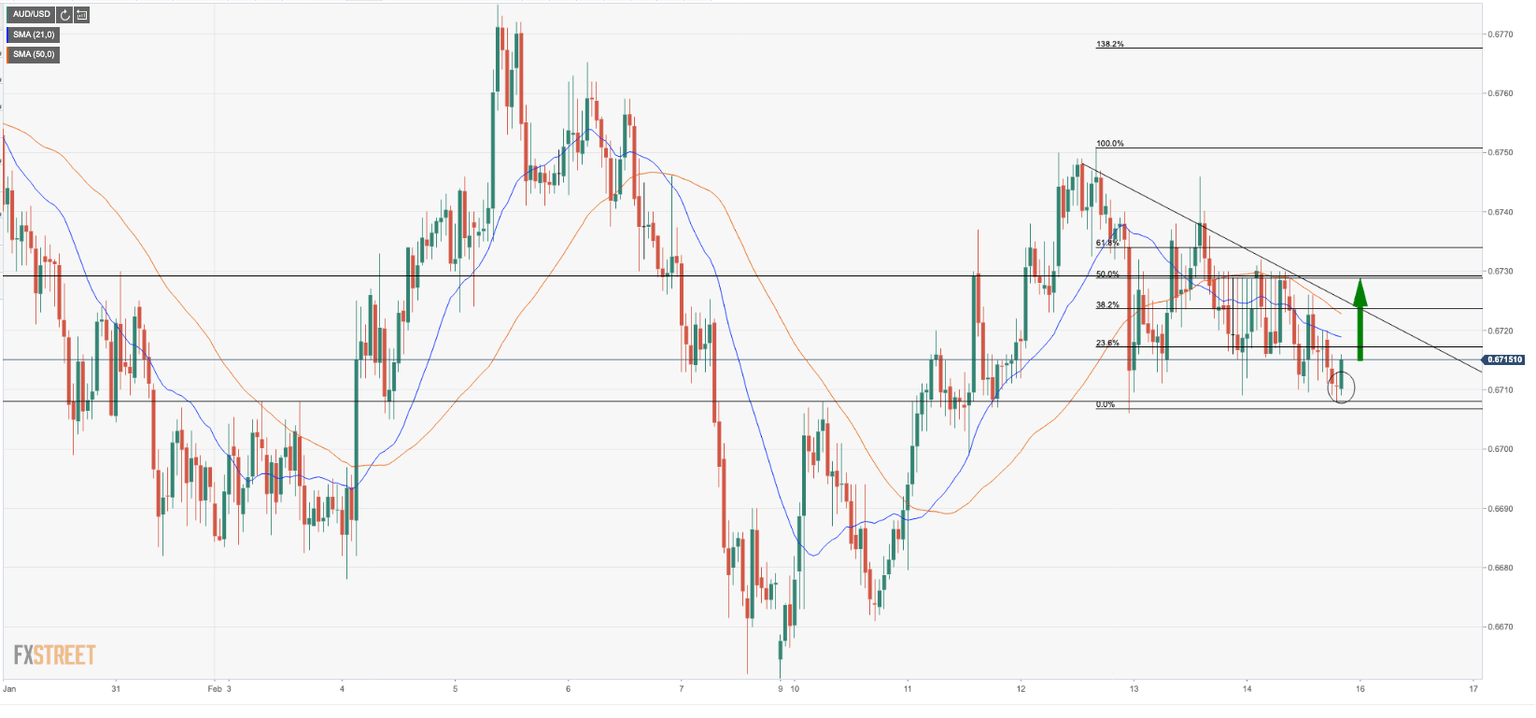

Chart Of The Week: AUD/USD bulls advancing in bullish descending triangle within weekly support

- AUD/USD has fallen into weekly support, with room for a bullish correction in the near-term.

- Bullish prospects seek out a test of a congested area of moving averages.

- Trendline resistance has a confluence of a Fibonacci resistance guarding a run of a 50% mean reversion.

- Descending triangle leaves a near term bullish bias in place.

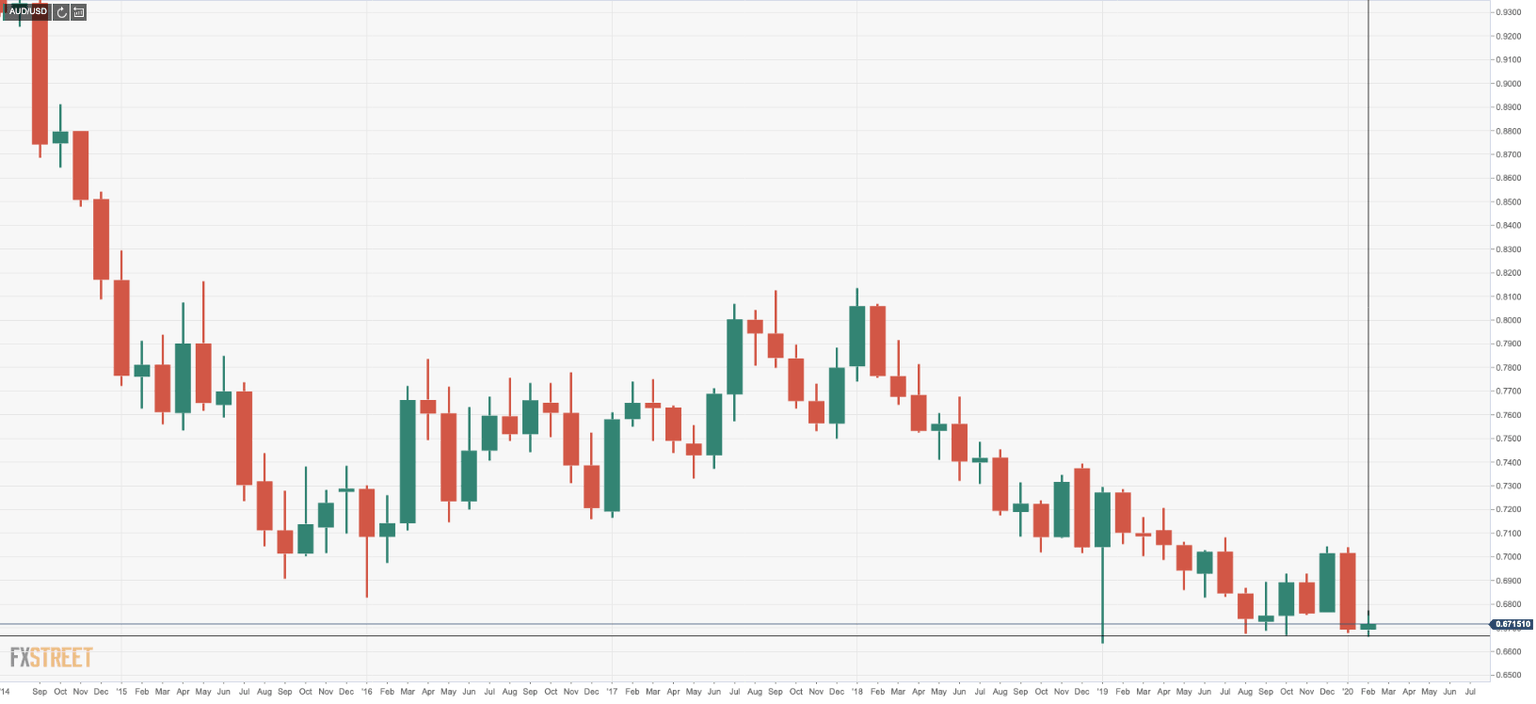

Weekly Support

There is a bottoming structure in place as the price firms in lower boundaries of the weekly decline.

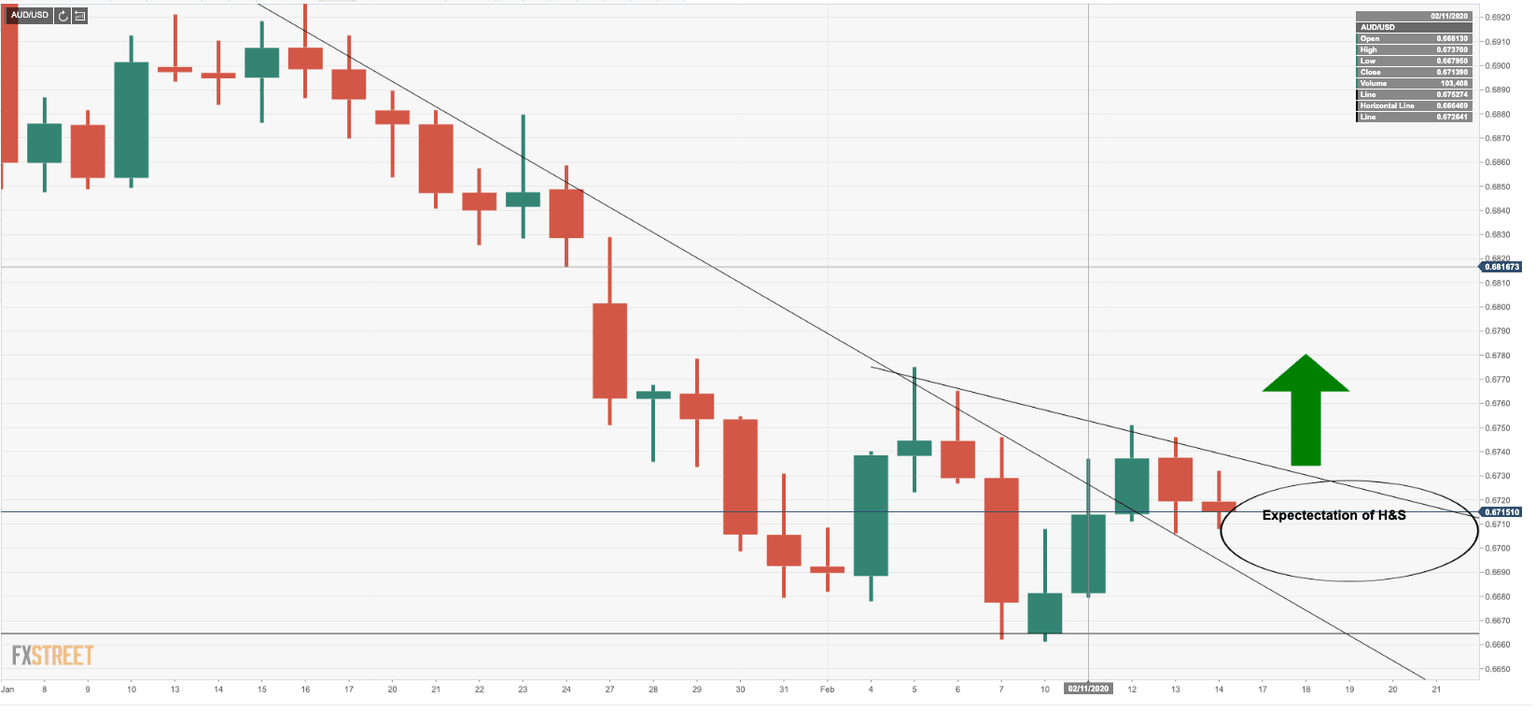

H&S in the making

The daily outlook holds the prospects of a consolidation phase, ultimately resulting in in a head and bullish reverse shoulders formation.

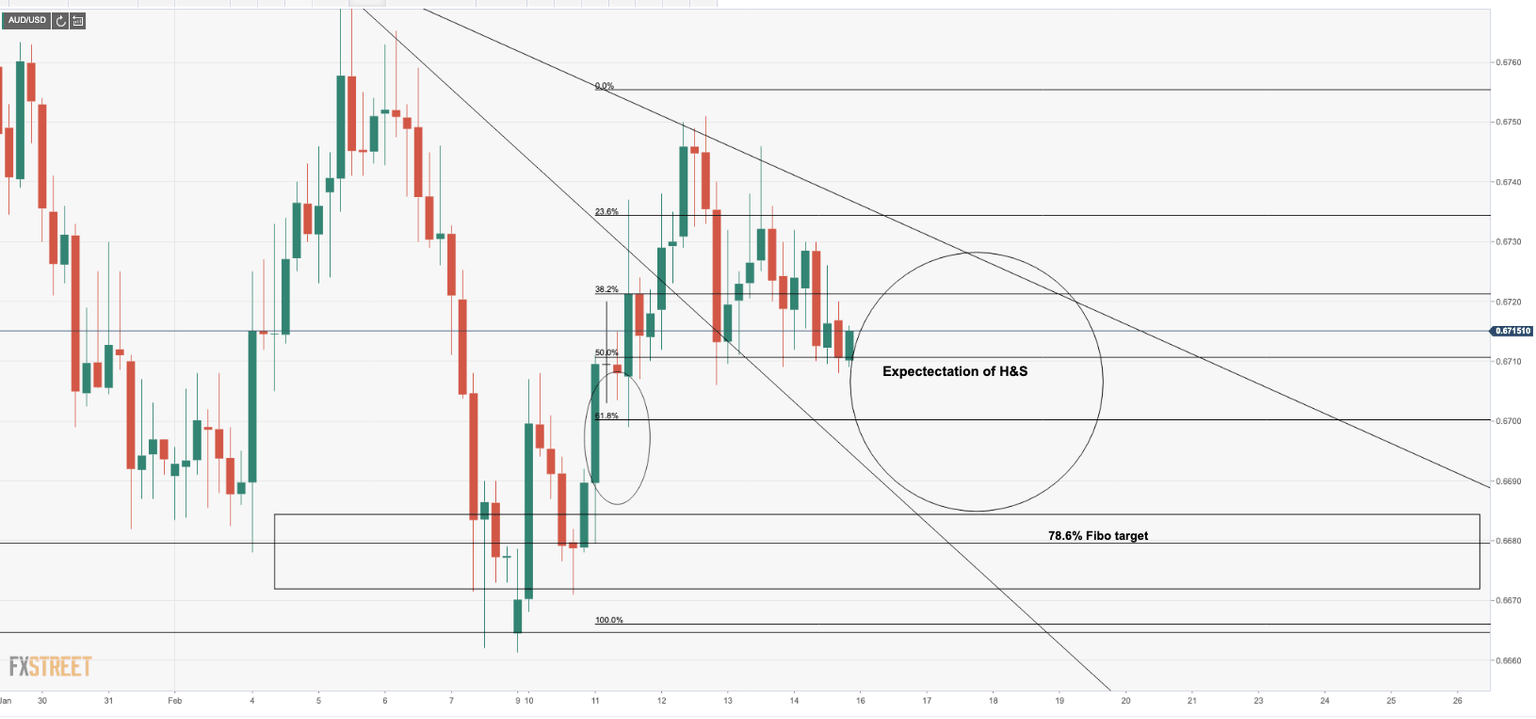

78.6% Fibo in sight

Bulls may prefer to hold out for improved risk to reward while seeking a test of the 78.6% to a critical support area prior to looking for longs back towards major trend-line resistance.

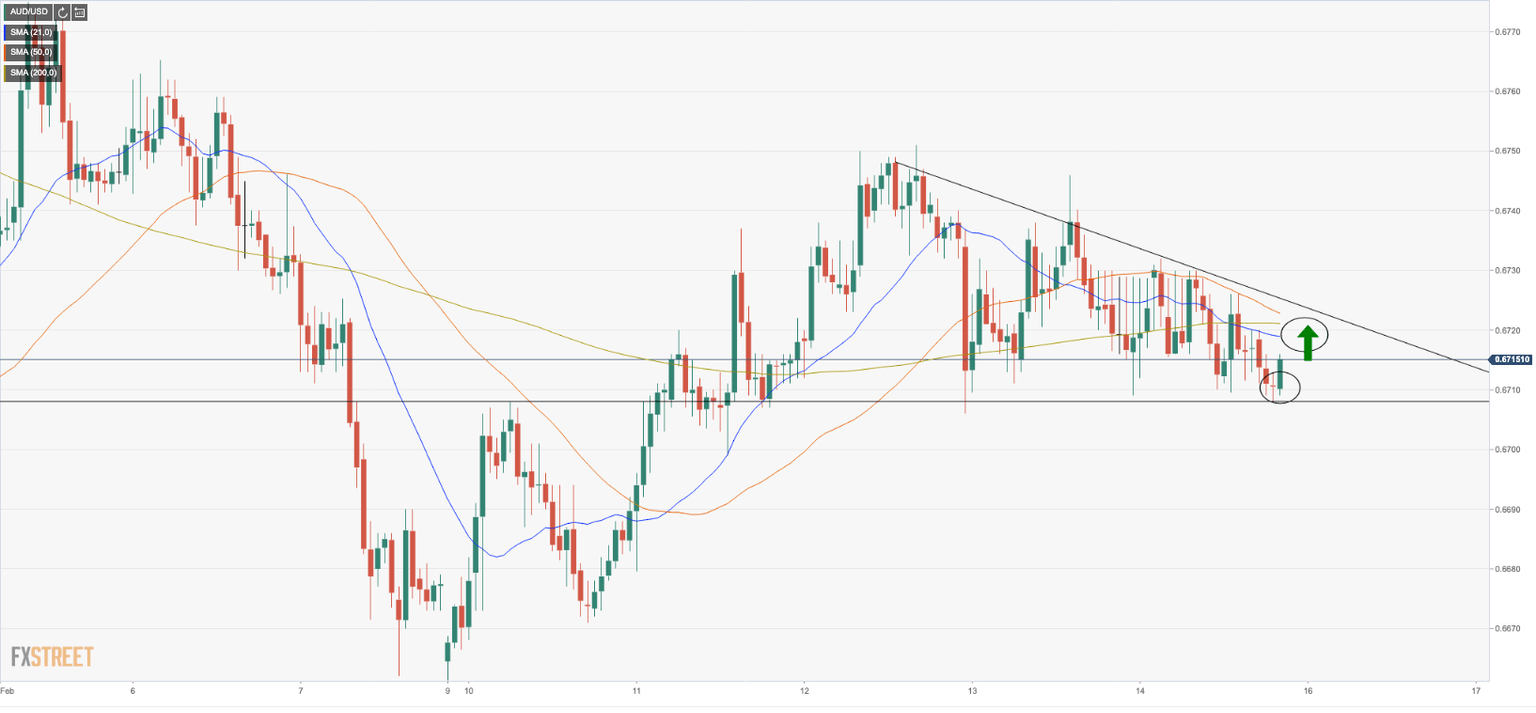

Descending Triangle

However, in the nearer-term, bulls are in control following a doji on the hourly formation which had lad to a bullish correction and exposing a bullish 200-hour moving average ahead of the 21-hour ma and an advance towards the hourly trendline resistance.

The 38.2 % Fibonacci retracement A break of the resistance opens a 50% mean reversion of the triangle's range around 0.6720.

Data focus

Meanwhile, we have a number of critical events for AUD. First in line, on the 18th, we have the Reserve Bank of Australia's minutes. These will be of particular interest considering that the Reserve Bank of Australia has displayed a preference to more clearly outline its thinking via Minutes than via the monthly statement. The wave of communication post the 4th Feb meeting reinforced the bar to easing is high. However, we will look for any signs that would force the RBA to reconsider its stance.

Then, on the 20th, the all-important Aussie jobs data will be up. "Assuming the unemployment rate rises 0.1%pts per month, the earliest the RBA would cut is in June assuming a 5.5% print in May is considered a material deterioration. We have headline at +12k, u/e rate at 5.2% and part rate unchanged at 66%. There is likely to be greater uncertainty for the Jan print," analysts at TD Securities explained.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.