Gold: Bulls are still swinging but the ceiling isn’t giving up easily

Gold is pushing right back into the zone where optimism and exhaustion tend to collide.

With higher-timeframe resistance directly overhead, today is all about whether buyers can finally break through or whether we set up for another reset.

Daily chart: Rejection, but not defeat

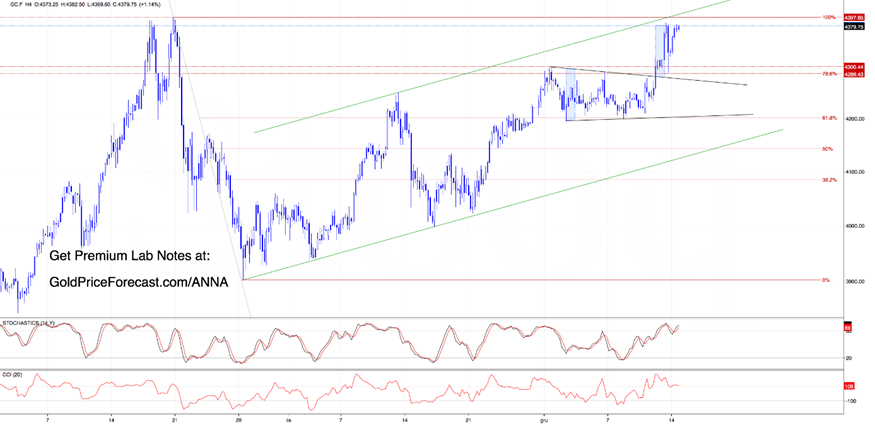

Even though bulls managed to break above the upper border of the black rising wedge, the proximity of the October highs, combined with two bearish engulfing patterns, proved too heavy on Friday. Price pulled back and closed the day (and the entire week) back inside the wedge.

What does that mean?

Momentum is there, but conviction isn’t yet strong enough to take out major resistance. The market hesitated, however, not reversed.

But today, buyers refused to stay defensive. Gold climbed back above the wedge, signaling that another attempt to challenge the resistance zone is underway, which means Friday’s upside targets remain in play:

If gold manages to hold above the upper border of the black rising wedge on the daily chart, the odds increase for an attack on October highs and potentially a new all-time high.

From a target perspective:

- First target: upper border of the green rising channel on H4, currently crossing above 4400.

- Second target: 4415 -> the 161.8% Fibonacci extension of the November 13-18 move.

- Above that? The psychological 4500 level enters the conversation.

Four-hour: Target hit, reaction delivered

As we wrote in the last Lab Note:

“That breakout opened the door toward 4380, where the upside move equals the height of the triangle.”

Not only did gold reach that level, but it also printed a daily high at 4387. Huge congratulations to traders who caught that move. Clean structure, clean breakout, clean follow-through. Exactly what we want to see.

That rally, combined with the cluster of resistance discussed in the daily section, attracted sellers. The correction dragged gold back toward the December 5th high - the top of the double-bottom formation we mentioned on Thursday (Lab Note #38).

Bulls stepped in again, and we’re now trading right back near Friday’s peak.

Indicators remain overbought, but without any confirmed sell signals yet. In strong trends, overbought is a condition, not a command. The burden is still on sellers to prove themselves.

Worth noting on H4:

The upper boundary of the green rising channel now sits around 4406, making it the first area to watch closely if gold pushes through 4400.

Lab takeaway: What matters today

Gold keeps coming back for another try, and that alone tells us plenty. This is not a market to short purely because it “feels extended,” but it’s also not a market to chase blindly into multi-layer resistance.

Today’s job is simple:

- let price show whether it can hold above the wedge

- watch how buyers behave in the 4400-4406 area

- respect momentum, but don’t ignore location:

- If bulls can absorb selling pressure above 4400, upside targets remain active.

- If they can’t, the market will reset and give a cleaner opportunity later.

Patience here isn’t passive… it’s strategic.

Stay sharp and let the daily candles speak.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Anna Radomska

Sunshine Profits

Anna's passion for drawing evolved into a fascination with colorful lines and shapes, which later inspired her interest in the stock market.