EUR/USD outlook: Bulls hold grip and extend gains above thick daily cloud

EUR/USD

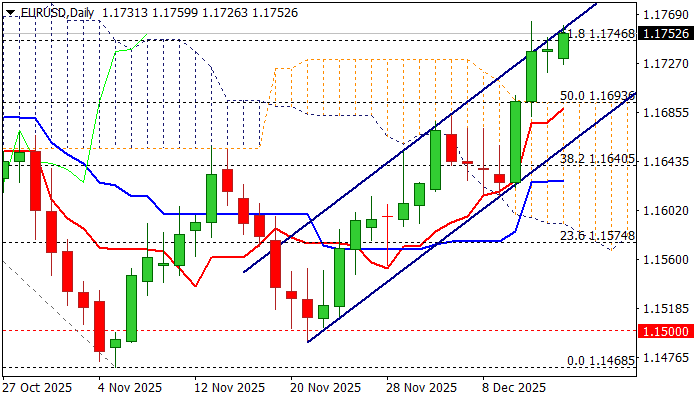

The Euro maintains firm tone at the start of the week and holds near new multi-week high, posted last Thursday (1.1762).

Bulls hold grip and probe again through cracked Fibo barrier at 1.1746 (61.8% of 1.1918/1.1468), also being on track for the third consecutive daily close above broken top of thick daily Ichimoku cloud (1.1693).

However, the near-term action continues to face headwinds from the upper boundary of bull-channel (bull-leg from 1.1490), with overbought daily studies adding to signals that the price may hold in a sideways mode and wait for fresh signals.

A batch of delayed economic data from the US will be released on Tuesday (NFP is the top event) and expected to provide more information to the Fed in shaping their monetary policy outlook, which would generate stronger direction signals.

Daily close above cracked Fibo level at 1.1746 to confirm fresh positive signals for probe through channel upper trendline and open way for acceleration above 1.18 mark.

Friday’s low (1.1750) offers immediate support, with near-term action to remain biased higher while holding above daily cloud.

Res: 1.1760; 1.1778; 1.1812; 1.1848.

Sup: 1.1750; 1.1693; 1.1673; 1.1640.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.