AUD/USD Forecast: Good as gold? Global gloom could overwhelm even robust Australian figures

- AUD/USD has held up yet failed to reach new highs amid global concerns.

- Sino-American relations, Australia's jobs report and US retail sales stand out.

- Mid-May's daily chart is showing bears are gaining ground.

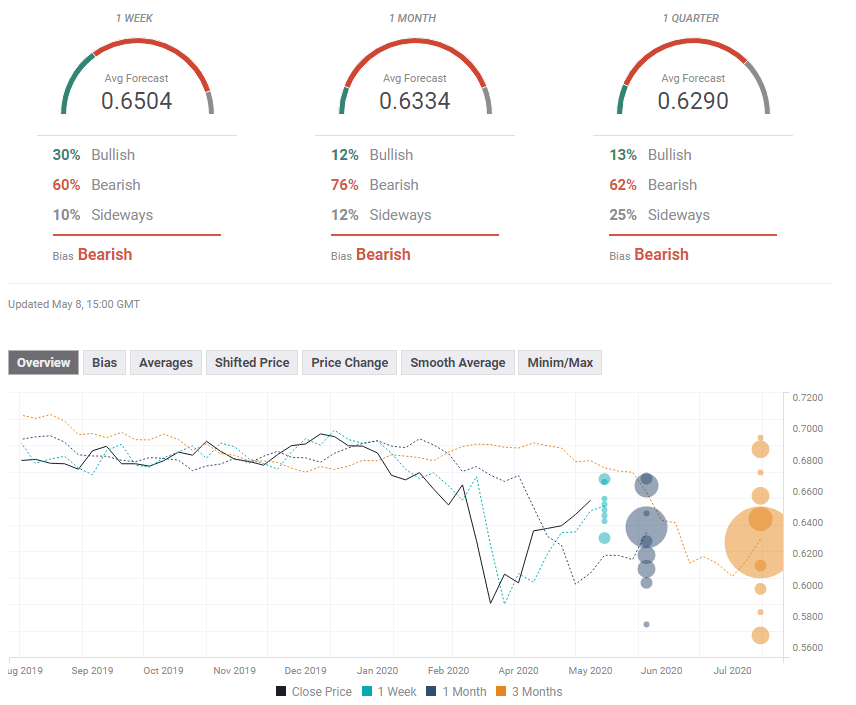

- The FX Poll is pointing to falls on all timeframes, yet with upgraded targets.

The Australian dollar benefited from the encouraging coronavirus situation at home and upbeat figures from Australian and China However, worsening Sino-American relations and concerns about the US economy limited further gains. Australia's jobs report, Chinese industrial output, and US retail sales are eyed in addition to the disease dynamics.

This week in AUD/USD:

Australia continues holding COVID-19 below 7,000 cases and 100 deaths at the time of writing, flattening the curve, and keeping it crushed. That has allowed further reopening of the economy, albeit each state has its specificities. A "travel bubble" discussed with New Zealand has been called off for now, but it remains on the list.

The Reserve Bank of Australia left the interest rate unchanged at 0.25% as expected and remained cautiously optimistic. While it acknowledged the impact of the disease on the global and local economies, it is in no rush to add stimulus. That supported the Aussie.

Economic figures from the land down under also kept the A$ bid. April's trade balance surplus surpassed A$10 billion, and finally, retail sales figures for March were upgraded to a leap of 8.5%. China, Australia's No. 1 trading partner, reported a surprising increase in exports but a fall in imports.

The Aussie's advance was curbed by worsening Sino-American relations. Both President Donald Trump and Secretary of State Mike Pompeo suggested that the coronavirus escaped a lab in Wuhan, China, rather than leaping from animals to humans. Trump also promised to verify if Beijing was fulfilling its obligations in the trade deal and threatened to cancel it. A drop in global trade and the risk-off environment is detrimental for the Aussie.

The US figures were mostly depressing, with jobless claims, ADP employment figures, and critical components of ISM's Purchasing Managers' Indexes – New Orders and Employment – crashing to rock-bottom levels.

April's Non-Farm Payrolls were horrible, yet markets had already priced them in. The US lost 20.5 million jobs and the Unemployment Rate jumped to 14.7%. Nevertheless, the response was muted.

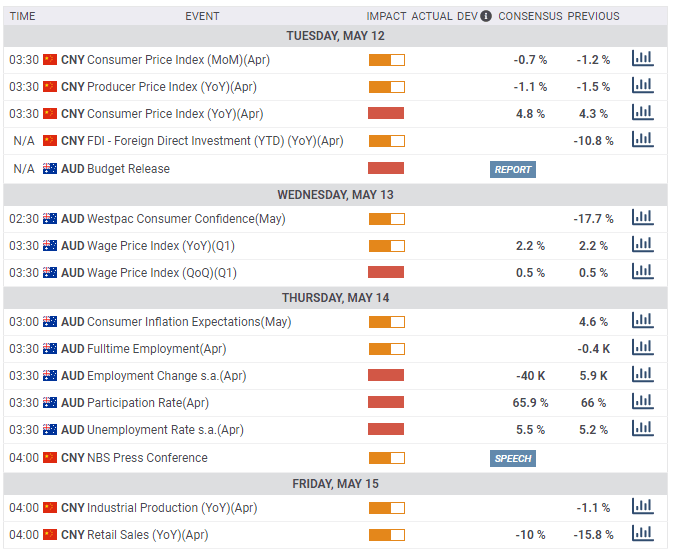

Australian and Chinese events: Jobs report stands out

Unless there is a surprising second wave in Australia, the pace of reopening could have an impact on the Aussie, with the gradual return to normality supporting the Aussie. The central government publishes its budget on Tuesday, and the more stimulus, the better. Prime Minister Scott Morrison has the opportunity to invest in these times of trouble.

Wednesday's quarterly Wage Price Index release for the first quarter provides a first look into the labor market, yet no earth-shattering change is on the cards.

The highlight of the week is due out on Thursday, with the labor figures for April. Economists are expecting a considerable loss of jobs, yet minuscule in comparison to the crushing seen in other developed economies. Australia's unemployment rate will likely remain well below 6%. However, it is essential to note that the range of estimates is likely broader than usual, and surprises cannot be ruled out.

Last but not least, China's industrial output statistics for April will likely show a monthly increase and perhaps also a yearly one. Factories had mostly returned to activity last month, yet consumers remain reluctant to go out and about, fearing the disease. Even an authoritarian regime like China's cannot force people to eat out.

Here the most prominent Australian and Chinese releases on the economic calendar:

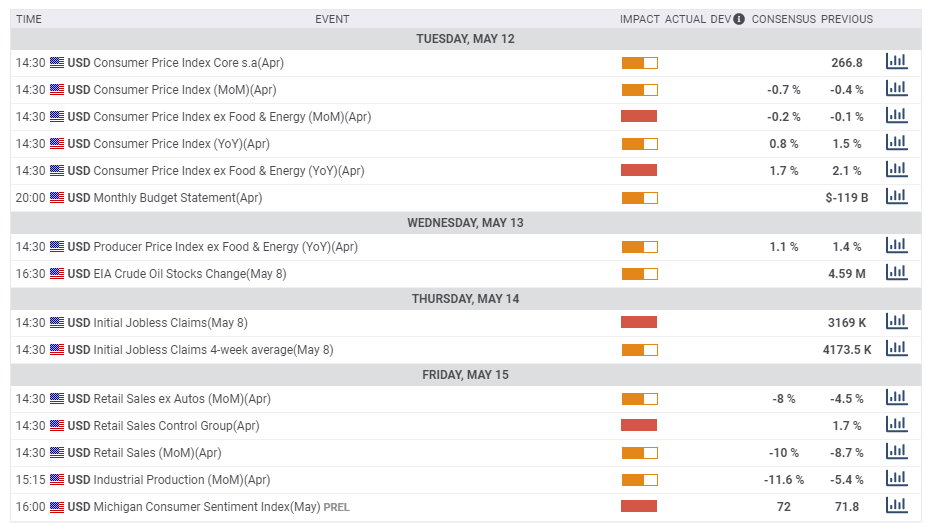

US events: Reopening, retail sales, and relations with China

There is bipartisan criticism in the US against China, and President Trump will likely continue attacking the world's second-largest economy. While this remains in the realm of politics and rhetoric, investors could learn to shrug it off. However, moving toward new tariffs or canceling the trade agreement could deal a blow to sentiment and the Aussie, a risk currency.

Additional US states will ease their lockdowns on May 11, boosting economic activity but also risking the second wave of infections. COVID-19 statistics remain elevated outside the New York region while tracing and testing are mostly lagging what experts deem necessary. Will it affect the market mood?

The US economy is suffering, and further evidence of that will likely be seen in the retail sales numbers for April, which could experience double-digit falls after tumbling in March by over 8%. Apart from being unable to shop outside, mass unemployment and uncertainty have also kept consumers from spending.

Are things improving moving forward? The University of Michigan's preliminary Consumer Sentiment data for May could bounce or at least stabilize after crashing.

Ahead of Friday's spending data, inflation figures could show a substantial fall in headline inflation, as energy prices tumbled last month. The Core Consumer Price Index has probably dropped below the 2% level, which is eyed by the Fed.

Weekly jobless claims will likely remain in the millions, yet their impact will probably be muted just after the Non-Farm Payrolls. Continuing claims are set to continue accumulating.

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

Aussie/USD has slipped out of the uptrend channel that has accompanied it since mid-March, and momentum on the daily chart has softened. The currency pair trades above the 50-day Simple Moving Average but below the 100 and 200-day ones. All in all, the picture has become more bearish.

Some support awaits at 0.6370, which cushioned AUD/USD in early May. It is followed by 0.6250, a support line from mid-April. It is closely followed by 0.6210, which was a high point in late March, and then by 0.61 and 0.5980.

Resistance is at 0.6480, a high point in early May, followed by the post-crash peak of 0.6560. Next, 0.6660 was a swing high before the downfall, and 0.6750 dates back to February.

AUD/USD Sentiment Poll

After the rally and going sideways, will global gloom finally hit the Aussie? Or is Australia's strength enough to keep the currency pair bid? The downside seems more appealing, but perhaps not instantly.

The FXStreet Forecast Poll is showing that experts have upgraded their forecasts but on average, still remain bearish in all timeframes. The rise of 1,000 pips from the lows is still baffling.

Related Reads

- Safe-havens, the US-Sino Cold War and a tip for traders – Interview with Marc Chandler

- Why markets are up, risks that are underpriced, indicators to watch – Interview with Ipek Ozkardeskaya

- EUR/USD Forecast: Economic reopenings are the key

- GBP/USD Forecast: Betting on Boris after Bailey's bailout UK GDP, US retail sales, and virus decisions eyed

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637245464224326250.png&w=1536&q=95)