EUR/USD Forecast: Economic reopenings are the key

- Data from both economies suggest that there’s a long way ahead of a possible bounce.

- Investors are mildly optimistic and focused on an uncertain future.

- EUR/USD maintains a bearish stance in the long term, eyeing 1.0635.

The EUR/USD pair is ending Friday near the 1.0850 area giving up its previous weekly gains. The shared currency suffered at the beginning of the week from mounting risk-aversion as US President Trump spurred tensions with China, threatening the country with new tariffs due to the mishandling of the coronavirus outbreak. Tensions remained throughout the week, as Trump also complained about China not filling the quotas set in phase one of the trade deal.

German Constitutional Court and Trump

The shared currency further suffered from news indicating that the German Constitutional Court ruled on the ECB stimulus program introduced back in 2015. The court said that the program had not violated any law, yet gave a three-month ultimatum to the ECB in order to demonstrate the proportionality between the plan and its effects. The news triggered a sell-off in local bonds, weighing also on local indexes, which anyway closed in the green.

Meanwhile, investors were mildly optimistic, as economies began to ease restrictive measures, hoping for economic recoveries. The greenback only eased on Thursday, amid fed funds rates futures turning negative for the first time ever. Still, the American currency retained its strength against a weakened EUR.

By the end of the week, sentiment remained mixed, as both, the US and China, reported they resumed trade talks and vowed to keep the deal alive, although later in the day, US Secretary Larry Kudlow said that China will be held accountable for the virus crisis. He also supported US President Trump’s desire to reopening the economy as fast as possible.

Awful numbers all over the place

Beyond sentiment, data was terrible both shores of the Atlantic. Markit upwardly revised its final versions of the Union’s and Germany’s final Services PMI for April but anyway remained at record lows. German industrial production and factory orders collapsed in March, while employment figures in the US hit record highs, with the April NFP report showing that over 20 million Americans are out of jobs, resulting in the unemployment rate hitting 14.7%.

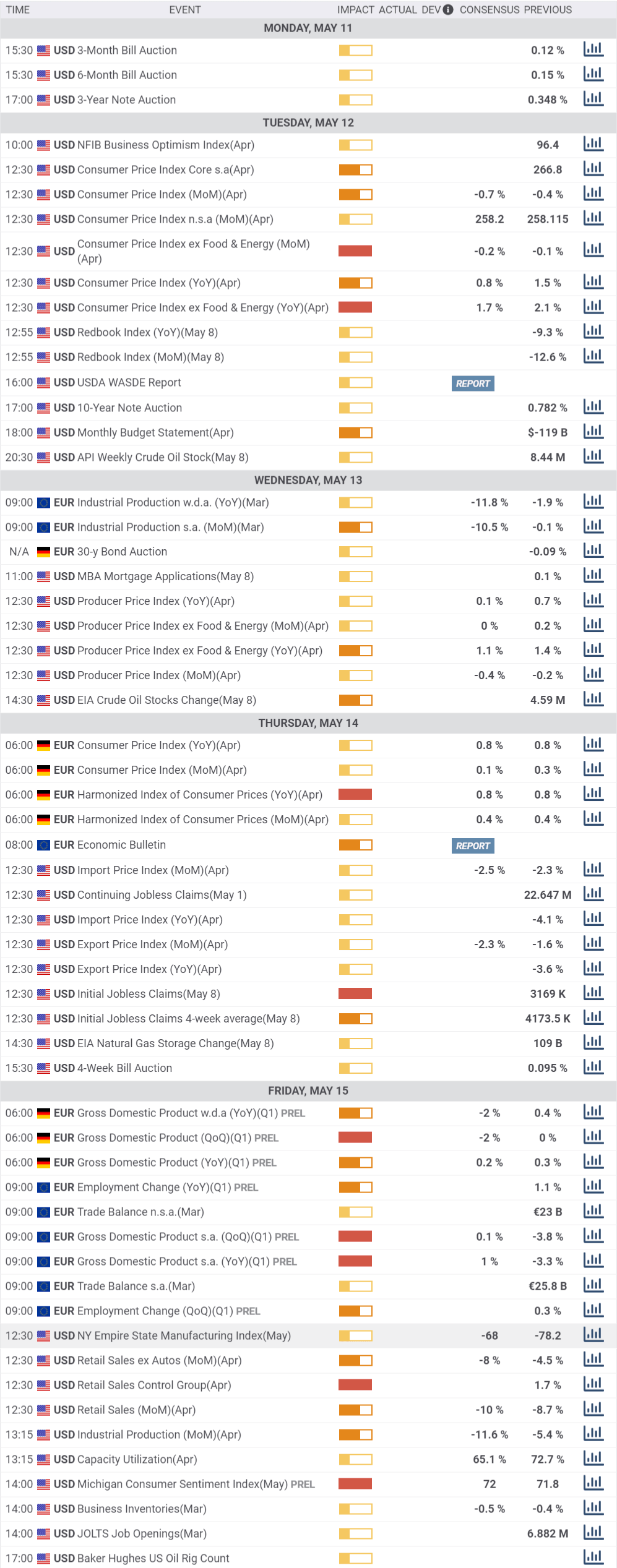

The upcoming week will be lighter in terms of macroeconomic releases. The US will publish April inflation data next Tuesday, seen at 0.8% YoY, down from 1.5% in the previous month. Germany will also unveil inflation figures but on Thursday.

Most relevant releases will come on Friday, as Germany will publish its preliminary estimate of its Q1 GDP, foreseen down by 2.0%. The EU will also release an update on Q1 GDP, foreseen at 0.1%, while the US will publish April Retail Sales.

EUR/USD technical outlook

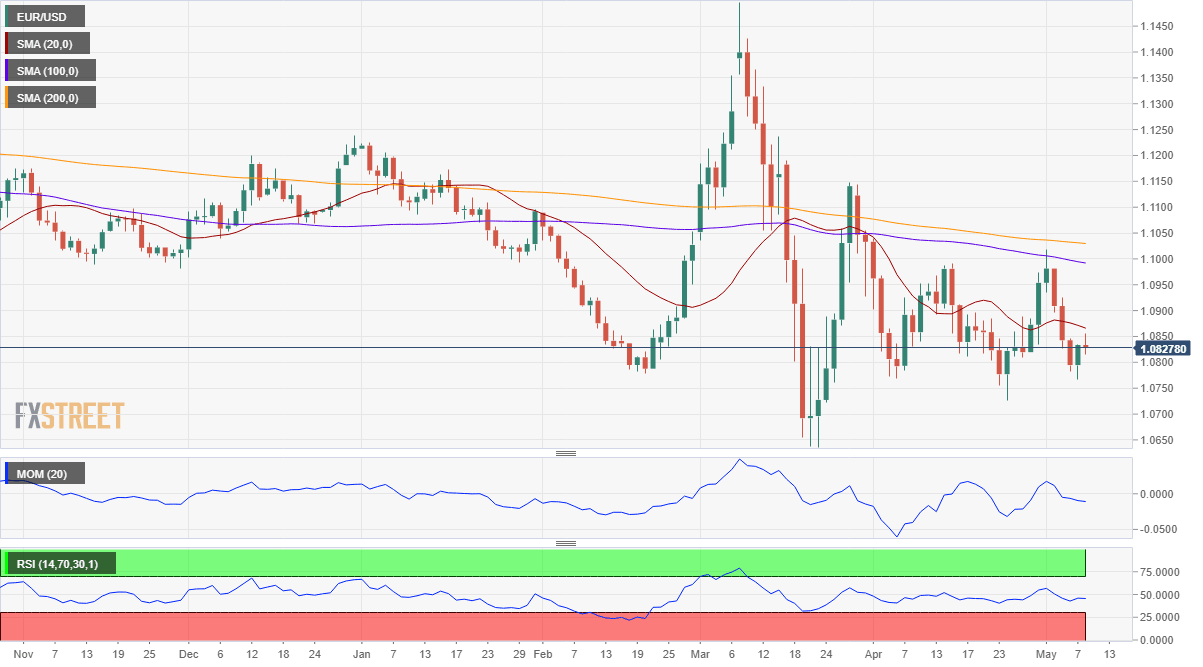

The weekly chart for the EUR/USD pair shows that the pair remained capped by a bearish 20 SMA, while the 100 SMA continues heading south below the 200 SMA, both far above the shorter one. Technical indicators have retreated from around their midlines, heading south within negative levels.

Daily basis, the risk is also scheduled to the downside, as the latest recovery is meeting sellers around a bearish 20 SMA, while the larger ones also head south but some 200 pips above the current level. Technical indicators have recovered from weekly lows but struggle to surpass their midlines, lacking strength enough to confirm a bullish extension.

The 1.0900 level is now the immediate resistance, ahead of the 1.0980 area. Beyond this last, the pair could extend its advance up to 1.1040. Supports, on the other hand, are located at 1.0790 with a break below it exposing 1.0720 first and 1.0635, the yearly low.

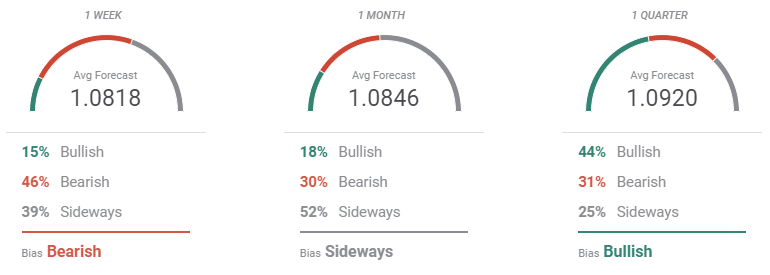

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that the pair is expected to remain under pressure next week, although the market does not it expect the decline to be long-lasting. It’s seen neutral in the monthly perspective, and then bullish in the quarterly view, with 44% of the polled experts waiting for an advance. The average target at this last time-frame is seen at 1.0920. Overall, the pair is expected to remain within a will limited range between 1.0700 and 1.1000 throughout the upcoming weeks, mostly a result of the ongoing uncertainty.

The Overview chart still shows that most targets accumulate around or below the current level, in line with the absence of interest around the common currency. Anyway, and when compared to the stats from the previous week, bullish pressure builds up in the quarterly perspective.

Related Forecasts:

AUD/USD Forecast: Good as gold? Global gloom could overwhelm even robust Australian figures

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.