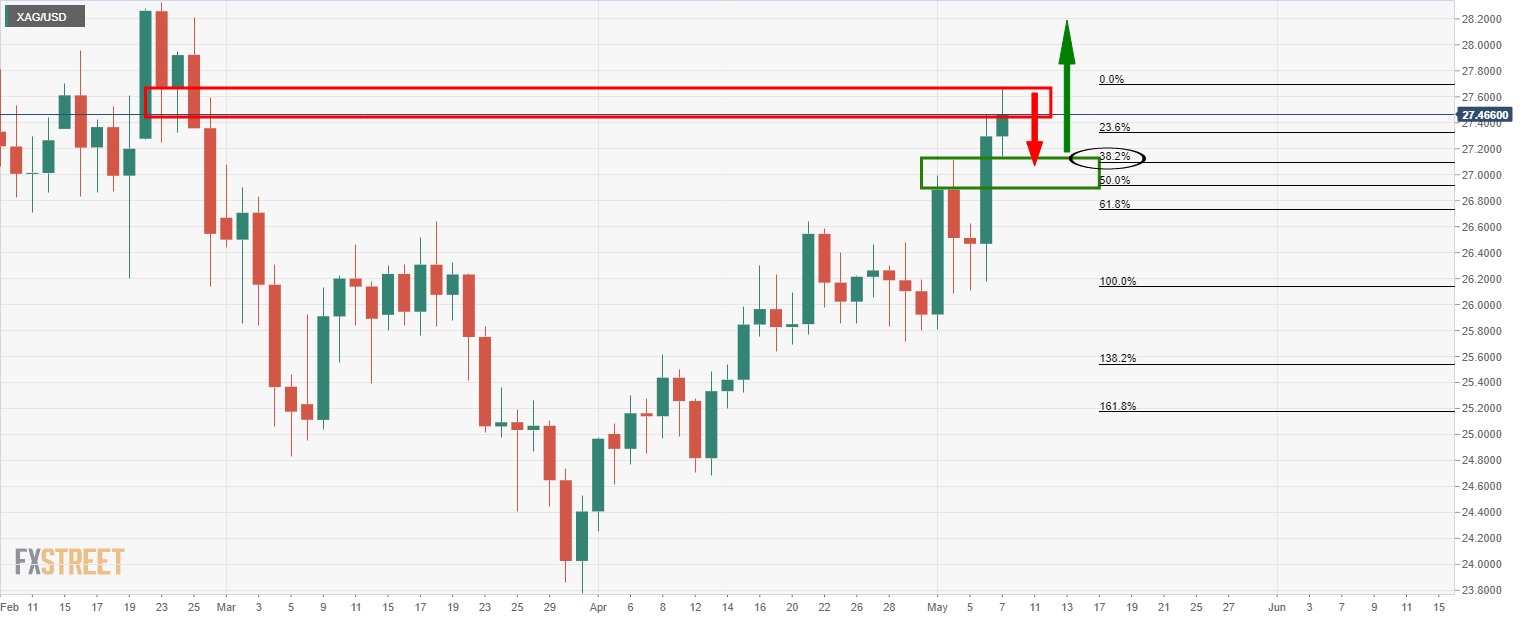

XAG/USD bulls moving up against a wall of key resistance

- The soft US labour market report sealed the dollar's fate.

- XAG/USD rose from a low of $27.14 to a high near $27.68 on Friday, testing critical resistance.

Bond yields drifted lower and commodity prices rallied on Friday, along with the price of precious metals.

The Nonfarm Payrolls data showed an unemployment rate at 6.1% was another disappointment with the headline way off expectations.

As a result, the DXY was ending lower by just above 0.7% and XAG/USD rose from a low of $27.14 to a high near $27.68.

While the US data releases have mostly been fine besides Friday’s jobs report, there are signs of catch-up in the UK and eurozone which may continue to weigh on the greenback for the days ahead, benefiting the precious metals in particular.

XAG/USD technical analysis

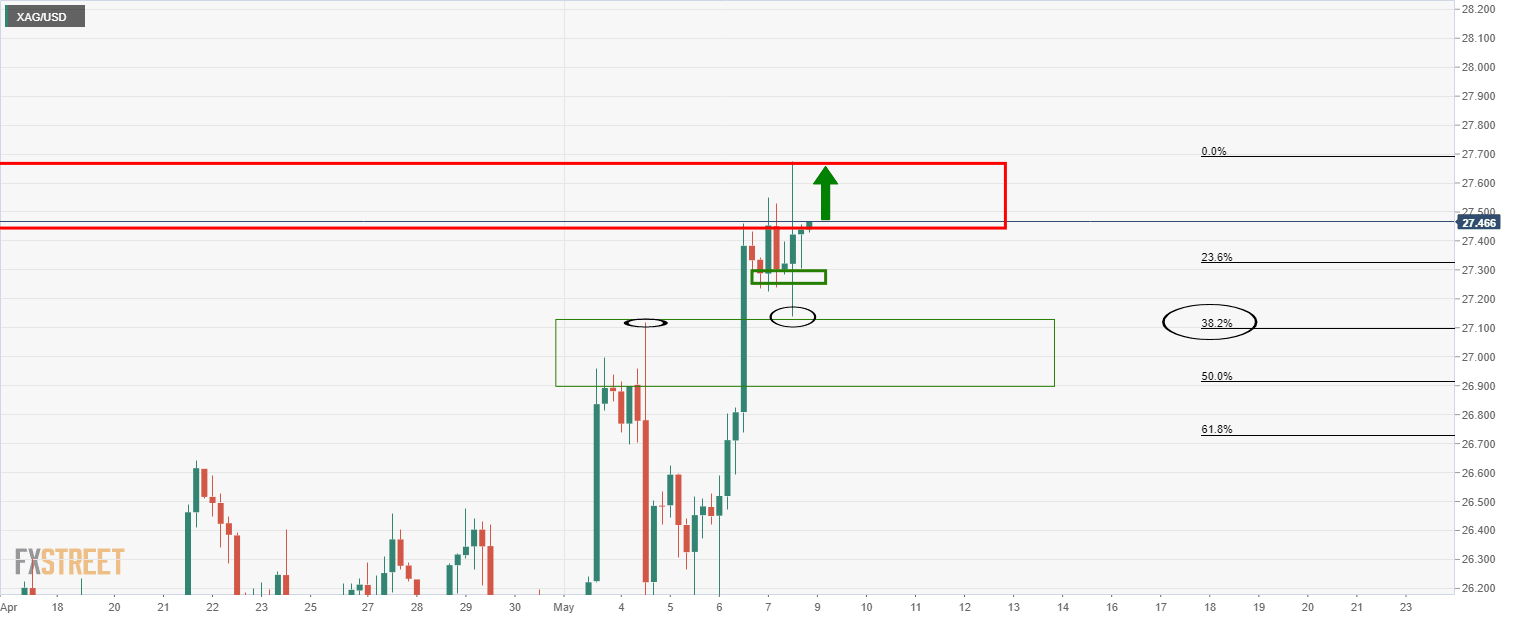

Technically, the bullish impulse may have run out of juice considering how far it has come in just a short couple of days.

The price has met a significant daily structure at the highs which have already started to result in profit-taking.

26.65 is the prior daily highs that could well be the first port of call in a deeper correction.

However, according to the 4-hour time frame, buyers are still in town with the price recovering from a 38.2% Fibonacci retracement in the corrective lows.

Should the bulls kick into gear again in the open of the new week, considering the bullish weekly close above prior weekly closing highs, the 28.00 psychological level will be a focus.

However, there are prospects of a test of the prior highs according to the weekly W-formation.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.