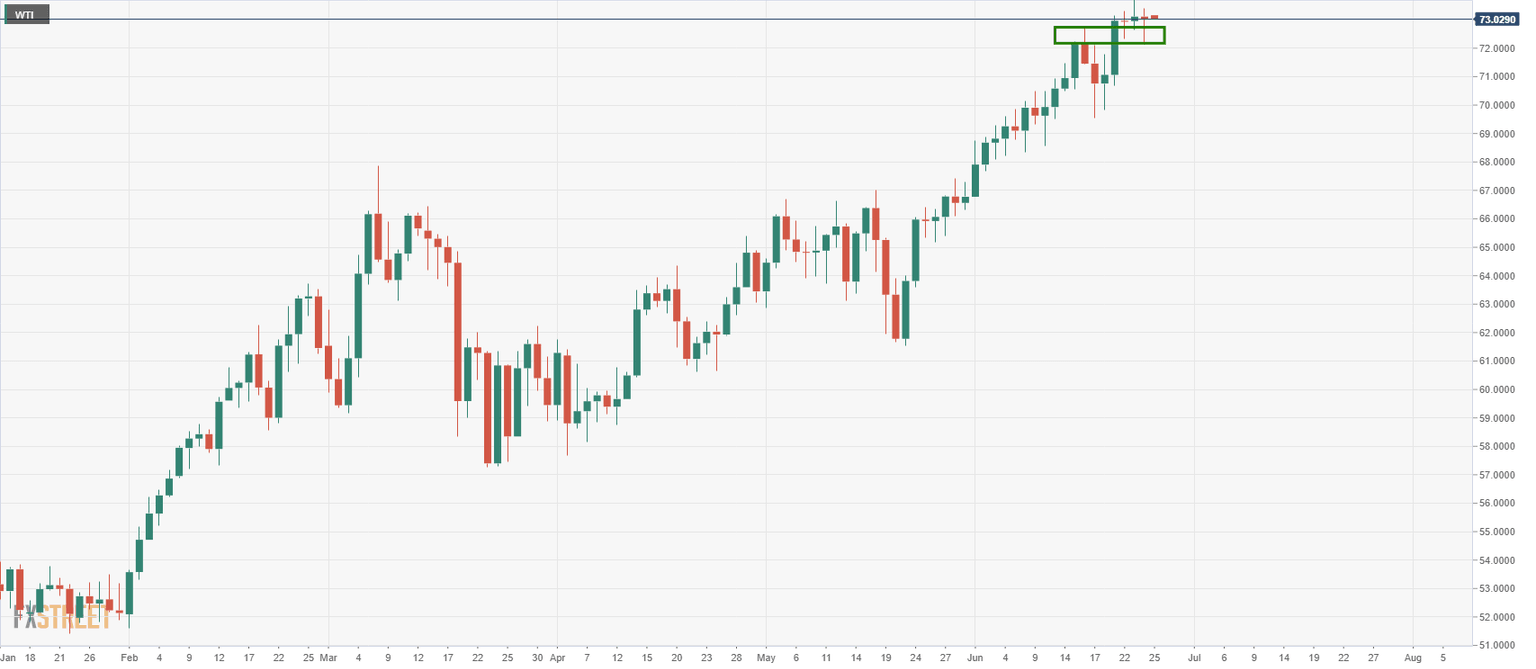

WTI reaching for $75 suppy zone

- WTI is supported on a number of fundamentals and bulls stay in control.

- $75bbls is a psychological target area with price holding near the $74.22 highs.

Oil prices have been elevated into the end of the week and WTI ended up some 0.1% at $73.23 in the New York session.

Spot travelled from a low of $72.35 to a high of $73.58, close to its highest levels in almost three years where the price consolidates in Asia so far, at $73.25.

A drawdown in US inventories and accelerating German economic activity has underpinned the black gold for a fifth consecutive day of higher closes.

In futures markets, both Brent and WTI contracts benchmarks hit their highest since October 2018.

Meanwhile, in data overnight, Germany showed the largest upward leap in retail conditions since German reunification more than three decades ago, not far below the 2017 record high, stoking expectations European fuel demand will recover.

Germany’s June IFO Index reaffirmed the message from the PMI data that the economy is growing strongly at present. Overall, the business climate sub-index rose to 101.8 vs 99.2, the current assessment rose to 99.6 vs 95.7 and expectations firmed to 104 vs 102.9.

Meanwhile, data in the EIA US crude inventories dropped to their lowest since March 2020 while US gasoline stocks also posted a surprise draw.

There are also doubts about the future of the 2015 Iran nuclear deal that could end US sanctions on Iranian crude exports.

Looking forward to next week, OPEC+ is faced with some pressing issues as it reviews its production agreement in a meeting that traders will be highly attentive to.

''The market is calling out for more crude oil, while others are concerned about the inflationary impact of higher prices. India expressed 'deep concern' over spiralling energy prices, with Oil Minister, Dharmendra Pradhan, calling on OPEC Secretary General, Mohammad Barkindo, to revive halted production,'' analysts at ANZ Bank explained.

''Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, said earlier this week that he maintains a cautious approach but doesn’t rule out action.''

WTI technical analysis

$75 remains in focus.

The weekly charts shows that the price is on the verge of breaking into supply territory.

A correction back to test prior highs could well be the first port of call, however, where it meets a 50% Fibo retracement.

The daily chart shows that the price is steadily approaching the target still with the price closing above the prior day’s close once again.

The focus is on the upside for the forthcoming sessions following a significant retracement to the prior resistance structure that has proved to be a solid support structure in 72.50.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.