Gold reclaims $5,000 as US inflation data ignites Fed cut speculation

- Gold climbs back above $5,000 as January CPI cools to 2.4%, reinforcing disinflation narrative.

- Lower Treasury yields and softer US Dollar strengthen upside momentum in bullion.

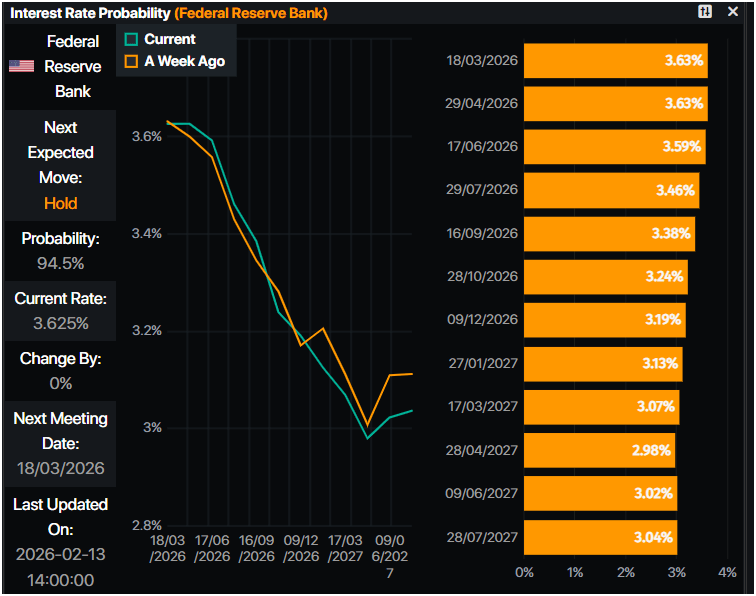

- Markets raise June cut odds at the Federal Reserve ahead of FOMC Minutes and PCE data

Gold (XAU/USD) price makes a U-turn on Friday and trims some of Thursday’s losses, rising nearly 2% following the release of a softer-than-expected inflation report in the US, which increased speculation that the Federal Reserve (Fed) could lower rates. At the time of writing, XAU/USD trades above the $5,000 milestone.

XAU/USD rallies nearly 2% after cooler US inflation data fuels renewed expectations of a June rate reduction

The US Bureau of Labor Statistics reported that the Consumer Price Index (CPI) in January fell below estimates of 2.5%, coming at 2.4% YoY, down from December’s 2.7%. Initially, the print is good news for the economy, but the so-called core CPI remains sticky at 2.5% YoY, also aligned with forecasts and below the previous print of 2.6%.

Initially, Bullion edged towards $5,000 before reversing course, but buyers emerged and bought the dip at around $4,950 before the yellow metal rallied toward its daily high.

However, the broad US economic data revealed during the week was solid. A stellar Nonfarm Payrolls report revealing the creation of over 130K jobs in January and the dip in the Unemployment Rate to 4.3% eased pressure on the US central bank, in regard to the labor market.

The question arises: will the Fed cut rates? They usually strive to get further data that confirms the resumption of the disinflation process. After peaking last year at 3% in September, the last three readings are 2.7% in November and December of last year, and 2.4% in January. Therefore, the stage is set, but the current stance by most Federal Reserve officials, led by Jerome Powell, suggests that they would remain on hold until Kevin Warsh succeeds Powell in May.

Money markets have increased the chances of a rate reduction in June, with odds standing at 55% that the Fed will reduce rates by 25 basis points, according to Prime Market Terminal data.

Lower US yields boost Gold prices

In the meantime, US Treasury yields continued to dive during the week, underpinning Bullion’s advance. The US 10-year Treasury note plummets nearly three and a half basis points in the day, 14 bps in the week, down at 4.06%.

The US Dollar is poised to end the week with losses of 0.85%, according to the US Dollar Index (DXY). The DXY, which measures the buck’s value against a basket of six currencies, is down 0.07% in the day, at 96.84.

Focus shifts to FOMC minutes, Fed speeches and PCE data

Next week, the US economic docket will be busy with the release of Durable Goods Orders, housing data, speeches by Fed officials and the release of the Federal Open Market Committee (FOMC) Minutes. Towards the second part of the week, traders will eye Initial Jobless Claims, GDP second estimate for the last quarter of 2025 and the release of the Fed’s favorite inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

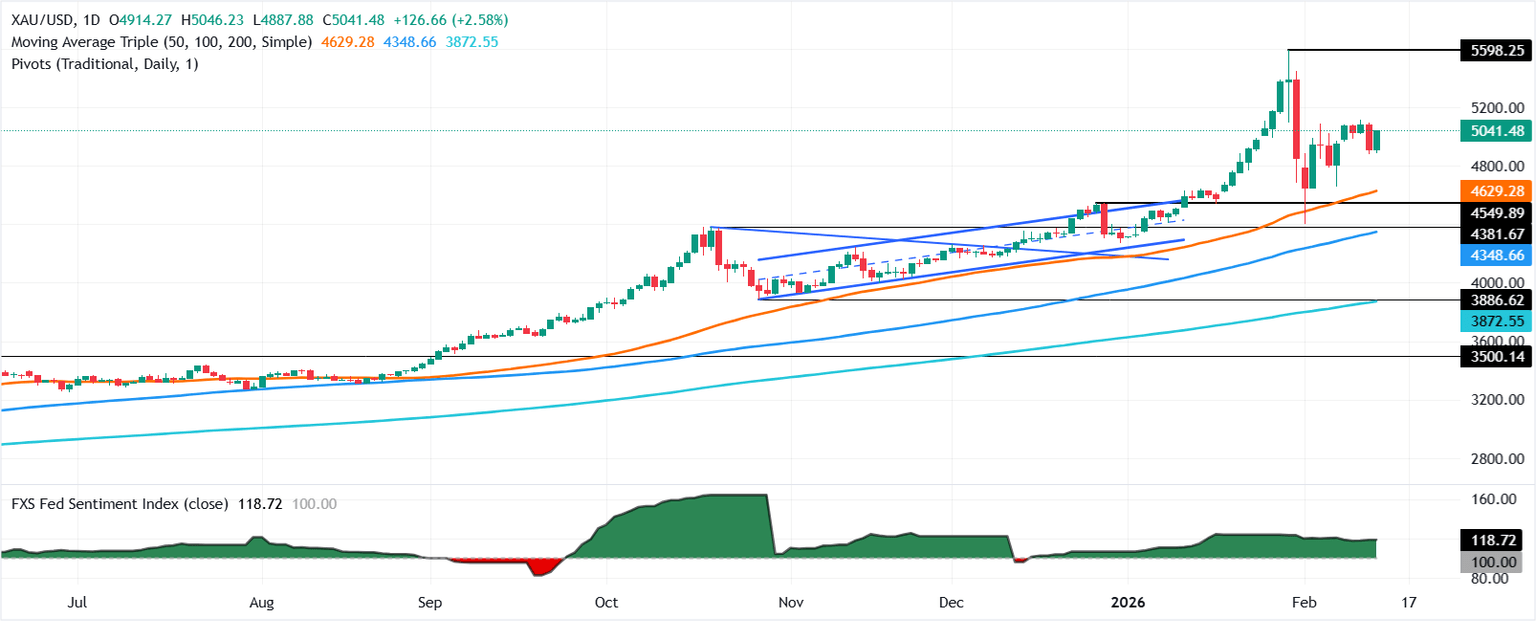

XAU/USD Price Forecast: Gold climbs past $5,000 eyes on crucial $5,100 resistance level

Gold’s upward bias remains intact, with bulls regaining the 20-day Exponential Moving Average (EMA) at $4,971, exacerbating a rally past the $5,000 figure. Momentum as depicted by the Relative Strength Index (RSI) shows that buyers are gathering momentum.

However, XAU/USD must clear $5,100. Once done, the next key resistance is $5,200, followed by the January 30 high at $5,451, ahead of the record high near $5,600. Conversely, if Gold struggles to remain above $5,000, it opens the door for lower prices.

The first key support would be the 20-day EMA ahead of $4,900. Once surpassed, the next floor would be $4,800 ahead of the 50-day EMA at $4,618 as the next demand zone.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.