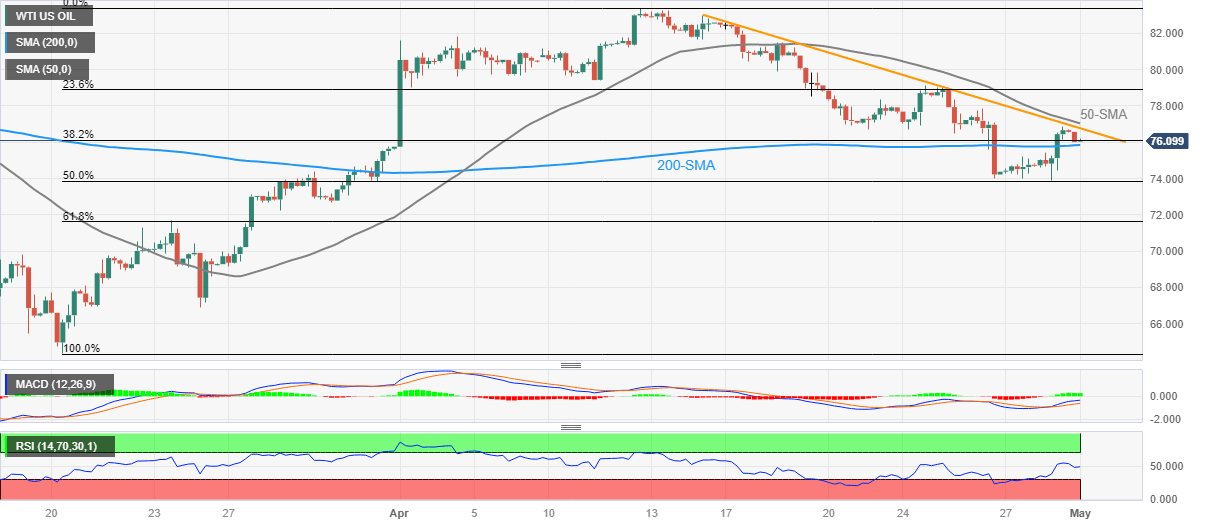

WTI Price Analysis: Oil sellers need validation from 200-SMA level of $75.85

- WTI crude oil snaps two-day winning streak, holds lower ground near intraday bottom.

- Fortnight-old descending resistance line, 50-SMA restrict immediate upside.

- 200-SMA, 50% Fibonacci retracement limit nearby downside as bears take a breather.

WTI crude oil retreats to $76.00 as it fades the previous day’s corrective bounce off 50% Fibonacci retracement of the March-April uptrend amid early Monday. In doing so, the black gold retreats from a two-week-old falling trend line and the 50-SMA. Adding strength to the downside bias is the steady RSI (14) line.

However, the 200-SMA level of around $75.85 and bullish MACD signals challenge the energy benchmark buyers.

That said, the quote’s weakness past $75.85 needs validation from the 50% Fibonacci retracement level of around $73.85 and the late March swing low of around $72.70 to convince the Oil bears.

Following that, the WTI crude oil price can approach the 61.8% Fibonacci retracement level, also known as the golden Fibonacci ratio, to act as the last defense for the Oil buyers.

On the flip side, the aforementioned immediate descending resistance line and the 50-SMA, respectively near $76.80 and $77.10, can challenge short-term Oil buyers.

Even so, multiple levels near $79.50, the $80.00 round figure and $81.60 can prod the WTI bulls before directing them to the latest multi-day peak of $83.40, marked in April.

To sum up, WTI crude oil price is likely to remain on the bull’s radar unless staying below $72.70.

WTI crude oil: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.