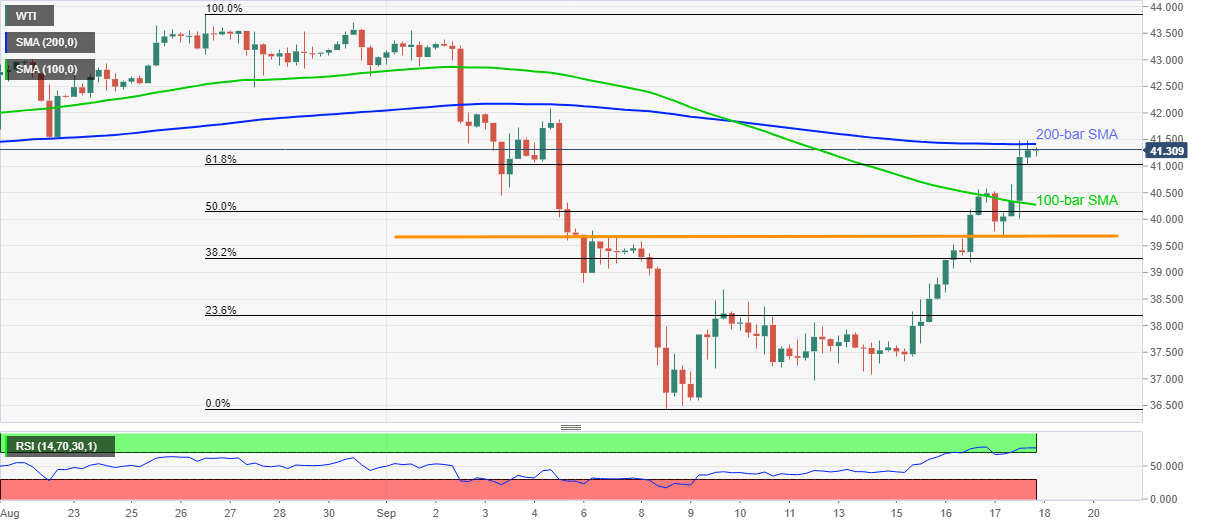

WTI Price Analysis: 200-bar SMA guards immediate upside beyond $41.00

- WTI fizzles the run-up above $40.00 after flashing two-week high of $41.48.

- Overbought RSI conditions, strong SMA probe the bulls.

- Sellers await a clear downside break of 61.8% Fibonacci retracement level around the $41.00 area.

WTI consolidates the recent gains to $41.48 within a choppy range above $41.00, currently up 0.20% around $41.30, during the early Friday morning in Asia. The black gold surged to the highest since September 04 the previous day after breaking 100-bar SMA. Though, the 200-bar SMA seems to restrict the commodity’s latest up-moves amid overbought RSI conditions.

Considering the strength of the 200-bar SMA and signals of a pullback marked by the RSI, sellers remain hopeful. The same push them to look for entry if oil prices drop below the 61.8% Fibonacci retracement level of August 26 to September 08 downside, near $41.00.

In doing so, WTI will become vulnerable to revisit the 100-bar SMA level of $40.27 before catching a breather around the $40.00 threshold.

It should, however, be noted that a nine-day-old horizontal support linear $39.70 may question the energy bears after $40.00.

Meanwhile, an upside clearance of $41.42 figures, comprising 200-bar SMA, will aim for September 04 top of $42.07 before the August 27 bottom near $42.50 challenge further rise.

In a case where the WTI bulls dominate past-$42.50, August month’s top, also the highest since March 05, surrounding $43.85, will be in the spotlight.

WTI four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.