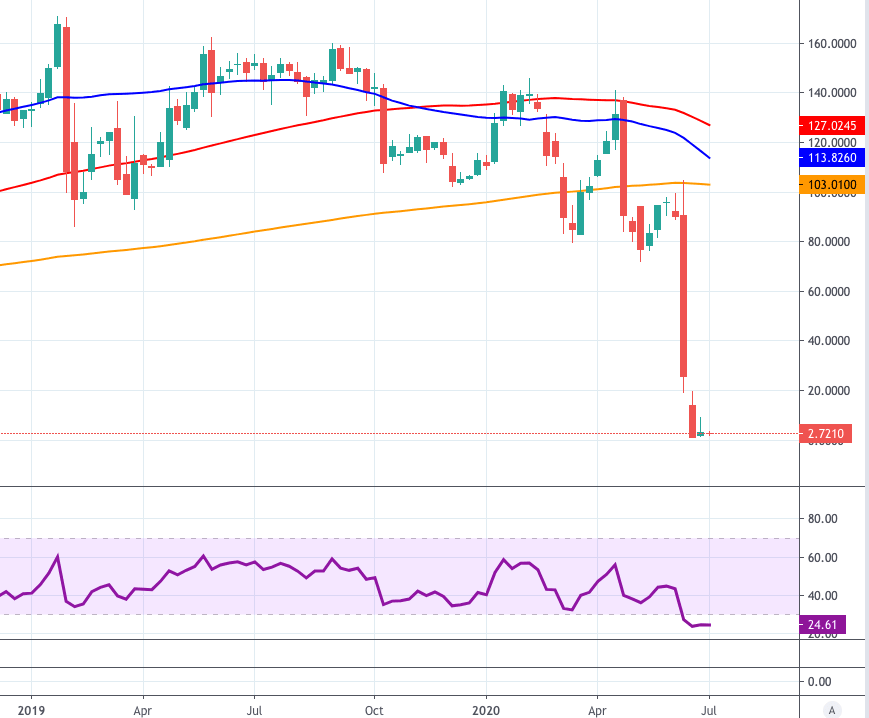

Wirecard Stock Price: WDI remains flat-lined below €3.00

- Wirecard AG remains under heavy pressure below the €3.00 mark.

- The all-time low just above €1.00 emerges as the next support.

German payments company Wirecard AG (ETR: WDI) appears within a consolidative range in the sub-€3.00 area so far on Thursday.

After reaching all-time lows just above €1.00 in late June, Munich-based fintech Wirecard AG (ETR: WDI) have failed to rebound further north of the €10.00 level (June 30), moving into the current consolidation phase afterwards but leaving the bearish view unchanged so far.

It is worth recalling that Wirecard AG (ETR: WDI) became the first-ever DAX company to file for insolvency and that the fraud scandal exposed debt to creditors exceeding €4 billion.

Adding insult to injury and following criminal complaints in the last couple of years, individuals from the German fintech are under the microscope of German state prosecutors over money laundering charges, according to news agency Reuters.

WDI Stock Quote

At the moment WDI is losing 2.32% at 2.7140 and faces immediate support at the all-time low at €1.76 (June 26). On the upside, a break above €9.19 (weekly high Jun.30) would expose €19.80 (weekly high Jun.24) and then €69.54 (55-day SMA).

WDI weekly chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.