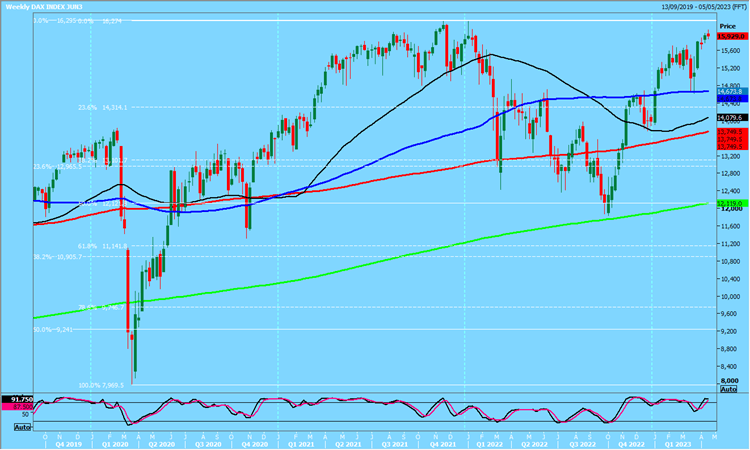

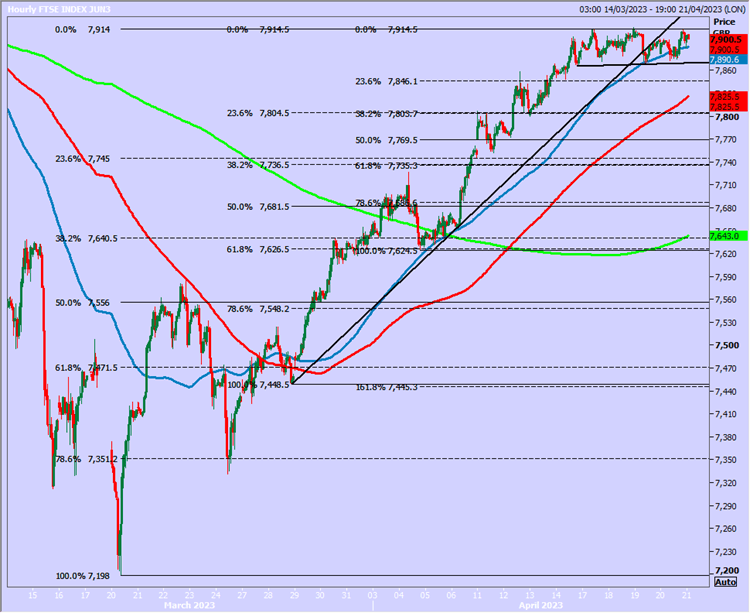

Will Dax and FTSE 100 break all-time highs?

Dax 40 June sees some profit taking in severely overbought conditions. Still no sell signal but obviously it would not be a surprise to see a small correction after such a strong bull run.

WE GOT CLOSE ENOUGH TO THE ALL TIME HIGH THIS WEEK FOR THIS TO COUNT AS A DOUBLE TOP IN MY OPINION.

FTSE 100 June trades sideways for 4 days as we become severely overbought on the daily chart. The series of 4 Dojis clearly shows the market in balance between buyers & sellers & this pattern can often lead to a correction in such severely overbought conditions - however we do not yet have a clear sell signal.

Daily analysis

Dax June we are in a bull trend so buying at support remains the favoured strategy although I am watching carefully for a sell signal as we approach the all time high. A double top would be an important longer term sell signal. We should have support at 15900/850.

A LOW FOR THE DAY EXACTLY HERE YESTERDAY.

A break below 15850 however risks a slide to 15720/700, perhaps as far as 15650/630. Just be aware that a weekly close below the 200 hour MA at 15880 would be the first minor negative signal we have seen for a month.

A break above minor resistance at 16070/090 retests the all time high at 16275/295.

FTSE June break above 7865 hit my next target of 7910/20 with a high for the week exactly here. Just be aware that we are severely overbought after an incredible 500 point gain in just 4 weeks.

Above 7920 this week look for 7955/65.

First downside target & support at 7855/45. A low for the day is certainly possible. Longs need stops below 7830. A break lower however targets 7810/00, perhaps as far as strong support at 7755/35.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Jason Sen

DayTradeIdeas.co.uk